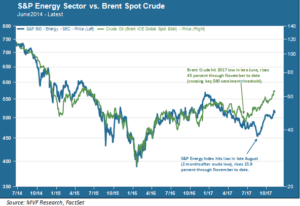

Every industry sector has its own received wisdom. In the energy sector, the two pillars of conventional wisdom for much of the past eighteen-odd months could read thus: (a) crude oil will trade within a range of $40 to $60, and (b) the fates of crude prices and shares in energy companies are joined at the hip. Recently, though, both of these articles of wisdom have come under fire. Energy stocks, as measured by the S&P 500 energy sector index, are up by a bit less than 14 percent from their year-to-date low set in late August. But the shares came late to the party: Brent spot crude oil reached its year-to-date low two months earlier, in late June, and has jumped a whopping 45 percent since. At the end of October the benchmark crude crashed through that $60 upper boundary and has kept going ever since. Are more good times in store, or is this yet another false dawn in the long-beleaguered energy sector?

Whither Thou Goest

That energy shares and oil prices are closely correlated is not particularly surprising, and the chart below illustrates just how much in lockstep this pair of assets normally moves. The divergence in late June, when crude started to rally while E&P shares stagnated and then fell further, caught off guard many pros who trade these spreads.

Given that close correlation, anyone with exposure to the energy sector must surely be focused on one question: is there justification for crude oil to sustain its move above the $60 resistance level, thus implying lots more upside for shares? A few weeks ago the answer, more likely than not, was “no.” Long-energy investors, then, should take some comfort in a recent prognostication by Bank of America Merrill Lynch opining that $75 might be a “reasonable” cyclical peak. If that level, plus or minus a few dollars, is a reasonable predictor – and if the historically tight correlation pattern between crude and shares still holds – then investors in energy sector equities could have a very merry holiday season.

The Upside Case

Perhaps the most convincing argument for the energy bulls is that much of the recent strength in crude prices is plausibly driven by organic demand. The global economy is in sync, with two quarters in a row of 3 percent US real GDP growth along with steady performances in China, India and other key global import markets. The continuity of global growth may finally be delivering a more durable tailwind to resource commodities. Meanwhile, on the supply side inventories wax and wane, but the supply glut that dominated sentiment a year ago seems to have waned. And US nonconventional explorers have also taken a pause: rig counts and other measures of activity in the Permian Basin and other key territories have stalled out now for a number of months. Add to this picture the ongoing effects of the OPEC production cuts and the recent political tensions in Saudi Arabia, and there would appear to be a reasonable amount of potential residual upside.

Caveats Still Apply

On the other hand, though, the structural reality remains in place that those US nonconventional producers are the key drivers of the marginal price of a barrel of crude. The recent downsizing of rig counts and active drilling projects may well be temporary as E&P firms look to shore up their beaten-down margins. Most shale drillers can now turn a profit at prices well below the current spot market. It is only a matter of time – and price level – before the activity will ramp up again. And we’re talking mostly about short-cycle projects that can turn off and on more nimbly than the traditional long-cycle, high capital expenditure projects of old.

Crude prices may well have another $10 or more of upside, but they come with plenty of caveats. For the next couple months though, at least, energy equities would seem to offer a reasonably robust performance opportunity.