Over the past few months, we’ve had a number of conversations with clients that go something like this:

Client: Wow, these are crazy times, huh? Politics! Never seen anything like this!

Us: Yep, they sure are crazy times.

Client: So, why does the stock market keep going up? When should I be worried?

In today’s commentary we will address this concern, and explain why we believe that, whatever one thinks of the political dynamics playing out here at home or abroad, it probably is not a good idea to transpose these sentiments onto a view of portfolio allocation. Political risk is a real thing. But history has shown there to be very little causal relationship between momentous political events and movements in risk asset markets. Any market environment, whether bull or bear, is affected by tens of thousands of variables every day, many of which have little correlation with each other, and very few of which are easy to pinpoint and ascribe to prime mover status. We offer up a case study in support of this claim: the US stock market in the early 1970s that encompassed the Nixon Watergate scandal.

That Dreary Seventies Market

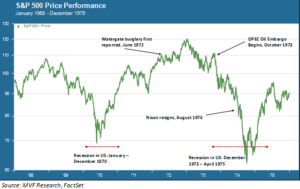

President Nixon resigned from office in August, 1974, shortly after it became clear that Congress was preparing to commence impeachment proceedings in the wake of the revelations about the Watergate crimes and attempted cover-up by the administration. As the chart below shows, the S&P 500 fell quite a bit during the month of August 1974, as well as before and after the Nixon resignation. But the chart also shows that there was a lot else going on at the same time.

The Nixon resignation remains to date the most consequential political scandal in modern American history. It had an earth-shaking effect on the political culture in Washington, leading to far-reaching attempts by lawmakers to restore the integrity of the systems and institutions the scandal had tarnished. As far as markets were concerned, though, Watergate was far down the list of events giving investors headaches. Following a historically unprecedented period of economic growth and rise in living standards over the prior two decades, the first five years of the 1970s witnessed two wrenchingly painful recessions, spiraling inflation and a gut-punch to household budgets in the form of OPEC’s 1973 oil embargo. The freefall in stocks that took place in 1973 and 1974, if it is to be tied to any specific catalyst, flows from the real dollars-and-cents impact of the embargo and the recession. Watergate, as important as it was as a political event, was little more than a blip on a radar screen already filled with bad news.

Tweets Come and Go, Markets Carry On

Which brings us back to today’s daily carnival of the bizarre from the banks of the Potomac Drainage Basin. While the tweets fly and the heads of the high priests of conventional wisdom explode, the economy…well, just chugs along at more or less the same pace it has for the past several years. Today’s initial Q2 GDP reading (2.6 percent, slightly below expectations) sets us up for another year of growth averaging somewhere around 2 percent. The labor market is healthy, there is neither hyperinflation nor deflation, and corporate earnings growth is trending close to double digits. No major world economy appears in imminent danger of a lurch to negative growth.

Yes, stock prices are expensive by most reasonable valuation measures. And yes, there is not much in the way of sector leadership momentum. But until and unless we see compelling signs of a shift away from this uncannily stable macro context, we see little evidence that Washington shenanigans will have much of an impact on stocks. At some point, those tens of thousands of global variables at play will deliver up a different set of considerations and necessitate new strategic thinking. Trying to time the precise market impact, as always, is a fool’s errand.