Earlier this fall we coined the phrase “sector spaghetti” to describe a phenomenon we observed in the US equity market, namely the absence of any sector leadership. The small concentration of tech shares that have driven performance for the lion’s share of this bull market started to fall sharply back in July as investors reacted badly to underwhelming earnings announcements from Facebook and others (underwhelming, perhaps, only in the febrile expectations of the analyst community, but still…). Without leadership by the enterprises that dominate the S&P 500’s total market value, the various industry sectors waxed and waned, their combined trajectories looking like a tangled pile of cooked pasta dumped on a kitchen counter. Hence, sector spaghetti.

Oh, and just how impactful was that “small concentration” of tech shares? Consider this: according to the Economist magazine, just six stocks – Alphabet (Google), Amazon, Apple, Facebook, Microsoft and Netflix – have accounted for 37 percent of the rise in value of all stocks on the S&P 500 since 2013. Think about those two numbers: 6 and 37. That’s a huge impact for such a tiny cohort.

A Picture Emerges

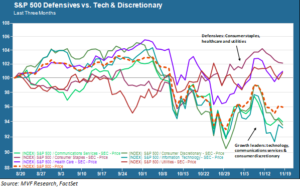

The spaghetti factor has cleared a bit, thanks to the pullback beginning in October that brought the S&P 500 to flirt with a technical correction on a couple occasions. A general risk-off sentiment has set in, and with it a rotation of sorts into the traditional defensive sectors including consumer staples, healthcare and utilities. The chart below illustrates the recent trend of these three sectors versus the erstwhile growth leaders of information technology, communications services and consumer discretionary.

The problem with this defensive rotation becomes clear when you look at the dotted red line in the above chart. That represents the price trend for the index itself. As you can see, it is much closer in proximity to the lagging growth sectors than to the outperforming defensives. The reason for which, of course, is the outsize influence those market cap-heavy sectors exert on the overall market: the three growth leaders account for more than 40 percent of total index market cap, compared to just over 25 percent for the three defensive sectors (energy, financials, industrials, materials and real estate make up the index’s remaining balance). A rotation out of tech is a rotation with a steep uphill climb.

What Is Tech, Anyway?

The “tech sector” is sort of a misnomer, to the point where the index mavens at Standard & Poor’s undertook a major restructuring of the S&P indexes earlier this year to better segment the various enterprises whose primary business falls somewhere on the value chain of the production, distribution and/or retailing of technology-related goods and services. The restructuring was helpful, to a point. For example, Apple, Facebook and Microsoft are all constituents of the information technology sector, but Alphabet (Google) and Netflix both fall under the newly-defined communications services sector.

But it is only helpful up to a point. Take the case of Amazon which, despite being a company entirely built on a technology platform without which it would not be a business at all, has always been and remains a member of the consumer discretionary industry sector. In fact Amazon, Microsoft and Alphabet are all industry leaders in the multi-billion dollar business of cloud computing services, yet all three are in different industry sectors.

More broadly, though, it is actually hard to think of any industry sector where “technology” in one form or another is NOT a core component of the industry’s competitive structure. Financial services companies compete in the fintech arena, while hundred year-old industrial concerns are in a race to grab leadership in the Internet of Things, whatever that winds up being. Even sleepy utilities, traditionally loved almost solely for their high dividend payouts, are scrambling to convince investors they are on top of the evolution to “smart grids” (another catchy name that mostly has yet to demonstrate an actual present-day revenue model).

The point is that technology is all-pervasive. But actual ownership of much of that technology remains highly concentrated – in the hands of those same companies responsible for a large chunk of this bull market’s gains. Any rotation out of those companies into something else is going to need a pretty compelling narrative to deliver commensurate returns. For starters, investors will be hoping next week for a second helping of strong holiday shopping results alongside their turkey and stuffing.