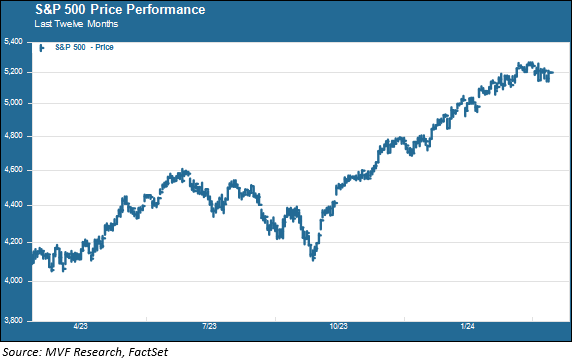

With all due respect to T.S. Eliot, April is not necessarily the cruelest month – but so far it has not been particularly upbeat either, as far as US equities are concerned. The S&P 500 established its last record high on the last Thursday in March, right before the long Easter weekend. Since then, stocks have bounced around – with a bit more volatility than we’ve been used to seeing lately – in a mostly directionless manner.

As usual, there are quite a opinions out there as to what it all means – is this a pause before a long downward spiral, thanks to peaking valuations, persistent inflation and interest rates staying higher for longer? Or is it a pause before the next rally, driven by stronger than expected corporate earnings, an indefatigable labor market and resilient consumer spending? Or are we going to drift, Flying Dutchman style, in a manner reminiscent of 2015, when the S&P 500 started the year at 2057, bounced all over the place and ended at 2043, effectively a year-on-year change of zero percent?

To Pause Is Normal

It goes without saying that there are plenty of unknowns that lie between here and the end of December, so making a long-term prognostication at this point is silly (just witness all the major securities firms already revising the year-end predictions for the S&P 500 they made on January 2). But it is not necessarily surprising that the market finds itself in a bit of a non-directional corridor. Just consider the market’s progress since October last year. From October 27, the lowest point of the fourth quarter, the index gained 27.6 percent to its most recent record close on March 28. That’s a hefty advance, and it is to be expected that a bit of profit-taking and hitting the pause button has ensued.

Moreover, there are good reasons to take into consideration both the optimistic take of a still-strong economy and commensurately robust corporate earnings, and the pessimistic view of sticky inflation and higher interest rates (relative to the bond market’s earlier unrealistic expectations). Both outlooks have evidence to support their case; most recently, the pessimists got a solid data point in hand with a Consumer Price Index report showing March prices rising more than expected. That sent stock prices sharply lower on Wednesday. The effect was relatively short-lived, though, as Thursday brought a cooler than expected report on wholesale prices and a subsequent reversal of most of the prior day’s losses in the stock market.

Taking Things In Stride

We actually think the market has taken recent developments relatively well, considering the major repricing of expectations that has been going on in the bond market. We talked about this last week, with the expectations for six interest rate cuts running into the harsh wall of reality to the extent that the bond market is now pricing in somewhere between one and two cuts in 2024. Changes in interest rates are a key driver of equity valuations as rising rates lower the present value of expected future cash flows. Those lower present values, in turn, magnify already-high price-to-earnings ratios and fuel concerns that the market is in bubble territory. Given the substantial change in interest rate expectations, it is perhaps a good sign that share prices are only a bit off their end of March highs.

The Q1 earnings season is officially underway as of today, with a handful of big banks leading the way (traders don’t seem particularly happy with the first batch of bank earnings, having expected/hoped that they might have raised forward guidance on net interest margins in light of expected higher interest rates). We will be looking for signs of upward or downward revisions in sentiment about macro uncertainty as management teams speak with analysts over the coming weeks. For now, we’ll stick with our assessment that the current pause is not the tipping point of a protracted downward trend, but we will have to see what the data tell us in the weeks ahead.