It is supposed to be the month of March that comes in like a lion, out like a lamb, according to the custodians of timeless wisdom. This year, though, that appellation could just as well apply to September. After a volatile beginning, financial markets settled down and more or less calmly navigated the twists and turns of the daily news cycles. At the end of it all, the S&P 500 posted a gain of just over two percent from the beginning to the end of the year’s ninth month – not a shabby chunk of change.

So how is the final stretch of the year shaping up? Well, we’re barely a week into the fourth quarter, but there are a few reasons why it might make sense to move the arrow a bit more in the direction of the bull and away from the bear.

Jobs Mojo

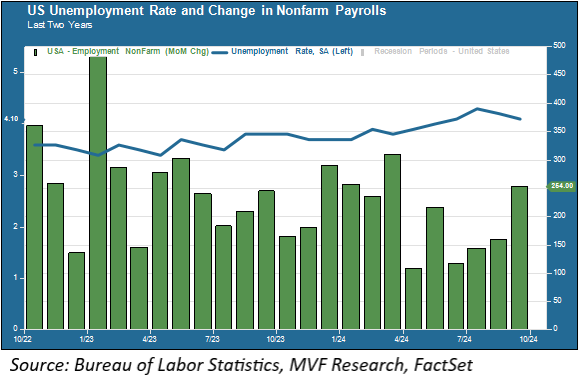

Remember the market’s big freakout back in August, as a handful of jobs numbers raised fears among some observers that a recession was just around the corner? Well, those fears seem to have largely dissipated into the ether. We had more jobs data this week – from a job openings report on Tuesday to a survey by ADP on Wednesday and then the monthly employment report from the Bureau of Labor Statistics this morning – all coming in ahead of economists’ forecasts with a particularly strong showing in nonfarm payroll additions in today’s BLS report.

Oh, and in addition to the 254,000 increase in nonfarm payrolls this month, the BLS also revised up by 55,000 the July NFP number. So that 89,000 payroll gains figure that everyone was so distraught about is now a haler 144,000 (the August nonfarm payroll number also was revised up by 17,000). Moreover, the unemployment rate for September ticked down a bit to 4.1 percent. As the above chart shows, the labor market picture looks remarkably stable over the past two years, with a slight cooling from last year’s torrid pace, but nothing that resembles a downward spiral into recession territory. As always, we apply a note of caution when looking at data from a single point in time. The trend, though, does not make a compelling argument for approaching turbulence.

A Strike Averted

A second potential near-term concern fizzled out in this morning’s news dump when we learned that the strike begun by the International Longshoremen’s Association earlier this week, threatening a protracted shutdown of US ports just in time for the holiday season, was called off thanks to a partial agreement reached between the unions and the port operators. The strike, about to enter its fourth day, could have caused billions of dollars of damage to the US economy – a JPMorgan report suggested the economy could lose around $4.5 billion for each day of the strike. Not to mention the political implications, as the non-arrival of Amazon packages could have people in a less than festive mood as they mail in their ballots or head to the polls on November 5. The current agreement extends union members’ contracts until January 15 (with an eye-popping 62 percent increase in wages already agreed to), so at least that will get us through the holidays.

Election a Non-event for Markets?

There has been a lot of talk throughout the year (and more than our fair share of chats with nervous clients) about the potential impact of the upcoming election on markets. We’re about a month away from the event itself, but we really are not seeing much in the way of market jitters with any identifiable connection to the election. If you are inclined to believe the polls, the presidential race is nearly entirely within the margin of error, and thus essentially a coin toss come Election Day if momentum has not moved significantly one way or the other by then. Of course, the polls are not perfect oracles, and this year in particular it may be difficult to accurately model what the electorate of actual voters is going to look like.

Beyond the race for the top job, of course, there are also the consequential outcomes of the House and Senate that will figure directly into whatever prognostications one might make about the formation of economic policy next year. So rather than worry about something with too many variables at play, the market’s attitude would seem to be indifference. Que sera, sera. Of course, October is only four days old, and there still may be some nasty tricks out there, somewhere. For now, though, we’ll take the treats of good jobs numbers and open East Coast ports.