As unrelentingly negative as this January has been, the prevailing sentiment appears to be weary resignation rather than panic. The typical pattern we have seen over the course of this recovery is for a sharp and swift drawdown followed by an equally swift recovery. That pattern probably drew its strength from complacency that the Fed put remained firmly in place. A kind word from Bullard here, dulcet tones from Evans there and presto! No need to focus on pesky things like earnings and free cash flow when Bernanke’s got your back.

The current climate seems driven by different considerations. The put, for all intents and purposes, is over. Would the Fed consider its options if this pullback descends into bear territory? Possibly, but in our opinion an emergency rescue could quite plausibly inject a higher dosage of fear into the market and make things worse. A more likely outcome, we believe, is that stocks will lurch both ways with higher than usual volatility – a slow burn scenario rather than a collapse-and-recover event.

A Tale of Two Pullbacks: 2015-16 vs. 2011

There are some useful insights to be drawn from a comparison between the current environment and the last US market correction, in the summer of 2011. The chart below compares the two pullback events.

The 2011 event was deeper than the present event (to date). It was also shorter. Most of the damage was done in the space of ten trading days from July 27 – August 10, during which time the index gave up 15.9 percent (see rightmost area of the chart above). Stocks then lurched sideways in a concentrated series of relief rallies and selling waves until a final spasm in early October closed out the event at minus 19.4 percent from the April 2011 peak, just shy of a bear market. During the height of the pullback in August there was genuine panic trading: the index lost more than four percent in a single trading session four times between August 4 – August 18, and there were also four relief rallies of four percent or more in the same time period.

The most interesting thing about the current pullback – or to be more precise the current stage of what is now an extended single event pullback beginning last August – is the lack of breathing space for a relief rally. As we write this on Friday morning the index futures signal a large jump at the open, which may or may not translate into a rally by the close. Sentiment has been unrelentingly negative. But – and here is where we draw the key distinction between today and 2011 – there is no panic in the streets. Sure, there have been several days of two percent or more down, and intraday volatility has been wider still. But there is a world of difference between a close of two percent down and one of four or five percent down.

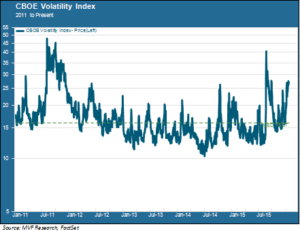

For that matter, the magnitude of the event is more contained than 2011. While other equity asset classes have moved into bear territory, the S&P 500 remains in mild correction territory, 12.7 percent below the all-time high set last May. And volatility has not spiked to the same degree it did in the earlier event. The chart below shows the trading pattern of the CBOE VIX index from 2011 to the present.

VIX spikes in the current pullback have yet to reach the peaks attained in 2011. It is also interesting that volatility during the recent phase of the pullback is far short of the brief spike last August. This again points to the idea that what we have now is a slow burn of negative sentiment rather than panic. We do expect, though, that volatility is likely to stay at elevated levels relative to what it was in 2014 and the first half of 2015.

But volatility swings both ways. This observation brings us back to the point we made in the second paragraph above. Higher volatility and periodic swings up and down make a more plausible scenario for 2016 than the collapse-and-recover pullbacks of recent years. Without the Fed as a backstop the market should be driven by corporate earnings as well as X-factor events around the world. Currently we see a negative tilt to X-factor risks, but that relates only to the ones clear and present in today’s environment. “Unknown unknowns” could fan the negative flames or turn them positive. Time will tell, and the ride will probably be bumpy.