As last year drew to a close we were writing quite a bit about the narrowness of the year-end stock market rally – noting, for example, that some 40 percent of companies on the broad-based Nasdaq exchange were down by 50 percent or more from their 52-week highs. We picked up the theme in the early weeks of this year when the bad news caught up with the blue chip S&P 500 itself. Now, however, we are contemplating the other side of that trade. There has been a genuine bear market – i.e., a decline of 20 percent or more from the previous peak – in a not-insignificant part of the overall US stock market. There are also perhaps some indications that this “bear of low quality” may be stabilizing.

Loss Leaders

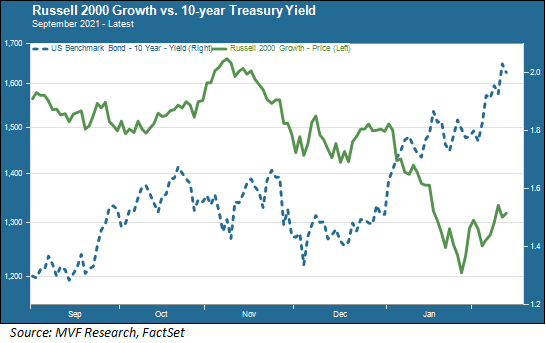

A reasonable visual for this low-quality bear can be seen in the performance of the Russell 2000 Growth index, shown below along with the trend in the 10-year Treasury yield.

The Russell 2000 Growth is a small-cap index full of technology-oriented companies many of which are at a relatively early stage of their corporate life, with unproven value propositions and an uncertain stream of cash flows some ways out in the future. As the above chart shows, this index peaked in early November and began a long decline that continued through the “Santa Claus” rally in the S&P 500 and other large-cap indexes in December, bottoming out in late January around 27 percent down from the November peak.

What were the proximate causes for this long decline? The go-to story with small-cap tech stocks with questionable cash flow prospects is sensitivity to interest rates. Interestingly, though, the index actually stabilized and then rallied in October when yields (the 10-year Treasury shown here as the blue dotted line) were rising. But the initial fall from the November peak in the Russell 2000 Growth did track the resumption of the upward trend in rates around the same time (that trend briefly reversed when the first news about the Covid omicron variant came out right after Thanksgiving, but since then it has been pretty much all one direction for interest rates).

Every Day Has Its Dogs, and Every Dog Its Day

The rate impact was amplified, of course, by the already-stretched valuations of many of these companies, the stock prices of which had gone up at a dizzying pace since the beginning of the post-lockdown rally in 2020. Changes in interest rates have an outsize effect on companies whose free cash flow growth models are farther in the future and more subject to change. When those future cash flows are discounted back to a present value, every incremental upward tick in rates exerts a more negative effect on values than is the case for more near-term, stable cash flows.

At some point, though, the repricing of risk happens and the pullback stabilizes. We may or may not be there at present, but it is worth noting that the Russell 2000 Growth is up around 10 percent from that late-January low, even while interest rates have continued to rise. A forward-looking investor might argue that the market is already starting to look past the present level of high inflation, and commensurately high interest rates, and on towards the stabilization in prices many expect to take place later this year, perhaps as early as in the latter part of the second quarter.

That same investor might note that, while everyone in the financial media world was obsessed this week with the inflation report showing the year-on-year increase in the Consumer Price Index at 7.5 percent, which was up from the previous month’s print of 7.0 percent, the incremental month-to-month increase was 0.6 percent, the same as last month. If that month-to-month trend were to continue through the next few CPI reports, it could validate those expectations for stabilization.

Again, just because the Russell 2000 Growth has enjoyed a substantial bounce off its late-January low doesn’t mean that we should sound the “all-clear” signal for these riskier areas of the market. But we think the overall theme of stabilization is worth paying close attention to, and this is one component of that theme.