The press conference following a Federal Open Market Committee (FOMC) meeting can be a pretty tedious affair, with carefully crafted Fedspeak answers to the predictable questions lobbed by financial journalists. But Fed chair Powell did say one important thing on Wednesday, very clearly and without nuance. “Dots do not represent policy decisions” he said. The dots referred to here are the Summary of Economic Projections (SEP) estimates each member of the committee makes about future economic and interest rate trends. This was of considerable interest to the attending journalists and to markets at large, because a few of these dots had shifted notably since the last SEP go-around back in March. Specifically, the median outlook for core inflation this year drifted up to three percent from 2.1 percent (though the long-term inflation outlook didn’t change).

Of more direct market consequence, the median “dot plot” around the Fed funds rate in 2023 had shifted to suggest two rate hikes that year from the zero lower bound. That’s newsworthy! In his comment Powell was trying to remind the journalists, and the market, that the dots are individual estimates and do not in any way denote an actual policy decision. 2023 is a long way from now. Even the very best and brightest minds at the Fed have essentially zero knowledge about what the world is going to look like then.

Reflation in Reverse

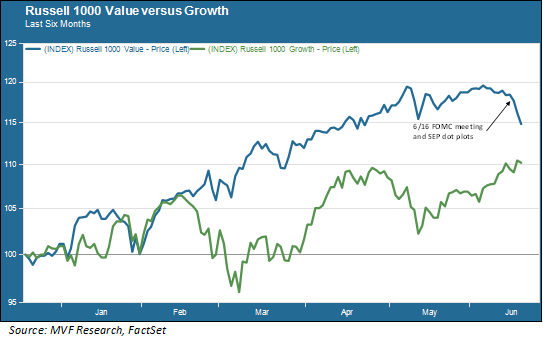

Powell’s measured comments, of course, had no impact whatsoever on the market’s hot take that the transition away from easy money has started. The principal victim of this hot take has been the reflation trade that propelled beaten-down value stocks, commodity prices and bond yields ever higher through much of the year to date. The chart below shows the immediate effect of the FOMC meeting and the dot plots on value stocks.

What Actually Changed, Though?

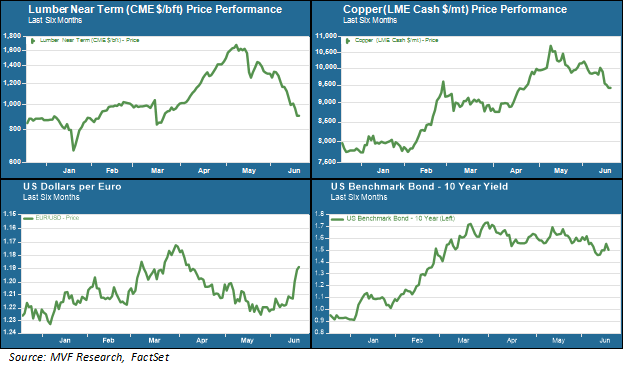

There is something inconsistent about the market’s hot take, though, which leads us to think that we may be heading into an environment characterized more by back-and-forth volatility than by a solid directional move away from the reflation trade. Recall that throughout this entire period the Fed has actually been resolutely consistent on one key point: whatever inflation we are likely to see in 2021, perhaps spilling into early 2022, is going to be temporary. And there is some evidence to support that view. In recent weeks we have seen a distinct pullback in key industrial commodities prices. Bond prices have stayed firm through a series of higher-than-expected increases in producer and consumer prices. And the US dollar, which tends to weaken when inflationary expectations go up, has also gained strength. The chart below illustrates these trends, all of which began well before this week’s FOMC meeting.

Now, these trends may or may not be indicative of anything longer-term. But they are all consistent with the Fed’s oft-stated expectation that the inflation arising from current asymmetries in supply and demand variables will iron themselves out in due course. Significantly, if that is the case then it would also be the case that Fed policy (i.e., low rates for longer) would not be unduly threatened by a structural change to higher inflation. Meaning…potentially no change in policy. Meaning that those dot plot shifts in the SEP this week are just what Powell said they are – simply estimates with no real implications for future policy decisions. Less signal, more noise.

It may take awhile for the market to arrive at a consensus narrative about what this all means for different asset categories. In the meantime, though, it would not surprise us to see more sharp movements back and forth as short-term triggers react without thinking to whatever headlines come out of the daily news cycle. A summer of more volatility, perhaps.