We have talked quite a bit in recent commentaries about the market’s odd habit of fighting the Fed throughout the monetary tightening period that began nearly one year ago. Even the Economist magazine, one of the more sober and dispassionate corners of the financial media landscape, chimed in recently with the observation that “sometimes it’s okay to fight the Fed.” Hmm, maybe not so much. On the heels of a heady January when it sometimes seemed like we were headed right back to the bubble-blowing meme stock craze of 2021, the big news in markets over the past several weeks has been a repricing of expectations about the Fed’s likely terminal rate, interest rates in general, the US dollar and finally, it would appear, the stock market. If the market started to get the memo sometime after the latest FOMC meeting, the latest inflation report out this morning would seem to sign, seal and deliver that memo.

The Fed’s Go-To Metric

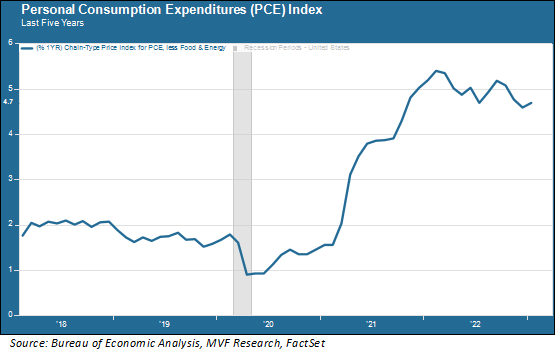

The Personal Consumption Expenditures (PCE) index is a lesser-known cousin to the more familiar Consumer Price Index, but it essentially performs the same function of measuring trends in consumer prices. The PCE, though, is the index the Fed uses as its main gauge of inflation for formulating monetary policy. Today’s report showed the PCE index (excluding the volatile categories of food and energy) increasing 0.6 percent during the month of January, translating to a 4.7 percent year-on-year gain. That was considerably higher than the 0.4 percent monthly gain (4.3 percent year-on-year) that economists expected, and it has not played very well so far this morning in marketland.

As you can see from the chart, inflation has leveled off at an elevated level (relative to where the Fed wants it) rather than come down significantly. Had the index done what the economists expected and grown at a 4.3 percent rate, the trend of slower increases that began last September would have continued; instead, the 4.7 percent rate represented an uptick from December’s 4.6 percent rate and thus a trend reversal. The composite picture for inflation, in fact, looks a lot like the “higher for longer” image that the Fed has been repeating ad nauseum in talking about where it sees interest rates.

Rates and Dollar Lead the Way

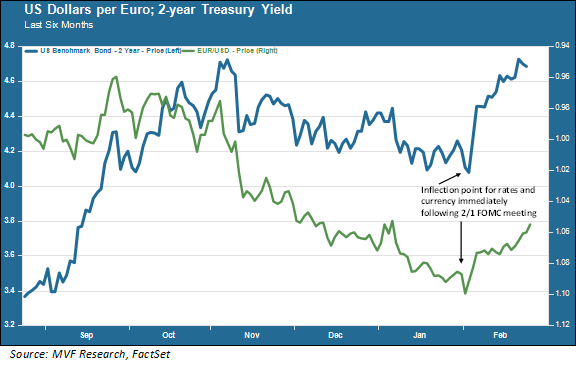

Today’s PCE report, of course, comes a full 24 days after the Federal Open Market Committee’s meeting on February 1. The interesting thing about that meeting, which we commented on at the time, was that the bond market and stock market came away with completely different interpretations. Stocks rallied hard on the notion that Jay Powell came off more dovish than expected, citing “disinflation” on several occasions and not pushing back too hard on looser financial conditions. But interest rate-sensitive yields like the 2-year Treasury had a different take entirely, and yields shot up. So did the US dollar against other major currencies.

As for stocks, the immediate post-FOMC euphoria gradually turned cooler, with shares mostly treading water until the more decisive downward trend of the past two weeks. We don’t find that overly surprising given how fast the market went up in January (and how much of that rally was fueled by some of the junkier corners of the market, having more to do with the covering of short positions than anything else). In our annual outlook last month we expressed our belief that markets are likely to be volatile for much of the first half of the year, but that if our base case assumption of a relatively brief cyclical economic downturn plays out (as we still think is the case) then market conditions could stabilize and turn firmer in the second half. As always, we caution that there is plenty of room for surprises between now and then that would necessitate a change of view.

Slava Ukraini

We would be remiss to not observe that today marks the one-year anniversary of the war in Ukraine, an event that sadly continues its unrelenting course of death and destruction. Those of us far away from the conflict can count our blessings that the war’s impact on the global economy has been less harmful than many of us originally feared. Notably, oil and gas prices have retreated from their highs reached in the immediate aftermath of Russia’s unprovoked invasion. But the war is not over, and the outcome is far from certain both in terms of the economic damage it could cause and, importantly, the implications for democracy and freedom in the world order. We are heartened by the continued strength of the Western alliance supporting Ukraine, made visible earlier this week by President Biden’s historic visit to Kyiv. But there is much left to be done. Our hearts go out to all those whose lives, livelihoods and loved ones have suffered the terrible consequences of this war, and we pray for better times ahead. Slava Ukraini.