It seems like the easiest trade in the world: interest rates go up and the price of high dividend stocks go down. Yield-intensive shares have taken a beating this year, none more so than the beleaguered utilities sector. While the S&P 500 is struggling to stay above break-even for the year to date, investors who took on exposure to high dividends are firmly in negative territory: DVY (the iShares ETF) is down by almost 5% as of yesterday’s close. XLU, the SPDR ETF which seems to have become a proxy for a pure play on the dividends-rates trade, is down by almost 12% for the same period.

As investors contemplate a likely secular environment of rising rates, it would seem sensible to reduce the enhanced dividend slice of a diversified portfolio, no? That approach could be a smart tactical play heading into the fall, with possible rate action on the calendar for the September and December meetings of the FOMC. But with below-trend growth likely to keep interest rates below historical norms for some time to come, we would caution against reading last rites on high yielding stocks.

Opposites Day

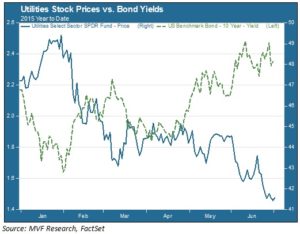

In the chart below we use XLU, the SPDR Select Utilities Sector ETF, to illustrate the uncannily tight negative correlation to bond yields that has characterized high dividend shares’ performance so far this year. This chart plots XLU’s price performance against movement in the 10-year Treasury yield.

The 10-year yield rose from 2.17% at the beginning of January to 2.42% as of the July 1 close. The average dividend yield for the S&P 500 utilities sector is 3.9%. Clearly, the negative correlation between rates and dividend shares has little to do with rational expressions of income preference. Traders make use of ready proxies like XLU simply to trade the day’s news on rates. Many algorithms in this trade key off events like FOMC meetings and the monthly release of jobs numbers. For example, the jobs report released back on February 6 contained a number of upside surprises, indicating a healthier than expected economy. On that day the 10-year yield spiked up 7.7 percent, from 1.82 percent to 1.96 percent, while XLU shares tanked by 4.1 percent. Irrational? Sure, but that’s the way of things in short-term trading. This rate-dividend pattern continued to be reliable as interest rates resumed their upward trend in late April, this time with US benchmarks following the unexpected reversal in Eurozone bond prices.

Give, Give, Give

Dividends, of course, are only part of the widely-followed metric of Total Shareholder Returns (TSR), the other and often larger component of that metric being share buybacks. The two often go hand in hand: as companies move off the steep stage of their growth cycle (the famous S-curve), they tend to give increasing portions of their earnings back to shareholders through buybacks as well as increases in the dividend rate. Over the course of the current six year bull market, top-line revenue growth has waned for a growing number of companies across all industry sectors. During the same time the pace of shareholder returns has quickened; companies are set to return over $1 trillion in buybacks for 2015, a record level representing more than 90% of total S&P 500 operating profits.

Critics will note that buybacks are easy in an environment where borrowing costs are ridiculously low. Rising rates could bring the buyback bonanza to an end, which would seem to be one more reason to be wary of overexposure to stocks and sectors with higher than average TSR yields. While we see logic in that argument we believe it oversimplifies the situation.

Quality, Not Quantity

We believe TSR will continue to be an important metric in evaluating the relative attractiveness of shares, but that the quality of TSR programs will become increasingly important. Companies that can meet their TSR goals largely with free cash flow (FCF) rather than tapping the debt markets will, all else being equal, be preferable to those with growing amounts of net debt on their balance sheets. Investors should also be able to see that buyback programs are being used for more than just insider stock and option awards. A good way to track this is by monitoring the number of fully diluted shares outstanding from quarter to quarter. Large buyback programs without a commensurate reduction in shares outstanding are likely going right into the pockets of options-holding insiders, and doing little to benefit outside shareholders.

Bond yields may be headed north from the historically low floor of the past six years. But “lower for longer” is still in our opinion the most likely scenario for the intermediate term. Lower for longer means that investors should continue to place a premium on shareholder returns. Once the short-term frenzy over the first rate hikes settles down, we expect that premium will come back into clearer view.