Four years ago, in January 2016, world equity markets took a sharp turn lower following the release of some underwhelming economic data from China. Specifically industrial production and fixed asset investment, two of the mainstay growth drivers for the Chinese economy, performed below market expectations. While that may not seem like earthshaking news to the innocent bystander, market observers read it as a confirmation of the systemic problems in China’s economy that had surfaced the previous August, when a sudden devaluation of the Chinese currency popped an asset bubble in that country and spread to global risk asset markets. Fear of an unraveling in the world’s second largest economy led to a correction of more than 10 percent in the S&P 500 that January.

A Splendid Little Trade War

China released a raft of economic data today. The release was significant as it came on the heels of the apparent truce in the trade war, underscored by the signing of a “phase one” trade deal between the US and China on Wednesday. Today’s data points would give investors the chance to assess how much damage the trade war had inflicted. Were we to be in for another negative surprise like in 2016?

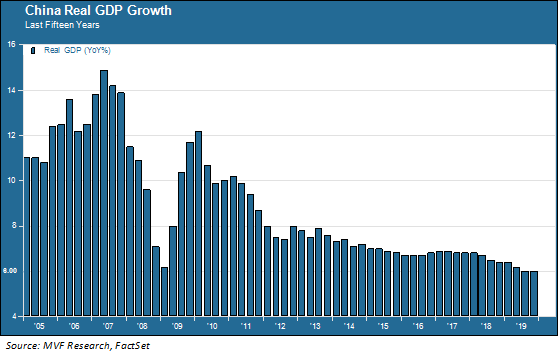

In short, no. Industrial production and fixed asset investment, those critical metrics that unnerved markets four years ago, were just fine, growing at mid-high single digits and significantly ahead of economists’ expectations. Retail sales were also strong, growing at a rate of 8 percent year on year. And real GDP growth, at 6.1 percent year-on-year, was slightly below expectations but very much in keeping with a recent pattern of moderating growth that predates the trade war. The chart below shows China’s GDP trend for 15 years, giving a clear picture of this slowing trend.

The slowdown in China’s growth has been a deliberate policy on the part of Beijing to try and shift the balance of economic activity from the frenetic infrastructure and property build-out of the late 2000s and early 2010s, and towards more consumer-oriented goals. Indeed, observers noted that the recent figures for fixed asset investment showed higher rates of growth in consumer-friendly areas like services and high tech, rather than the usual large-scale infrastructure projects and housing complexes.

A Little Less Uncertainty

The upshot from the two-year trade war would appear to be that it did not accomplish very much. China’s economy has survived the successive waves of punitive tariffs, and the US economy has likewise done just fine, thank you very much. The agreement reached Wednesday does very little other than to put a hold on any new tariffs (though existing ones will be staying around at least through the election, so the administration maintains). China’s obligation to purchase some $200 billion of US agricultural products is very unlikely to happen (there are sufficient outs baked into the contract terms) and for that matter probably a violation of World Trade Organization regulations about undue preferential treatment.

But the phase one deal does remove at least a little uncertainty from the economic scene, and that is what merits the “one cheer” in our headline. We think it is reasonable to assume that the trade war will recede into the background somewhat as a factor in stock market trends, as opposed to the pivotal role it played last year. Here at home, political considerations will be first and foremost between now and November, and the administration is unlikely to experiment with any new salvos that could increase economic risk and take away campaign talking points (watch out, though, for rhetoric aimed at Europe where the Trump team may try to gin up dubious threats and throw red meat to its nativist, EU-hating base).

Trade Is Not the Problem

Back in China, the cease-fire will probably also help sentiment in the short run. Chinese equity markets are off to a stonkingly good start, up around 5 percent since the beginning of the year. But there are other problems there that are due to surface at some point. In recent years Beijing has quietly yet firmly shifted economic focus away from the domestic private sector – which is home to the country’s most productive enterprises in the fastest-growing industry sectors – in favor of the state-owned enterprises which in terms of size still dominate a broad swath of economic activity. As a result, an increasing number of private businesses are either being starved of the liquidity necessary for growth, or are experiencing direct interference from the government in their activities. This trend includes some of the largest Chinese high-flyers like Alibaba, Tencent and Baidu.

We got a taste in 2016 of what happens when China catches cold – it’s contagious and spreads quickly to other markets. In 2019 the market’s obsession with the daily minutiae of the trade war may have been in large part due to concerns that it would result in another nasty bout of illness. But in shifting their attention away from trade following the phase one deal, investors would be well advised not to lose sight of the other potential problems bubbling under the surface in an economy too big to ignore.