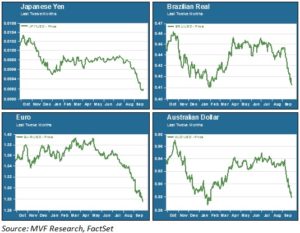

The S&P 500 is up by about 8% for the year to date, even after Thursday’s pullback (an increasingly rare one-day reversal of more than 1%). Meanwhile the EAFE index of developed international stocks is in the red for the year, and recently red-hot emerging markets have also given up more than 5% in the past several weeks. As always there are many factors at play, but one that stands out is the strength of the U.S. dollar, which continues to set new highs for the year against other major currencies. When the dollar rises relative to another currency, assets priced in the foreign currency lose value when expressed in dollar-denominated terms. As the chart below shows, other major developed and emerging currencies have taken a beating at the hands of the dollar recently.

It’s the Economy

What’s behind the greenback’s surge? A look at headline growth data tells an important part of the story. While the Eurozone and Japan are struggling to stay out of recession territory, the U.S. grew at 4.6% in the second quarter, according to the latest revision announced today. Unemployment has been trending down while inflation remains tame. Corporate earnings have been healthy as well. According to FactSet, a data research firm, earnings are projected to be 7.3% for the full year. Surprisingly – given the way consensus estimates normally compress as the event nears – this end-of-September estimate for FY2014 growth is higher than it was at the end of June. International flows into U.S. asset markets this year has been profound; the unexpected strength in U.S. Treasury bonds this year, for example, has been largely driven by foreign demand. The dollar, it would seem, is where everyone wants to be.

Room to Run

Nor does the rally appear to be at high risk of running out of steam (though it should be said that currency markets are highly volatile). Take the euro, for example, which has fallen about 8% from its twelve month high point reached in March of this year. At the current rate of 1.29 euros to the dollar the Eurozone currency is still about 8% higher than its five year low of 1.20. Some observers see a potential return to the EUR/USD parity that prevailed in 2002, when the currency came into existence as legal tender. Elsewhere, the ongoing weakness in key commodity prices from gold to crude oil, copper and wheat has taken a toll on resource-heavy currencies like the Australian dollar. And “policy divergence” is a phrase making its way into the financial discourse as the U.S. prepares to wind up its quantitative easing program while stimulus remains the name of the game in Europe, Japan and elsewhere.

No Free Lunch

While a strong dollar can be good for dollar-denominated risk assets, there are concerns about the effects an overheated currency can have on other parts of the economy. Quarterly earnings conference calls are brimming with talk of “FX headwinds” as managers explain why profits and sales have missed projected targets. A great many companies on the S&P 500 generate more than half their revenues in markets outside the U.S., and are thus exposed to weaker currencies. U.S. exports are also harmed by a rising dollar, as it increases the price of U.S. goods relative to those produced by other countries. Also, the dollar is attractive in part because investors expect interest rates to rise when the Fed begins to guide short term rates higher, which most predict will be sometime in 2015. Rising rates can be bad news for stocks and other assets (though they don’t necessarily have to be).

We continue to believe there is a good case to be made for maintaining overweight positions for U.S. assets in diversified portfolios. Nothing is set in stone, though, and currency market conditions are subject to rapid change. Diversification always matters, even when it appears to not work.