Way back in the middle of July, we wrote about what investors might expect come September. With the year’s ninth month drawing to a close, we pulled up that piece to see how our midsummer musings actually panned out. It concluded with the idea that, while surprises may percolate up for a temporary disruption, the TINA syndrome rules – There Is No Alternative when it comes to equities, and particularly large cap, domestic U.S. equities.

There could be worse ways to sum up this past month. Central bankers spoke (and spoke, and spoke), OPEC doyennes hung out and chatted on the sidelines of an energy conference in Algiers, and derivatives traders frowned at their book of business with Deutsche Bank. Markets overall were a bit more volatile than in August, which is to say that they actually registered a pulse. But the S&P 500 opened the month at a level of 2170. With four-plus hours of trading left before month-end, the index is – guess where? 2170! Alles ruhig — All quiet on the large cap front.

…and the Red Queen’s On Her Head

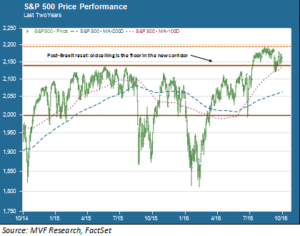

The above chart is an old favorite we like to update and trot out when our point is to show how little has changed over the past couple years. For most of this two year period U.S. large cap stocks, here represented by the S&P 500, traded in a fairly well-defined corridor between price levels of 2,000 and 2,130. That corridor was punctuated twice on the downside by the pullbacks of August 2015 and January 2016. The ceiling was finally breached this July in a frenetic post-Brexit rally. Since then, the old ceiling has become the new floor in an even narrower (as yet) corridor. Briefly put: those events that – from the standpoint of an observer in July – could have catalyzed a major market move wound up not having much impact at all. The expectations bar keeps rising for the capacity of anything to truly shake up this market. This week’s talking points – Deutsche Bank, oil and the U.S. election – are no exceptions.

Deutsche Doesn’t Rhyme with Lehman (or AIG)

While diversified equity portfolios are generally doing fine, pity the poor sort with a bag full of Deutsche Bank stock. That name has plunged 62 – yes, 62 – percent from its 52-week high set last October. The large German concern has long been seen to have a comparatively thin capital cushion and a rather complex book of business making a straightforward asset-liability analysis difficult. Negative sentiment about the bank gained steam with a U.S. Justice Department announcement that it intended to seek $14 billion in penalties for the bank’s role in mis-selling mortgage backed securities. A terse statement by Angela Merkel’s government to the effect that Germany has no intention to supply any capital injections to Deutsche or any other troubled domestic bank ahead of next year’s federal elections ramped up the bears and led to a spate of Lehman/AIG circa 2008 analogies. The analogies are poor, starting with the notion that the Justice Department would go all-out to claw that $14 billion in full regardless of any potential market fallout. On the German side, the idea of hundreds of millions of euros in domestic deposits left to hang in the wind in an election year is somewhat farcical. We do have larger concerns about the health of the Eurozone banking system. But we don’t see much likely collateral damage from Deutsche’s current woes.

One Night in Algiers

“We’re ba-a-a-ck!” was the underlying message of various OPEC nabobs from the sidelines of an energy conference in Algeria’s capital city this week, with Iran’s oil minister lauding an “exceptional decision” made by the cartel. While crude oil prices did jump up mid-single digits as a result of the happy talk, there is little to suggest that a production freeze of 240,000 – 700,000 barrels per day (the putative range under consideration) will by itself sort out the supply-demand imbalances that are still working themselves out in world markets. As always when the contentious agendas of OPEC members collide – particularly those of Saudi Arabia and Iran – the details will be sufficiently devilish to cast doubt on the efficacy of any outcome. As far as equity markets were concerned, in any event, the Algerian goings-on merited little more than a casual side-glance.

Blue, Red, Back to Bed

We were pleased to see a Barron’s article this morning titled “Does the Market Care Who Wins in November?” Readers of our weekly commentary will not be surprised to learn that the article answers this question with an emphatic “No.” Even better, for empiricists such as ourselves, was that the article went on to cite an actual academic study, conducted by the American College of Financial Services, that supplies data in support of this argument. What the study says, in essence, is that in a multi-variate world, a single event like a political election will be lost in a multitude of other variables, mostly monetary factors, that will more actively influence the market’s direction.

Take it from us, you’ll never hear a CNBC news anchor intone the phrase “multi-variate world.” We would strongly suggest committing that phrase to memory, though, and calling it to mind every time you run into someone with a “strategy” for how to invest ahead of the election.