A financial firm by the name of Coinbase went public this week, and instantly garnered a market capitalization of $76 billion. How big is $76 billion? Well, it’s bigger than the parent company of the New York Stock Exchange (worth $73 billion at today’s prices). It’s bigger than CME Group, the Chicago Mercantile Exchange that is home to much of the world’s futures, options and other financial derivatives activity (about $64 billion). And it completely dwarfs NASDAQ, Inc. ($26 billion), where the world’s technology superstars and their up-and-coming rivals come out to play.

So what does Coinbase do, to make it so impressive in comparison to some of the biggest and most well-established financial securities exchanges around the globe? It acts as an intermediary for people buying and selling cryptocurrencies, none more so than this century’s version of Dutch tulip bulbs or the South Sea Bubble – namely bitcoin. For a hefty fee – around 0.5% per transaction – Coinbase will attempt to shine a healthy transparency on the mostly murky and frequently unsavory world of cryptocurrency. The company has dreams of one day being the platform of choice in a world without borders, where nations and their currencies have largely dissipated and some kind of decentralized magical force allows humans liberated from their governments to barter, truck and trade with each other in perfect privacy, yet with perfect security. That would be the ultimate realization of the libertarian fantasies proclaimed by bitcoin’s original creator Satoshi Nakamoto (who may or may not be a real person, to this day nobody knows).

The Price of Everything, the Value of Nothing

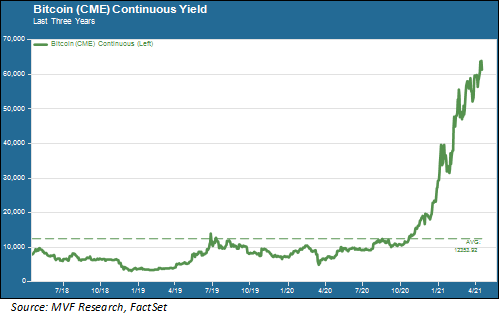

Needless to say, that perfectly decentralized One World bears no resemblance to the world we actually inhabit. National borders indeed have become more defined, not less so, in recent years as countries have had to face the many discontents wrought on their populations by three decades of no-holds-barred globalization. Nevertheless, as you are no doubt aware, the bitcoin craze moved into a new gear last year and has been blasting through milestone after milestone so far this year, as shown below.

That chart says just about everything you need to know about Coinbase and its sky-high valuation. As bitcoin goes, so goes this one-trick pony of a financial intermediary. Which brings us back to that never-ending topic of discussion: what exactly is in store for the legions of the crypto faithful?

Digital, Yes. Decentralized, Probably Not

We have written at length in other commentaries, as well as our annual outlook earlier this year, about the ways in which bitcoin and its ilk fail to serve an effective role as currencies. They are terrible as a unit of measure due to the wild day-to-day volatility. That volatility also makes them sub-optimal as a means of exchange. Businesses would have to contend with uncontrollable swings in their profit margins, making them less stable as enterprises. Finally, as a store of value these cryptocurrencies are only as valuable as the market’s perception. In this way they really are more like 17th century Dutch tulips (at one time a single bulb could buy you an actual house along one of Amsterdam’s canals) than they are like today’s industrial commodities. They don’t actually serve a purpose. They’re not even something pretty to look at. The tulip bubs had that, if nothing else.

But there is another and perhaps more compelling reason why bitcoin could wind up on the trash heap of speculative financial history sooner rather than later – and that has to do with another variation of digital currency. Several stories in the news this week talked about the rapid advancement China’s central bank is making in the creation of a digital renminbi (the country’s national currency).

China’s renminbi project is essentially an alternative form of digital currency to the decentralized blockchain technology that underlies bitcoin. Central bank digital currencies (CBDCs) such as the renminbi are governed by the rules and processes of the sponsoring central bank. In effect they act as digital cash. Just as with physical cash – banknotes and coins – you can transact without the intermediation of a bank, likewise CBDCs would be a relatively seamless way to transact for goods and services without debit or credit cards, or paper checks, or even a payment service like Venmo or Apple Pay that still is linked to an intermediated account. China has a head start in this arena, but other central banks are likely to follow.

CBDCs thus actually do solve a problem, where decentralized cryptocurrencies do not (and will not, for as long as we have a financial system defined by the rules and regulations of national borders). It is relatively easy to imagine a world in which central bank digital currencies become an increasingly important part of the global payments system. It is much less easy to imagine a financial world ruled by decentralized blockchain. Not impossible, mind you. But very difficult.