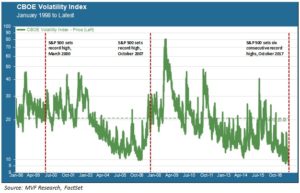

Another week, another string of record highs for U.S. equities. But this wasn’t just your normal “upward drift for no particular reason” set of days. It was an “upward drift for no particular reason AND a 20 year record smashed!” sequence of new highs. Yes, the last time the S&P 500 recorded six consecutive all-time records was in June 1997, back when the Spice Girls were telling us what we want, what we really, really want. And while prices continued their inexorable ascent, volatility continued to plumb new lows. The CBOE VIX index, the market’s so-called “fear gauge”, suggests that times have never been safer for equity investors: the index has closed below 10 more times in 2017 than in any other year since the VIX first launched in 1990.

The Great Risk Conundrum

This presents a conundrum: while the S&P 500 is more expensive than any other time in the past hundred years (the heights before the market crashes of 1929 and 2000 being the exceptions), it is also serenely placid. Contrast today’s environment with the stretch of market history leading up to the 2000 dot-com crash. The chart below shows the VIX index price trend from 1998 to the present.

The contrast between today and the late 1990s is noteworthy. The S&P 500 reached a then-all time high of 1527 in March 2000. As the above chart shows, though, the final two years of that bull market came with exceedingly high volatility. A VIX price of 20 or higher is considered to be a high risk environment; the index remained above that level for much of the final stretch of that raging bull market. In the mid-2000s the situation was different, but the VIX still was consistently trading at elevated levels well in advance of the 2008 crash.

See No Evil, Hear No Evil

During both of those earlier periods (i.e. 1998-2000 and 2006-2007) markets were jittery for a variety of reasons. Periodic pullbacks in the stock market reflected these concerns – in particular, the Russian debt default of 1998 that led to the collapse of hedge fund Long Term Capital Management, and then, in early 2007, the failure of two Bear Stearns mortgage-backed funds that turned out to be the canary in the coal mine for the broader financial system meltdown. In both cases, investors would eventually buy the dip and keep the damage contained, but markets would remain in an elevated state of nervousness until the bottom finally fell out.

The message the market sends today is entirely different; namely, that there is literally nothing out there in the big bad world that could have an adverse impact on risk asset markets. Arguably, the one single issue able to move investors to action (in a positive direction) for the past twelve months has been tax reform. This trend, which we highlighted in last week’s column, continues with a vengeance despite a lack of hard evidence that any kind of truly meaningful, broad-base reform will emerge out of the current Congress and White House. Apart from taxes, though, the market seems content to channel its inner Metallica and proclaim that “nothing else matters.”

Swan Spotting

Even if the “reflation trade” that springs from tax reform hopes dies out again – like it did back in February – we think it more likely than not that the market would simply revert to form and drift ever so gently upwards. Why wouldn’t it? The global economy, if not particularly inspiring, is at least in relative harmony with growth occurring in most major regions encompassing both developed and emerging markets. Not a single piece of headline macro data suggests that the current recovery cycle has peaked. Quite the opposite: when economies peak they tend to overheat, in the form of escalating prices and wages. This simply has not happened. As long as it doesn’t happen, the Fed and other central banks will have a great deal of latitude in guiding their balance sheets and policy actions back towards some semblance of normal.

Thus the “sunny skies” portion of today’s column title. The “swan songs” bit refers to the black swans – the unexpected events that can suddenly emerge from the murky sea of risk factors and knock Ms. Market off her game. We know from observing market behavior this year that the bar is high indeed for the kind of black swan that could have an impact. But the very definition of a black swan is something you can’t name because you have never seen it before – so you have no way of quantifying what it is before it happens. Presumably there will be such swans in our not too distant future. One or two such events could even be of such import as to keep market volatility elevated for longer, akin to that stretch of bull market between 1998 and 2000. Then – and perhaps only then – do investors’ thoughts turn seriously to questions of more defense in their allocation strategies.