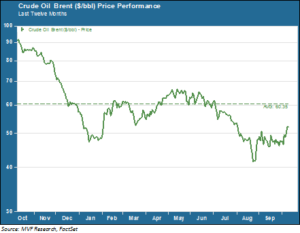

Those brave enough to wade into the markets on August 25, at the depths of the recent pullback in risk assets, have been amply rewarded. The S&P 500 is up 7.8 percent since then (as of the 10/8 close). But oil bulls have fared even better. Spot prices for the key Brent and West Texas Intermediate crude benchmarks have jumped by more than 25 percent since late August amid a growing sentiment that the collapse in energy prices has finally found a floor. Is this sentiment justified, or is this just a repeat of the false dawn we saw earlier this year? Consider the chart below, which plots the price trend for Brent spot crude over the last twelve months.

Impressive though this latest rally may be, prices actually rose faster and higher back in February. A strong jobs report jolted risk assets back to life after a volatile January. Brent crude jumped 29 percent between January 14 and February 19 as part of this broad-based rally. But the rally ran into headwinds around the $60/barrel level. The structural factors of oversupply and weaker demand have proven resilient, making it difficult to see a clear path for prices to regain the $100-plus level where they traded for almost the entire stretch of time from 2011 to midsummer 2014. Even the usual tailwind of summer demand failed to boost prices much past the mid-60s, and then the China story moved front and center to deflate animal spirits and push prices to new six year lows.

Supply Side: Cuts Ahead

US domestic energy companies have surprised observers, continuing to pump out volume in the face of sharply lower upstream price realizations. That may be changing. A report last month by the International Energy Agency predicted that US production will fall sharply in 2016 as the effects of the long price winter finally force decisions on project viability. Experts estimate that some $1.5 trillion of global energy investment is unlikely to be viable in the $50/barrel price area. Industry executives at this week’s Oil and Money conference in London cautioned that a supply contraction from projects switching off may lead to a sudden spike in prices down the road, as spare capacity disappears. Such a spike, though, does not appear imminent. Reduced supply will take time to work its way into the price equation; indeed, the latest figures last week pointed to yet another rise in US crude oil stocks.

The Return of Geopolitics

Another factor, which has been notable for most of this year by its absence, is geopolitics. Instability in the Middle East often leads to higher oil prices, but the volatile conflicts raging across the region this year have had little impact. That may be changing, though, with Russia’s military intervention adding a new dimension of complexity – and risk – to the situation in Syria. The so-called “moderate” Syrian rebel groups Moscow appears to be targeting in its air-to-ground operations have been the beneficiaries of support by the US and some of its key Gulf State (and oil producing) allies. There is continued concern in some policy corners about the potential for a proxy war. A “geopolitical premium” is arguably one of the factors at play in this week’s leg of the crude price rally.

The Demand Puzzle

Hanging over the question of how sustainable this latest energy price rally can be is demand – or, rather, the continued lack thereof. The International Monetary Fund has reduced its forecast for global growth in the wake of growing concerns over the size of China’s slowdown. Its current forecast for China’s real GDP in 2020 is 14 percent lower today than it was three years ago. China’s problems are having a visible effect around the world; for example, Brazil’s exports to China (now its largest trading partner, having supplanted the US) have fallen by 23 percent this year and factor heavily into Brazil’s negative growth environment. A vicious cycle of low growth in developed and emerging markets feeding off each other will be at the top of the list of concerns for international policymakers as they meet for the annual World Bank and IMF meeting in Lima, Peru this week.

The average price of Brent spot crude oil from January 2011 to June 2014 was $110. We do not see the current environment favoring a return to those levels within a 2015-2016 time frame. Investors game enough to put their short-term money at play could perhaps do well by a strategy of “buy at $40, sell at $60.” For those contemplating their annual asset class exposure rebalancing, we would continue to recommend staying modestly underweight oil and industrial commodities more generally. False dawns look rosy, until they fall back into night.