The US stock market is having itself a pretty decent year so far in 2023, all things considered. Last week we talked about the market in terms of volatility, namely that there hasn’t been much of that in equities even while bonds have been bouncing around like dragonflies drunk on Adderall. Bank crises, debt ceiling worries, the growing likelihood of a recession? Bonds gyrate while stocks yawn.

This week we focus on another unusual characteristic of the stock market – the extreme narrowness of outperformance, dominated almost exclusively by a small number of mega-cap technology companies.

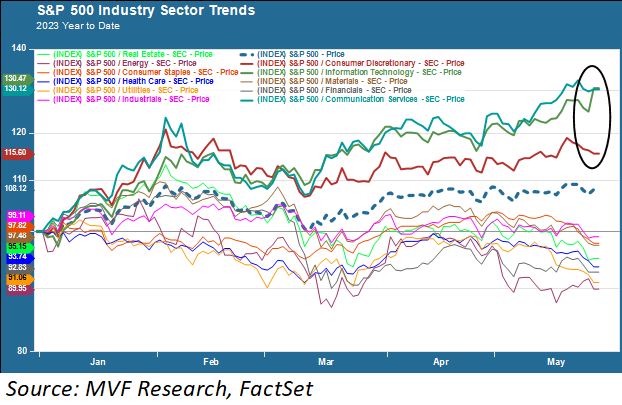

Sector Divergence

Let’s take a look at the evidence. First of all we present a chart showing the year-to-date performance by industry sector. Notice here that three sectors – information technology, communications services and consumer discretionary, highlighted on the chart by the circle – are the only ones outperforming the broader index. The other eight, ranging from industrials to energy, all trail the benchmark.

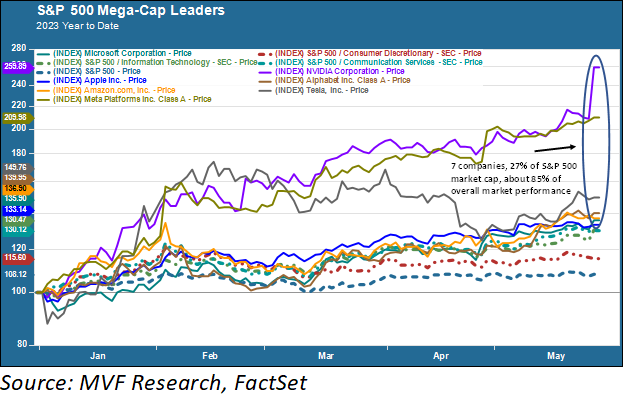

We noted above that outperformance in the market this year is confined narrowly to a small number of “technology companies.” So what explains the outperformance of those other two sectors, communications services and consumer discretionary? Very simply, those sectors are home to four companies that largely fit the description of “technology.” The communications services sector contains both Meta (Facebook) and Alphabet (Google), while consumer discretionary is where online behemoth Amazon and EV bellwether Tesla reside. Now, in the chart below, we will see why those four companies (alongside three companies in the info tech sector) have an outsize effect their sectors and the market.

Here they are – the Big Seven that collectively explain about 85 percent of the total performance of the S&P 500 in the year to date: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. These seven companies account for about 27 percent of the total market capitalization of the benchmark index. It is largely thanks to them that investors with passive exposure to the broad index are enjoying returns in the high single digits so far this year.

Interest Rates, Repositioning and AI

What has been driving this outperformance? We see three key factors. First, these are all technology-driven companies, and tech names tend to enjoy a disproportionate benefit, relative to other sectors, when interest rates come down. Early in the year this was a key factor; after a couple modestly favorable inflation reports late last year, the market seized on a narrative that the monetary tightening cycle was coming to an end and the Fed was about to turn on a dime and start cutting (that narrative has since been shown to be lacking in any kind of evidentiary context).

When the Fed pushed back hard against the market’s rate cut fantasies in the February FOMC meeting, rates started to rise again. The tech names didn’t really miss a beat, though, because of another factor at play. Whereas “defensive stocks” once conjured up the image of staid utility companies and cash flow-predictable defense contractors, that moniker now applies to Big Tech more than anything else. The economy’s fortunes may rise and fall, but Apple, Microsoft and their ilk aren’t going anywhere. As the banking crisis in March caused ripples of concern elsewhere, investors kept turning to tech for safety.

But arguably the biggest explanatory factor for the dominance of the Big Seven is neither interest rates nor defensive repositioning, but rather the buzzword that has totally taken over the imaginations of Silicon Valley – artificial intelligence. If you want a visual for this, just look at the price trendline in the chart above for chipmaker Nvidia (the purple line). This stock popped by 25 percent in just one day (yesterday) after releasing its first quarter earnings report. Nvidia makes graphic processors that power generative AI-driven applications and large language models, and has a leading position in supplying its processors to the Microsoft/OpenAI strategic venture that has been the talk of the Valley this year. Unlike some other tech crazes of late, this one looks pretty solid in terms of hard numbers. The frenzy in Nvidia shares yesterday came mostly from the company’s outlook on forthcoming sales to cloud and internet companies, as well as automotive, financial, healthcare and telecoms concerns. To one extent or another, all the Big Seven companies have a case to make that they are at or somewhere close to the leading edge of the generative AI explosion.

Narrow Performance, Wide Risk

While it has been nice to have the biggest names in the S&P 500 drag the market higher so far this year, there is understandably some concern in the market about what will happen if the factors driving outperformance start to go the other way. According to a recent report from Bespoke Investment Group, the three-month performance spread between the market cap-weighted S&P 500 (which is the one used as a market benchmark) and an equal-weighted variation is wider than it has been any time since 1999. The report goes on to note that an equal-weighted basket of those Big Seven stocks is up 70 percent year-to-date, while the other 493 stocks in the index are up only 0.1 percent (again, on an equal-weighted basis). And 275 companies in the index are in negative territory for the year so far.

All of which is to say that we don’t have too much to complain about as the second half of the year approaches – but there is still a long way to go.