Apple is a phenomenally successful company, and at $607 billion it is also the world’s most valuable enterprise. So it is probably not surprising that new product announcements would command Wall Street’s attention. But there is a level of showmanship and high drama to Apple’s product launches unparalleled in the annals of modern markets. The effect these feats of corporate kabuki have on the stock market should put the definitive nail in the coffin of the Efficient Market Hypothesis and the idea that the market is in any meaningful way rational.

Fanboys and Haters

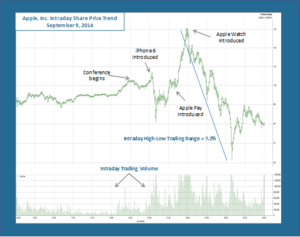

This past Tuesday Apple convened a conference in its Cupertino hometown to announce a sequence of new offerings: new versions of the iPhone, a new payment application called Apple Pay, and its debut into the so-called “wearables” market with Apple Watch. How did the markets react? A picture says a thousand words.

“Don’t fall in love with a stock” is a timeless maxim, but one seemingly lost on the vast legions of Apple devotees as well as the less populous but still prominent haters of everything Jobs, Cook & Co. The skeptics had the upper hand as CEO Cook described the features of the new iPhone 6 and 6 Plus. Perhaps the market’s dour take on the new 4.7 and 5.5 inch screens is that they address a market where Apple’s rivals, notably Samsung, have an existing advantage. In any event, the bulls regrouped when Cook moved on to the second innovation, a payment system aimed at nothing less than consigning the credit card to the dustbin of economic history. Finally came the product tech blogs and fanboy sites have been chatting about for weeks: the Apple Watch. Some observers seemed to like it – the Financial Times correspondent Tim Bradshaw spent part of his liveblog coverage doing a selfie/demo of his Watch-adorned wrist. Oh, and U2 performed live! But Wall Street turned its nose up and the share price plummeted.

Intraday Ranges and Small Countries

Let’s put some quantitative context into that wild roller coaster of a price ride. The intraday spread between the high point reached after the Apple Pay announcement and the post-Watch low was 7.2%. Now, 7.2% of $607 billion is about $44 billion. By comparison the total Gross Domestic Product of Botswana is about $34 billion. Yes, more money changed hands in reaction to a single company’s product launch than the total economic worth of several dozen sovereign nations.

Did the net present value of Apple’s future cash flows really change by a magnitude of $44 billion in the space of an hour? After all, the fundamental value of any stock is nothing more or less than the sum total of the expected future cash generated by its assets, discounted at an appropriate cost of capital. Now, these new products will very likely make a significant contribution to Apple’s earnings for years to come. But there is plenty of uncertainty about the future for any business, including category-killing Apple. That uncertainty should in theory keep a lid on immediate changes in the stock price. But financial theory is often starkly at odds with financial practice.

The Wisdom of Crowds

Is there anything useful to be gained from this snapshot of the collective response to Apple’s new products? We do think the crowd got it right in one sense, which is that Apple Pay was probably the most interesting, and potentially game-changing, announcement of the day. Although the technical details are still coming out, one of the apparent features of this platform is a security function giving added protection to customers’ financial data. Neither Apple nor the merchant will collect user data during a transaction; payment approval will be transmitted by a unique code. Given the unsettling, and likely continuing, rise in cyber fraud, Pay could prove to be a very strong addition to the Apple product line.

But that remains to be seen. Apple is best known for sleek, engaging and user-addicting consumer technology. Apple Pay is a deviation from the standard playbook that Steve Jobs handed off to Tim Cook. We probably will not know for some time whether the crowds truly were wise in their insta-valuation of Apple Pay.