Our brains are wired to seek explanations for things – to weave a sensible narrative around events in the hope of making them seem less random or threatening. We see this play out every time a reporter stares at us assuredly from behind the anchor desk and tells us that “the stock market did X today because of “Y”. “Y” could be the release of Fed meeting minutes, or Russian troops amassing on the border of Ukraine, or a Chinese bond auction failure. It doesn’t really matter what the day’s headline is; the news anchor is crafting a story out of the millions of random buy and sell orders flashing in trading system centers around the world. The stories may help us process information, but there are limits to how much light they can really shed on the goings-on of the capital markets.

Cyclicals and Defensives

One of the recurring favorites of Wall Street storydom is how various industry sectors and investment styles perform at different stages of the business cycle. The rule of thumb is that defensive sectors tend to do well when the economy turns down; conversely, cyclicals have a history of outperformance during times of economic strength. Slowdowns favor value-oriented stocks, where dividends contribute significantly to total return. Growth stocks are the leaders during the good times. Or so the story goes.

Time for a Value Story?

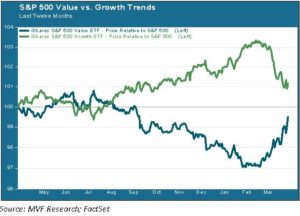

Consider the last twelve months; we show here below the performance of US large cap value and growth equities.

The chart shows a seemingly nice, tidy style trend. Growth stocks decisively took command in summer 2013 and led the market’s rally through January 2014. That trend started to run out of steam in February and went into sharp reversal last month, with value back in the ascendant. How closely does this trend track the business cycle from last summer through the present?

Quite a lot, perhaps, at least on the surface. During the fourth quarter of 2013, a series of macroeconomic data built a case for stronger than expected growth. The Fed’s December Board of Governors meeting ended with a decision to begin tapering the QE program, another sign of confidence in economic recovery. Markets rallied strongly through the end of the year. But the New Year presented headwinds. Jobs data painted a mixed picture: lower unemployment, but less-than-stellar payroll gains. A harsh winter took a toll on much of the country. Russia amassed troops on the Ukrainian border. This would seem to paint a compelling value/defensive narrative.

More Than Meets the Eye

If you look closely enough at the underlying data in any given market trend, though, you are likely to see more complexity than the top-line narrative would suggest. Consider that the top-performing sector during that growth run in the second half of 2013 was healthcare, traditionally considered to be one of the more defensive sectors. Or that the cyclical materials and consumer discretionary sectors were strongest during the February pullback.

Moreover, with the harsh winter behind us, the US economic picture for the rest of the year continues to look relatively upbeat. Economists have lowered their expectations for first quarter earnings, but expectations for the full calendar year are in the high single digits – hardly indicative of a burgeoning slowdown.

Certain growth sectors do indeed seem to be reversing – much of the decline in major US indexes this week has come from the tech and biotech sectors. But that may be more about investors rebalancing their portfolios – buying the losers and selling the winners – than it is about any meta “return to value” narrative. If there is a sector story, maybe it is simply this: mean reversion happens. Every now and then it’s time for something to mean-revert up, and something else to mean-revert down. It’s not a very colorful story, to be sure. But letting the data speak for themselves may be a better way to invest than trying to guess what the next big-picture story will be.