There has been considerable chatter over the last week or two by observers and participants in the junk bond market. Prices for HYG, the iShares ETF that tracks the iBoxx US high yield bond index, started to fall sharply at the beginning of this month and continued through midweek this week, when investors mobilized for at least a modest buy-the-dip clawback. The chart below shows HYG’s price trend for 2017 year to date.

This performance has prompted the largest weekly investment outflows from the junk bond market in three years and sparked concerns among some about a potential contagion effect into other risk asset classes. It comes at a time when various markets have wobbled a bit, from industrial metals to emerging market currencies and even, if ever so briefly, the seemingly unshakeable world of large cap US equities. Is there anything to the jitters?

Pockets of Pain

We don’t see much evidence for the makings of a contagion in the current junk bond climate. First of all, the pain seems to be more sector- and event-specific than broad-based. While junk spreads in all industry sectors have widened in the month to date, the carnage has been particularly acute in the telecom sector (where average bond prices are down more than 3 percent MTD) and to a somewhat lesser extent the broadcasting, cable/satellite and healthcare sectors. The key catalyst in telecom would appear to be the calling off of merger talks between Sprint and T-Mobile, while a string of weak earnings reports have bedeviled media and healthcare concerns. High yield investors seem particularly inclined to punish weaker-than-expected earnings.

There gets to be a point, though, when spreads widen enough to lure in yield-starved investors from the world over. We have seen that dynamic already play out twice this year. As the chart above shows, high yield prices fell sharply in late February and late July, but were able to make up much of the decline shortly thereafter. So while pundits are calling November the “worst month of 2017” for junk debt, they are somewhat facetiously using calendar year start and end points that obscure the peak-to-trough severity of those earlier drops. We still have the better part of two weeks to go before the clock runs out on November, which is plenty of time for buy-the-dip to work its charms.

Bear in mind as well that there is very little in the larger economic picture to suggest a higher risk profile for the broader speculative-grade bond market. Rating agency Moody’s expects the default rate for US corporate issues to fall in 2018, from around 3 percent now to 2.1 percent next year. An investor in high yield debt will continue receiving income from those tasty spreads above US Treasuries (currently a bit shy of a 4 percent risk premium) as long as the issuer doesn’t default – so the default rate trend is an all-important bit of data.

About Those Investment Grades

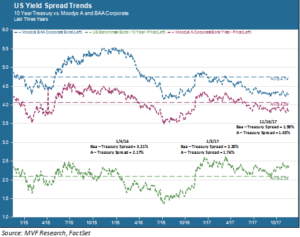

Meanwhile, conditions in the investment grade corporate debt market continue to appear stable. The chart below shows yield spreads between the 10-year US Treasury note and investment grade bonds in the Moody’s A (A1 to A3) and Baa (Baa1 to Baa3) categories. Baa3 is the lowest investment grade rating for Moody’s.

Investment grade spreads today are a bit tighter than they were at the beginning of the year, and much closer than they were at the beginning of 2016, when perceived economic problems in China were inflicting havoc on global risk asset markets. In fact, investment grade corporate yields have been remarkably flat over the course of this fall, even while the 10-year Treasury yield gained almost 40 basis points in a run-up from early September to late October.

Investors remain hungry for yield and the global macroeconomic picture remains largely benign. Recent price wobbles in certain risk asset markets notwithstanding, we do not see much in the way of red flags coming out of the stampede out of junk debt earlier this week. A spike in investment grade spreads would certainly gain our attention, but nothing we see suggests that any such spike is knocking on the door.