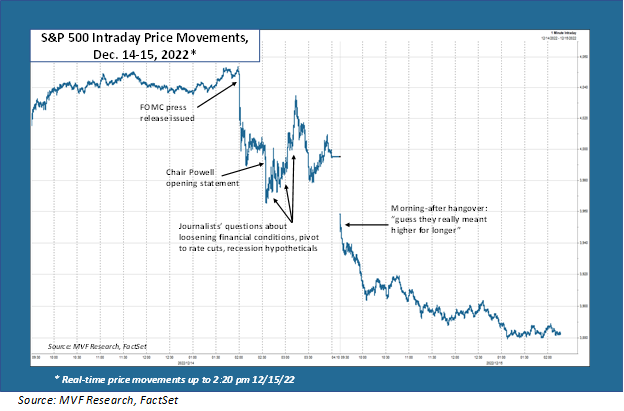

There was a curious dynamic playing out in the stock market during Wednesday’s Federal Open Market Committee confab. The Fed speaks – market goes down. Journalists ask questions – market goes up. We took the liberty of illustrating this odd dynamic in the chart below, showing the intraday trading patterns around the key events of the FOMC official statement and subsequent press conference.

To fully appreciate this chart, it is important to understand who is doing most of the trading here. More precisely, what is doing the trading, because it is not a bunch of humans watching the TV and then barking buy and sell orders into a phone like a scene from Trading Places. No, the action here is being done by very sophisticated trading programs employing state-of-the-art artificial intelligence. This high-powered AI basically digests all the verbiage – both from the press release and from the spoken words of Jay Powell and the assembled journalists – and spits out trade orders in real time. Essentially, the trader bots are looking for specific words and phrases that tell them whether the vibes in the room are hawkish or dovish, and then selling or buying accordingly.

Nothing New Under the Sun

Consider the FOMC press release. This came out at precisely 2:00 pm on Wednesday afternoon and, as you can see, the trader bots hit their sell buttons in unison. What was the trigger here? Most likely, it was this phrase: “The Committee anticipates that ongoing increases in the target range will be appropriate…” Remember the excitement in the market last week when the inflation report came in cooler than expected? Many investors hoped that a softer inflation outlook could bring down the Fed’s expectations for its terminal rate; i.e., where they expect rates to be when they stop tightening. A press release that did not contain the two words “ongoing increases” would have been consistent with that hope. But there was the phrase – and sure enough, even though the magnitude of the target rate increase this time was 0.5 percent as opposed to the 0.75 percent cadence of the past four meetings, the terminal rate expectations in the accompanying Summary Economic Projections were indeed higher.

This should not have been a surprise, though, because Powell and his colleagues have been unrelentingly clear in their messaging about this. Yes, it was appropriate to dial the rate hikes back from 0.75 percent, but rates are going to keep going up, and then staying elevated, until there is compelling evidence that inflation is on its way back down to the two percent target rate. This has been the message ever since Powell’s speech at Jackson Hole back in August. There was nothing in the FOMC press release to suggest that conditions have gotten worse – they haven’t, and it really does seem like inflation has passed its peak. But two consecutive CPI reports (October and November) do not rise to the level of “sufficiently compelling.” Once again – and we have seen this dynamic all through this tightening cycle – the market simply got out ahead of its skis.

The Press Games the Refs

The press conference itself really illustrated how this AI-powered trading dynamic works. When Powell walked up to the lectern and started in with his opening remarks – which, again, sounded like nearly every speech the man has given for the past four months – the trader bots went into another funk (shown in the above chart). Then the journalists started asking questions.

Now – these are some of the most prominent financial journalists for major press organs like CNBC, Bloomberg and Marketplace. They are all extremely fluent with the language that drives short-term trends in securities markets – any one of them could tell you what “ongoing increases” means to investor sentiment, for example. And their questions reflected this fluency; they used terms like “loosening financial conditions” (referring to rising stock prices and falling bond yields), “pivot” (a course reversal in which the Fed starts cutting rates as soon as it gets to its endpoint in the tightening cycle) and “recession fears” (which has a very specific meaning in Fedspeak, i.e. stopping its tightening policy in order to avert a potential economic downturn – this was what the Fed did throughout the middle of the 1970s, and it was not a good policy).

You can see how stock prices are bouncing back and forth pretty wildly during this section of the press conference but mostly lurching higher. Again, it’s those words – and the journalists know full well what they are doing when they lace their questions with these trigger phrases – trying to coax out something newsworthy from Powell that will move markets and give them something juicy to write about. It makes for a good game, perhaps, but in the end it is all little more than clever effervescence. In the end Powell would not be moved – he stayed on message, and the doves were nowhere to be seen.

Looking Ahead

Our main message to you is pretty much what it always is – these short-term gyrations are best ignored for portfolios with long-term financial objectives. We think the FOMC’s current expectations for a terminal Fed funds rate – with the median rate at 5.1 percent based on this week’s Summary Economic Projections – are pretty close to where things will actually wind up. The economic slowdown question does loom large as we look ahead to 2023. But, as we have noted repeatedly in recent commentaries, the data points that we have in front of us today are inconsistent. A number of indicators suggest that the cooling period is underway (most recently US retail sales, which came in softer than expected in the November report issued yesterday). The labor market is still perplexingly strong (though this is also a lagging indicator). The Treasury yield curve is inverted and positioned for a recession, yet credit risk spreads are still relatively tight. There is a lot to pay attention to in the coming weeks, before the Fed meets again on February 1 next year. Meanwhile, patience and discipline remains the best advice we can give. Too bad there’s not an AI-powered trading bot that keys off those words.