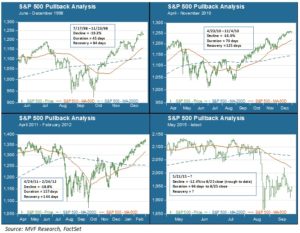

So here we are, somewhere along the path of the latest double digit reversal in large cap US stocks. Whether this is a technical correction – a bump in a still-bullish road – or the early stages of a long winter of discontent remains to be seen. In our opinion, though, the evidence appears to favor the former interpretation. While the script changes from pullback to pullback, there are some similarities in how they play out. Consider the following chart, which illustrates the current environment in the context of peak-trough-recovery trends for three previous corrections.

Selling Waves and Relief Rallies

We focus on these three prior instances – in 1998, 2010 and 2011-12 respectively – because they represent corrections that did not lead to subsequent bear markets. Let us examine some key metrics. The dominant feature of each pullback is a series of volatile selling waves and relief rallies in between the previous high point and the eventual recovery of that high point. The volatility can seemingly come out of nowhere, which is what makes the initial selling waves so difficult to foresee. The CBOE VIX index, widely used as a so-called market “fear gauge”, was relatively benign in the month leading up to each of these four reversals and then shot up literally overnight with the first selling wave. Consider the most recent case. In the thirty days leading up to the first massive selling wave one month ago, the average VIX close was a tame 13.4. A week later the index was over 40, and it has averaged 26 from then through yesterday’s close. Based on historical averages, a VIX level over 20 generally indicates an environment of elevated risk.

While much of the media focus during a pullback is on those days of extreme selling – for example the first several days of August in 2011 or that recent miserable sequence from August 21 -25 this year – investors would be better served to pay more attention to the directional pattern of subsequent selling days and relief rallies. The turning points of these successive micro-trends can be an important signal: if each successive trough of a selling wave is shallower than the previous one – and if each subsequent relief rally peak is higher than the last – it can potentially signal that the worst of the selling is over. However, the road to recovery can be a bumpy one. In a double digit reversal the normal relationship between a price index and its key technical indicators is inverted. Support levels become resistance levels. While many dismiss technical indicators as silly, past reversals show that they matter.

Consider the relationship between the S&P 500 price index and its 200 day moving average (the blue dotted line) in the above chart. Now, clearly there is nothing magic about this line – it is simply a rolling average of the index’s close for the last 200 days and therefore entirely arbitrary. But short term trading programs use metrics like the 200 day average as triggers for their buy and sell decisions. Note how, in each of the 1998, 2010 and 2011 corrections, the relief rallies approach but fail to breach the 200 day average on one or more occasions, then falling to another bout of selling. Perception becomes reality: the moving average has meaning simply because the trading algorithms confer meaning upon it. Bear in mind that more than half of the exchange volume on any given day is generated by computerized program trading, which helps explain the stickiness of these technical indicators.

Technical Context: Where We Are Today

Looking at the current pullback in this technical context, the good news is that the series of selling waves following the 8/25 trough have trended shallower. We have had a couple selling waves of more than one percent since the most recent relief rally peaked on 9/16, but the bottoms remain elevated from the previous selling waves that occurred just after Labor Day. The directional relief rally / selling wave trend is positive.

Against that good news we would offer two points of caution. First, the magnitude of the peak to trough even to date is 12.4 percent, considerably less than the maximum declines of the other three corrections shown. Second, the index has not yet tested its key technical resistance levels. In fact, the current pattern bears an uncanny resemblance to the Septembers of both 1998 and 2011: a decisive relief rally trend following a concentrated period of extreme selling. In September 2011 the index ran into headwinds at the 200 day moving average, and the subsequent selling wave set a new event low before finally recovering and achieving escape velocity at the end of the month. We may not yet be fully out of the woods this time around.

Events Matter

Technical analysis aside, though, one should never forget the decisive role external events play in these pullbacks. In August 1998 the Russian government defaulted on its debt, and a major financial institution (hedge fund Long Term Capital Management) went bust. In summer 2011 the wheels seemed to be coming off the single currency Eurozone, while the US Congress almost brought about a default on US Treasuries with its brinksmanship over the debt ceiling. By contrast, the variable most obviously at play in the current environment is China’s wobbly economy, punctuated this summer by its domestic stock market crash and subsequent currency devaluation. A slowing Chinese economy, while important, is not necessarily an event of the same magnitude as a government default or currency union breakup. The US, meanwhile, does not appear to be headed towards recession, and odds are still good that the Fed will get on with its rate program before the end of the year.

In other words – just because recent corrections have ended closer to 20 percent down than 10 percent down does not necessarily mean that we still have another five percent or more to lose in this one. Events and context do matter. We study the technical aspects of historical corrections because it helps give perspective when a new one occurs. But we always remind ourselves that each double digit reversal is miserable in its own unique way. And also, inevitably, that this too will pass.