Americans love to shop, and as our shopping habits go, so goes the economy. Such is the conventional wisdom, in any case. Consumer spending has consistently accounted for around 70 percent of our gross domestic product (GDP) for many decades now. Every so often, though, a narrative takes hold to challenge the conventional wisdom. Consumers are “going small” (1970s), or “rejecting excess” (early 1990s, pretty funny in hindsight) or “repairing household finances” (post-2008 recession). There is often a grain of truth in the contrarian narrative. Somehow, though, we just go right on spending. This week we saw both sides of the narrative. A string of Q1 earnings reports in the retail sector cast a pall over the market and sparked renewed speculation about the vanishing consumer. Then, Friday morning delivered up a new batch of data from the Commerce Department showing that overall April retail sales grew by 1.4 percent (month-to-month), the briskest pace in over a year and comfortably ahead of expectations. Is this just one outlier data point, or are rumors of the consumer’s demise greatly exaggerated?

Follow the Wages

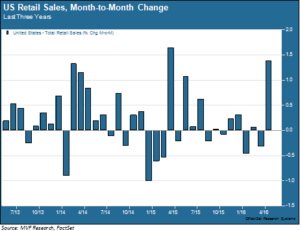

We are generally not ones to make a big to-do about one monthly number. As the chart below shows, monthly retail sales have bounced around quite a bit over the past three years, and in recent months the pace has lagged the average for the overall period.

But an improved outlook for consumer spending habits does not strike us as surprising in view of other recent headline data. Last week’s jobs report, while underwhelming in terms of payroll gains, showed a healthy uptick in wage gains; in fact wages are growing at a notably faster pace than overall inflation. Consumer confidence indicators have also been robust; the latest University of Michigan Consumer Sentiment Index release also came out today and was well ahead of expectations. And the headline retail number was not unduly skewed by volatile sectors like automobiles or building materials; the core retail sales figure, which excludes autos, gas and building materials, was up 0.9 percent for the month against expectations of a 0.4 percent gain.

High Street Hangover

Brick-and-mortar retail outlets garner a great deal of focus during earnings season, mostly because they have long served as an easy go-to touchstone for retail sentiment. But high street retailers are not the force they once were. The multiline retail segment of the S&P 500 consumer discretionary index, which includes much-followed Macy’s, Kohl’s, Nordstrom and Target, accounts for only 4.3 percent of the total market value of all consumer discretionary segments. By comparison, the internet retail segment makes up 18 percent of the total consumer discretionary index – most of which can be ascribed to category-busting Amazon. That company’s record earnings release last week presaged the line item in today’s Commerce Department report showing that online retail sales grew by double digits on a year-on-year basis from last April.

Uneven Returns

As the economy continues to recover – and particularly as the brisk pace of job creation finally translates into the long-expected pickup in wage growth – it should be reasonable to expect retail spending to continue trending positive. In any given quarter the fruits of that pickup may be spread unevenly around the stock price performance of competitors in mainline, specialty and online retailing. Why is Gap down in the mid-twenties so far this year while Urban Outfitters, a peer in the specialty retail space, is enjoying a nice year to date return of just under 20 percent? Maybe there is something enduring about the latter’s move to further diversify and optimize its revenue mix, maybe not. Consumers may be fickle, asset markets even more so.

Over time, we expect the broad-based paradigm shift into online will put increased pressure on all business models, with a resulting competitive winnowing out among winners and losers. But the American consumer appears to be very much alive and, as far as we can see, inclined to keep spending in one form or another.