In late November of every year, our team convenes for a series of discussions about how to position the portfolios under our management for the year ahead. Since we manage our clients’ assets around long term financial goals, the changes we make from year to year tend to be incremental rather than radical. That being said, we do take into account potential likely economic and capital market scenarios for the year ahead, assessing the balance of upside and downside factors, to determine whether a somewhat more defensive or somewhat more growth-seeking approach makes sense.

In this week’s post we want to help you understand the thinking behind the portfolio management decisions we have made since the beginning of the year and how they stack up in the context of the current environment. A major influencing factor leading to those decisions was the expectation that we would be managing through a period of heightened uncertainty.

Structural Volatility

During our deliberations in late 2018 financial markets were in a tailspin, with the S&P 500 coming very close to a technical bear market (the threshold for which is a 20 percent retreat from the previous high). Emotions can run high during pullbacks of this magnitude, and those emotions can lead to the wrong decisions. Rather than focusing on the immediate moment, therefore, we considered a broader picture of how markets had been behaving for much of the previous year. The fall 2018 pullback was the second significant correction of that year, the first having occurred in late January. After a very strong bull run in 2017 during which stock markets rose by more than 20 percent with very low underlying volatility, we believed the bull market had entered a new phase – one with less directional certainty (either up or down) and more dramatic variations around central trends.

We communicated this view to you in our annual outlook published on January 19 of this year. “We believe heightened volatility will be the principal characteristic of asset markets in 2019” was the key message of that report, noting that “volatility” is a two way street — both up and down. From a practical standpoint, that meant bringing our equity weightings down somewhat from where they were in our 2017 allocation models. Not dramatically – again, our portfolios are positioned around long-term financial objectives, not short-term market timing considerations. But we felt that a somewhat more defensive position for the risk asset classes in our portfolios was appropriate for an uncertain environment.

What About Bonds?

The volatility picture clarified in late April and May when markets pulled back by almost 7 percent, then rose sharply in June and July and have since fallen hard again in August (a bit more than 6 percent down from the late July high after this past Wednesday’s selloff). The S&P 500 is still up around 15 percent year to date, thanks to that sharp rally off last December’s low point, but it is below the pre-correction levels of January 2018. Sentiment is anything but complacent.

Meanwhile, the really big story in financial markets today is less about where the S&P 500 is on any given day, and more about what is going on in the bond market.

We manage the fixed income component of our portfolios with two objectives in mind: risk management, and predictable income aligned with the liquidity needs of each individual client. Our bond allocations are by and large conservative with a focus on high quality, low risk instruments. In a practical sense this implies a mix of short to intermediate term fixed and floating rate securities, and defined maturity ladders for more predictable cash flow management.

Back to that big story in bonds – the inverted yield curve has fixated financial market commentary for the past several weeks, particularly this week when 10-year yields fell below 2-year yields and the 30-year Treasury fell below 2 percent for the first time ever. The sheer force of the global bond rally – including by now more than $16 trillion worth of bonds trading at negative interest rates – has left seasoned market pros groping for reasoned explanations. When bond prices go up, interest rates go down – but there is something peculiar about how this relationship works that is worth understanding.

Bond Math Drama

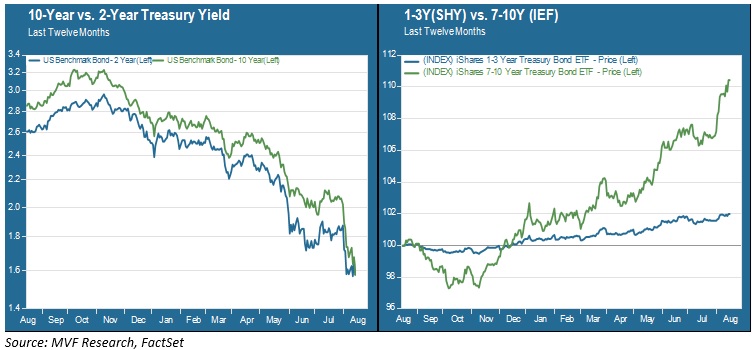

Not all bond prices react the same way to a change in interest rates. To be specific, the price of a bond with a longer maturity will, all else being equal, go up or down by more than a bond with a shorter maturity for a given change in interest rates. You can see this effect (called the “duration effect” in bond parlance) in the chart below.

The left panel of this chart shows the interest rate trend for 2-year and 10-year Treasuries over the past year, which has been largely down after peaking late last year. On the right panel, you see the price effect of this interest rate trend on short term bonds (represented by a 1-3 year Treasury ETF shown in blue) and bonds with longer maturities (the 7-10 year Treasury ETF shown in green). The difference is dramatic – the price of longer term bonds has surged with the decline in rates. In fact, bonds in the 10-20 year range are outperforming the S&P 500 on a total return basis for the year to date.

But we don’t make bond allocation decisions with a view to outperforming the S&P 500. Again – this portion of our portfolio is for safety and for income. On a price appreciation basis our allocation will substantially lag those go-go long duration bonds – and we’re fine with that. What goes up that dramatically can also go down with equal amounts of drama – and that runs counter to our fundamental bond allocation philosophy.

Just as we described with regard to our equity allocation decisions, we believe that a conservative approach in the form of high quality bonds with low to intermediate maturities is the right decision for an environment of uncertainty. There are a great many questions about where bond yields go from here, how sustainable this phenomenon of negative interest rates will be, and how successful global central banks will be in fending off a potential economic downturn with their traditional monetary policy toolkits. We do not think this is an appropriate time to take aggressive positioning moves in fixed income.

This past week has in some ways been a microcosm of the volatility we wrote about at the beginning of this year. Monday, Tuesday and Wednesday all saw price moves in the S&P 500 greater than 1 percent – two down and one up (as we write this on Friday morning the index is perhaps poised for another 1 percent-plus day on the upside). In such an environment we need to keep our portfolios positioned so as to not miss out on growth opportunities while still maintaining a level of downside protection consistent with each client’s level of risk tolerance. It’s not an easy balancing act – but that’s our job and that’s what we will keep doing every day.