If the European Central Bank had announced three or four years ago that it was preparing to drop its overnight deposit rate below zero, the Euro could easily have plummeted and yields on European benchmark securities would likely follow close behind. Negative interest rates are the latest frontier in the Wonderland of central bank stimulus tools – attempts to inject liquidity and stimulate enthusiasm for commerce in the absence of genuine organic demand.

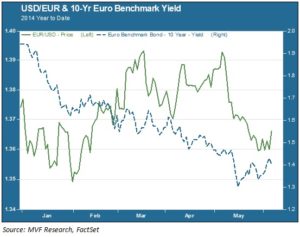

So when the European Central Bank announced on Thursday its plan to reduce the ECB deposit rate to -0.1% the Euro…rallied, of course. We live in a different world now, a world where the logically predictable impact of any macro event is almost instantaneously offset by Algo Armies – trading bots with massive order volumes primed to take the other side of the trade. As the chart below shows, both the Euro and the 10-year Euro benchmark yield have been falling for about a month now as traders and hedge funds anticipated that the continuing string of low inflation figures in Europe would force ECB Chairman Mario Draghi’s hand. The Euro found a floor, though, and yesterday rebounded off the floor in the wake of Draghi’s announcement.

Up Is The New Down

The negative rate decision was just one of the policy measures announced yesterday – the ECB will also inject a package of cheap new €400 billion liquidity to encourage more bank lending, and begin to set up a framework for asset backed securities purchases to support small business initiatives – but it was the headliner. The idea of negative interest rates comes across as counterintuitive. You pay money to a bank for the “privilege” of opening a savings account at the bank. What’s next, the bank pays you negative interest on a mortgage, or a credit card? We’ll pay you to go to the mall – that’s the reductio ad absurdum of negative interest rates.

And yet, that is essentially the logic of the ECB’s move, and in theory it is not all that absurd. Year-on-year inflation in the Eurozone is running around 0.5% as of the latest May figures. With unemployment stuck in double digits there is not much evidence of the kind of natural demand that would lead to natural price increases. By charging banks to deposit money the ECB really is saying: don’t deposit money. Go out and lend money. Spend, don’t save.

Still On The Hot Seat

The problem is that there is very little empirical evidence to attest as to whether this creative measure will work or not. This is not the first time negative rates have been used: Denmark cut its deposit rate below zero for a brief time after 2012. But it is the first time the measure has been attempted as a key policy stimulus by one of the major central banks. Like the Fed and the Bank of Japan, the ECB has an inflation target in the neighborhood of 2%. Realistically, most observers expect prices to remain below those levels well into 2016, and will consider a baseline headline rate of 1.5% to be a sign that things are on the right track.

Meanwhile, Chairman Draghi and his colleagues will not be far from the hot seat in the coming months. A failure for inflation to gain some meaningful traction will renew calls for more aggressive stimulus measures, including a full-on commitment to the asset-backed bond buying program and other “traditional” QE measures (the quotes are because QE itself is anything but traditional, but it is now a mainstream tool of postmodern central banking).

If the ECB’s move had any impact on world equity markets yesterday it was near-uniformly positive, though at this point the rally seems to have a life of its own rather than any dependency on macro events to push it one way or another. It may be worthwhile to keep watch on trends in the Euro, though, and perhaps to hold Eurozone equity exposures not too far from neutral rate targets.