To alternately channel-flip between cable TV’s political shows and its business & markets fare is to see a tale of two Americas. On the one there is fever-pitch intensity about, apparently, the end of the world as we know it. On the other, the blood pressure levels of financial news anchors are sedate as they dispense the day’s economic headlines. Risk asset indexes are drifting their way more or less benignly through a season that, in years past, has offered up more tricks than treats. Other than a sentiment that political risk is more or less fully baked into the cake, as we have noted in several recent commentaries, what are the key contributing factors to the apparent glass-half-full sentiment? As always there are many factors at play, but prominent among them is a renewed run of the bulls in oil.

The Soothing Balm of Texas Tea

After stabilizing in the first quarter of this year, crude oil spent much of the ensuing time bouncing between a floor of $40 and a ceiling of $50 per barrel. It managed to test both ends of that range in the month of August, buffeted by conflicting data about persistently high inventory levels, on the one hand, and rumors of a forthcoming production freeze, on the other. Unusually, given OPEC’s notable string of recent failures to achieve anything of substance at their periodic get-togethers, the September 26 meeting on the sidelines of an energy conference in Algeria managed to win the day. A tentative production freeze agreement sent oil prices soaring.

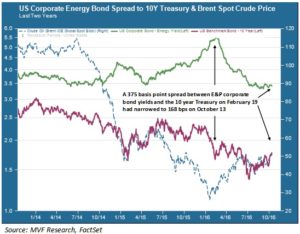

True – the framework production freeze deal announced after that meeting would amount to less than one percent of OPEC’s current output of 33 million barrels per day. Also true – there are still plenty of details regarding individual OPEC member obligations that have to be worked out for the freeze, targeted for November, to take place. But the details do not appear to have fazed investors. Oil producers are taking advantage of the spike in futures prices as far out as December 2018, where prices for Brent delivery are up 36 percent. Spot prices are sustaining their levels above the earlier resistance ceiling of $50. More tellingly, as seen in the chart below, risk spreads between corporate bonds in the oil & gas exploration and production (E&P) sector are less than half what they were in February.

To Market, To Market

While there have been plenty of recent false dawns in the beleaguered exploration & production economy, capital markets seem to be giving the current environment a tentative vote of confidence. Just this past week saw the return of investor interest to the E&P IPO market. Extraction Oil & Gas, a U.S. producer, filed for a $633 million offering of new shares that ended up being priced above the investment bankers’ target expectations. This represents the first initial public offering since 2014; meanwhile, the volume of secondary offerings (i.e. issuance of new equity by companies already in the public market) is $26 billion, making 2016 a record year. Even junk bond investors are sticking their toes back in the water, with a spate of new issues in September amounting to over $1.8 billion.

This flurry of financing activity in the oil & gas E&P sector helps overall market sentiment in a couple ways. First, the opportunity for firms to raise new debt and equity capital allows them to repair their balance sheets and reduce the likelihood of default. And those more forgiving risk spreads shown in the chart above also make the burden of carrying new debt less onerous. So, companies that have made it through the wilderness of the last couple years may be less likely to fold in the coming months or years even if, as expected, oil prices remain well below their highs reached in the middle of 2014.

The Permian Way

Second, at least some of that newly-raised money will be used to purchase new equipment and services as projects become economically viable again. The sharp downturn in energy sector capital expenditures has been a major factor in the dismal performance of the business investment component of Gross Domestic Product in recent quarters. An upturn in activity here should raise confidence in 2017 GDP, which in turn will allay occasional murmurings of a coming recession heard in some corners of the financial commentariat. And there should be more projects to fund than there would have been a couple years ago. Cost structures for U.S. exploration & production companies have fallen by about 40 percent on average during the downturn. Practically speaking, this means that a project that two years ago would have been profitable only with crude oil trading higher than $60 is now profitable at $40 oil. This is especially true in the Permian Basin of West Texas, widely regarded as the most opportunity-rich geography of the domestic oil & gas market and a major investor draw.

There are plenty of risks remaining in the oil & gas sector, and one could argue that investors pouring money into these opportunities now are doing so with rose-tinted glasses. Whether that turns out to be true or not, the perception of stability and improvement in the sector now is, we believe, helping to grease the wheels of risk asset markets heading into the final stretch of the year. A yawningly boring October, should it continue for stocks and other risk assets, may be the tastiest treat of all for investors’ Halloween bags.