The S&P 500 has taken something of a breather this past month. After notching yet another all-time record on March 1, the index has mostly been content to tread water while the animal spirits of investors’ limbic brains wrestle with the rational processors in their prefrontal cortices. This past Tuesday’s pullback – gasp, more than one percent! – brought out a number of obituaries on the Trump trade. We imagine those obits might be a bit premature. As we write this, we do not know whether today’s planned House vote on the so-called American Health Care Act will pass or not (let alone what its subsequent fate would be in the Senate). But markets appear tightly coiled and ready to spring forth with another bout of head-scratching giddiness if enough Members, ever fearful of a mean tweet from 1600 Pennsylvania – knuckle under and find their inner “yea.” An outcome we would find wholly unsurprising.

Risk On with an Asterisk

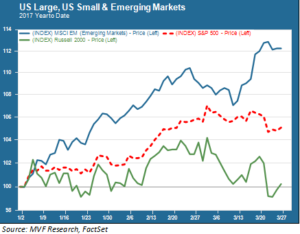

If the melt-up is still going strong, we might want to look farther out on the risk frontier to see how traditionally more volatile assets are faring. All else being equal, a “risk-on” sentiment should facilitate a favorable environment for the likes of small cap stocks and emerging markets. Here, though, we have a somewhat mixed picture. The chart below illustrates the year-to-date performance of small caps and EM relative to the S&P 500.

In a time where US interest rates are expected to rise and the fortunes of export-dependent developing economies are at the mercy of developed-market protectionist sentiments beyond their control, emerging markets are going gangbusters. Meanwhile domestic small caps, which could plausibly be equated to more of a pure play on an “America first” theme, are languishing with almost no price gains for the year. This seems odd. What’s going on?

Rubles and Pesos and Rands, Oh My!

We’ll start with emerging markets, where the driving force is crystal clear even if the reasons behind it are not. The Brazilian real is up about seven percent against the dollar this year, while the much-beleaguered South African rand has enjoyed a nine percent tailwind over the past three months. Seven of the ten top-performing foreign currencies against the US dollar this year come from emerging markets. So when you look at the outperformance of EM equities in the above chart (which shows dollar-denominated performance), understand that a big chunk of that outperformance is pure currency. Not all – there is still some outperformance in local currency terms – but to a large extent this is an FX story. Moreover, it is not necessarily an FX story based on some inherently favorable conditions in these countries that would lead to stronger currencies. It is much more about a pullback of late in the US dollar’s bull run, a trend which has surprised and puzzled a number of onlookers. Whether you believe the EM equity rally has lots more fuel behind it comes down to whether you believe the dollar’s recent weakness is temporary and likely, on the basis of fundamentals, to reverse in the coming weeks or months.

Value Stocks Running on Empty

Back in the world of US small caps, the performance of the Russell 2000 index shown in the above chart owes much of its listless energy to…well, energy. Namely, the small energy exploration & development companies that populate a good proportion of the value side of the small cap spectrum. Value stocks were more or less holding their own through the first two months of the year (though still underperforming large caps), but they got hit hard when oil prices plunged in the early part of this month.

And it’s not just oil and energy commodities, but also industrial metals that have weakened in recent weeks, leaving shares in the materials and industrial sectors – high fliers in the early days of the reflation trade – underperforming the broader market. So this leaves investors to ponder what exactly is left of the tailwinds that drove this trade. The Republicans’ clumsy handling of their first big policy test – repealing and replacing a law they’ve been calling doom on for seven years – may signal a much larger dollop of execution risk (for all those tax and infrastructure dreams) than baked into current prices.

On the other hand, one could make the case that tax reform – likely the next item on the policy agenda – is less complicated than healthcare. If a consensus builds around the idea that Tax Santa is arriving sooner rather than later, one could expect at least one more brisk uptrend for the reflation trade. That outcome could very well catalyze a reversal of the performance trends shown in the above chart, with emerging markets pulling back while small caps gain the upper hand. Of course, there is always the option of staying focused on the long term, and playing through the noise of the moment without getting sucked into the siren song of market timing.