The home page for Barron’s online this morning is an instructive sign of the times. One of the lead articles is headlined thus: “Investors Regain Interest in U.S. Stocks,” going on to talk about a $4.6 billion of net inflows into global equity ETFs and mutual funds in the past week. Just two articles below that happy headline is a somewhat more dour take on things: “Unprecedented Outflows from U.S. Stocks Could Leave Remaining Investors Holding the Bag.” It may be the best of times, it may be the worst of times, but in any case it does appear to be a remarkably confusing time.

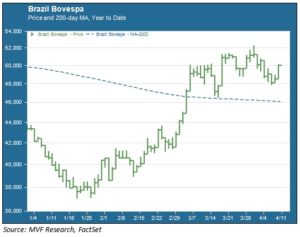

With that confusion in mind, let us consider Brazil. The once-high flying South American bellwether is rarely far from the top of the headline stream in both the financial and the political sections of major media outlets. Investors with the stomach for event risk, though, have little to complain about in the first quarter-and-a-bit of this year. The chart below shows the price performance of the domestic Bovespa stock index for the year to date.

No Country for the Weak of Heart

The Bovespa is up an impressive 37 percent from its low for the year reached on January 26. Over the course of this rally we have learned the following pieces of information about Brazil: Real GDP in 2015 fell by 3.8 percent, the most in 25 years; the magnitude of GDP decline from peak to trough is 7.2 percent, the worst since the 1930s; and the economy is set to shrink another four percent in 2016. Inflation is over 10 percent, and the total public debt to GDP is over 70 percent, a level not compatible with the country’s existing socio-economic commitments.

All of which is to say nothing of the toxic political climate, long mired in a financial corruption scandal surrounding Petrobras, the national oil concern. Brazilian President Dilma Rousseff has fought attempts by opposition lawmakers to bring impeachment charges against her for some time. She appears to be losing the fight with the defection of three political parties from the coalition led by her Workers’ Party (PT), most notable of which is the Brazilian Democratic Movement (PMDB) led by Michel Temer. With polls showing around 70 percent of the population supporting impeachment, Rousseff may find herself at least temporarily out of power before the end of this month.

Salto do Gato Morto

Given the dire state of both the economy and the political system, can the current rally in the Bovespa be anything other than a dead cat bounce (approximately translated into Portuguese above)? The bullish case would start with the observation that oversold assets will attract mean reversion at some point. The Bovespa is currently around 49 percent below the post-2008 high reached in November 2010. Does that qualify as “oversold”? Perhaps yes, if one assumes that the likelihood of a Dilma Rousseff exit – with PMDB head Temer as the potential replacement – is fully priced into current levels. This outlook would also be premised on the view that the wrenching GDP retreat will bottom out in 2016, that a weak currency will give a tailwind to exports and that a stabilization in commodity prices will boost the economically important resource sector.

Of course there is no certainty that events will play out to such a tidy resolution of the current problems. The PMDB is hardly a squeaky-clean political establishment; six of its members including both the upper house and lower house speakers are under investigation in the Petrobras affair. Nearly 60 percent of the Congress is under some form of criminal investigation for a range of misdeeds including homicide. On the economic side of things the banking system, which has stayed relatively intact amidst the general gloom, may be vulnerable (especially the large public sector banks) to growing capital adequacy pressures if the recession doesn’t trough in the near term.

Tango Merval

For those who missed the Bovespa ride in the first quarter, we would be skeptical of any tactical overlay opportunities for the coming months and view the potential case for Brazil as net-negative. For those with a taste for wading back into riskier LatAm equities, we are somewhat more favorably disposed towards Brazil’s neighbor to the south. Argentina is returning to international capital markets next week after a 15 year exile, with a global bond offering investors expect to fetch between $12-15 billion. The proceeds from this offering will be applied to repaying a consortium of creditors led by U.S. hedge fund Elliott Management, on which the prior Argentine government defaulted in 2001. Observers expect that a successful bond offering next week will pave the way for Argentina’s ability to return to global debt markets at least once more later this year.

Argentina’s Merval stock index has also fared well this year, with the latest close about 28 percent above its January low. But whereas Brazil faces a daunting challenge to recapture the performance of its glory days in the early years of this decade, Argentina’s new reformist government could potentially be the catalyst for significant upside ahead after the many years in the wilderness under the previous isolationist government of Christina Kirchner. Not without risk, of course – Argentina has broken the hearts of many an investor going back to the Baring Crisis of 1890. On the other hand, as a Russian proverb has it, no risk means no Champagne.