That ain’t workin’, that’s the way you do it…

Way back in the day, when Dire Straits composed their satirical riff on the easy-money world of MTV and rock celebrities, interest rates were still coming down from the double-digit rates of the early 1980s and the hangover of stagflation still gnawed at the minds of central bankers. The VIX index did not yet exist to serve as a barometer for measuring the market’s mood swings between fear and complacency. And the idea that central banks would take on a second life as the world’s largest sovereign wealth funds, buying assets in the open market in an attempt to prop up slow-growing economies, was scarcely imaginable.

Same Data, Different Tune

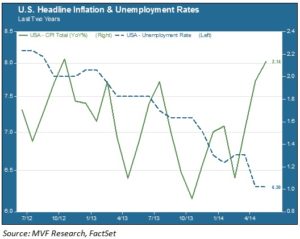

This week we learned that U.S. headline inflation is back over 2% year-on-year, with an even stronger annualized run when looking at the last three months. Prior to December 2013, the Fed had maintained that 2% inflation and 6.5% unemployment were levels consistent with a gradual move towards moving interest rates off their historically low floors. Now the numbers are there, but the tune has changed.

Of course, three months does not necessarily a sustainable trend make. But a majority of data points indicate that the second half of 2014 will see more robust growth than the first, with corporate earnings ticking into high single or low double digits and real GDP coming in above 3%. Yet Fed Chairwoman Janet Yellen, speaking after the Board of Governors meeting this past Wednesday, did everything in her power to convince markets that interest rates would not be coming out of their deep sea beds any time in the foreseeable future. In fact the tone she struck was notable for its lack of conviction in economic growth prospects. QE tapering continues – monthly bond buys are down to $35 billion – but the money is still free and the Fed clearly wants it to stay that way.

Central Banks, Yield Hunters

Meanwhile another news tidbit this week, courtesy of the Financial Times, focused attention on the new role of central banks as global fund managers, boosting their already expanded balance sheets with equity investments. The State Administration of Foreign Exchange, an arm of China’s central bank, is apparently the world’s largest portfolio manager with over $3.9 trillion in equity assets under management (including direct equity stakes in a number of prominent European companies). The FT article notes that central banks in Europe are also part of the action in embracing equities as part of a yield-hunting strategy.

Manufactured Markets

What’s ironic – and not just a little troubling – about the idea of central banks as yield hunters and stock pickers is that they themselves are the architects and manufacturers of the free money, zero-yield world in which we live. As a matter of policy central bankers have sought to push investors out the risk frontier, hoping that the ensuing wealth effect would work back into the real economy. The first part of that equation has clearly worked – global equity markets are at all-time highs. Whether the rebound in GDP and employment is a direct result of the Fed’s nudge is up for debate. But it seems an odd time for central banks to be following their own advice and piling into risk assets, with potentially unfortunate consequences whenever this bull market finally plays out.

Gotta Move Them Color TVs

A closer look at the inflation numbers this month indicates price gains across a broad range of goods and services, signifying rising levels of demand. Admittedly the Personal Consumption Deflator, which the Fed prefers as its inflation barometer, somewhat lags the headline Consumer Price Index. But if the price trend of the past several months continues, Yellen’s Fed will come under increasing pressure to make some hard decisions about rates. Markets have followed a zig-zag course this year between yield plays – defensive sectors and high-dividend shares – and growth areas like small caps and technology. The next couple headline macro readings, along with 2Q sales and earnings results, will likely have a major influence on which trend plays out for the rest of the year. One would hope that the central bankers moonlighting as stock portfolio managers are ready for either outcome.