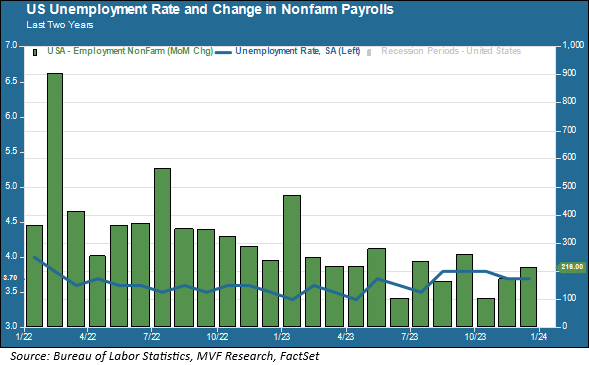

The first week of 2024 served up a bevy of data about the health of the US labor market. The main takeaway is that there are still jobs aplenty in our economy, nearly two years into the most dramatic monetary tightening program since the early 1980s. The December report published this morning by the Bureau of Labor Statistics showed 216,000 payroll additions last month, with the unemployment rate holding steady at 3.7 percent. Hourly wages rose by 0.4 percent, which is more than the 0.1 percent increase in the Consumer Price Index last month. In fact, hourly wages for the full year 2023 rose by 4.1 percent, while headline inflation for the same period was 3.1 percent (we use the headline inflation numbers here rather than the core number which the Fed focuses on, because for actual people the energy and food components excluded by the core index are rather important ones).

Coming In For A Soft Landing

There are several things worth noting about this chart. First, you can clearly see that fewer jobs were created last year than in 2022. That is, in fact, just about exactly what the Fed hoped would happen: a cooler jobs market but one still showing gains every month. Second, the unemployment rate remains below four percent. The current level of 3.7 percent is just a few ticks higher than the 3.4 percent level achieved back in April, which in turn represents the lowest rate of joblessness since 1968. The median unemployment rate for the US economy since 1950 is 5.5 percent.

At least for the moment, these jobs numbers add to the mounting evidence that the Fed has managed to engineer that fabled “soft landing” of economists’ dreams. At some point it may even sink into the sensibilities of disgruntled American citizens (only 14 percent of whom, according to a recent survey, think the economy is doing at all well) that things are actually okay. Yes, the price of eggs is higher than it was in 2019, but so are their incomes, as attested to by those BLS wage numbers. Inflation continues to trend lower, the recent holiday shopping season proved resilient, and 2024 appears to be starting off on the right foot. At least for now.

The Market’s Take

All well and good, one might say, but how will markets react? Don’t we have a “good news is bad news” problem in which better economic growth implies interest rates staying higher for longer and thus disrupts all those rate cut hopes that have kept stocks and bonds humming along so nicely for the past couple months? Perhaps, though it’s worth noting that US stocks are up this morning in the wake of the jobs report, reversing earlier declines in futures markets. The bond market does seem to be rethinking some of the exuberance that followed the most recent Fed policy meeting in December, but in our opinion that exuberance was never warranted in the first place. If the Fed does pull off the soft landing and we get through the tightening cycle with no recession, that should be favorable to risk asset performance this year. It’s early yet, and the first few days of the new year have not been particularly rosy for stocks (which is not necessarily surprising, given the barnstormer of a finish to 2023). But so far, so good as far as the economy goes. Next up: fourth quarter earnings. We’ll have more to say about the challenges companies will be facing this year in forthcoming commentaries.