The HBO comedy “Silicon Valley,” which recently concluded its final season, provided its viewers with a humorous yet dead-accurate take on the quirky, cynical culture of the modern-era tech world and the characters – the larger-than-life titans and desperate start-up kids and assorted hangers-on feeding at the deep-money troughs – who populate it. One episode early in the series featured a satire of one of those ubiquitous “tech crunch” competitions where wannabees pit their new-new thing against the established giants in hopes of catching an amorous glance from one of those deep-pocketed VCs out in the audience with whom to skip down the Yellow Brick Road towards the Emerald City (or at least a $1 billion valuation and the coveted “unicorn” status).

In this episode the plucky team of nerds from start-up Pied Piper hope that their revolutionary data compression engine will punch their ticket to untold riches. Unfortunately, they discover at the tech crunch event that evil nemesis Hooli (an entirely unsubtle stand-in for Google or Facebook or any other Death Star platform of your choice) has effectively swiped their technology and integrated it into their own vast, app-rich platform. After Hooli’s presentation (which ends with a live performance by Shakira, thus perfectly encapsulating how these things actually work in real life) one of the despondent Pied Piper guys sums up the lament of every would-be giant killer: “At best, we’re just a crummier version of Hooli.”

Head Lamps and Crochet Kits Delivered to You

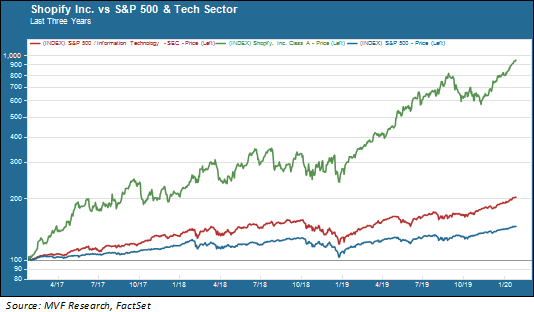

We thought of that “Silicon Valley” episode a couple days ago while contemplating the stock market performance of a company called Shopify. We illustrate this performance in the chart below.

That’s a pretty stunning three-year performance, far outpacing even the market-leading tech sector (crimson trend line) let alone the S&P 500 itself (blue trend line). Have you ever heard of Shopify? Many people have not, but we would bet dollars to doughnuts that you have come into contact with many of the names that reside on its platform. Here’s how it works. Your online habits – what you buy, what you search for, how you connect on social media – are all part of what the giant tech platforms early on identified as “behavioral surplus” – basically, residual data that could be Hoovered up from your interactions with the various sites, packaged, used for analytical purposes and sold to third parties. That data would be invaluable to, say, a retailer of bespoke handbags who would love to pinpoint the subset of online humans predisposed at some given time to drop some cash on a classy one-of-a-kind bag. Shopify makes that happen: think of it as an online retail space that not only houses independent enterprises but performs all the back-end functions – logistics, payments and the like – so that the retailers can spend their time doing what they do best.

We would imagine that you have had the experience of reading something online and seeing those small, neat little ads strategically positioned to catch your eye and – more importantly – offering a product or service that is directly meaningful to you. For example one of us (Katrina) is an avid trail runner who also likes to crochet, and not a day goes by on her feed without the appearance of highly specific ads featuring companies that do nothing but make head lamps for night running, or cute kits for crocheting colorful blankets and the like. That’s Shopify, the foundation on which each of these little bespoke enterprises sits.

Fee, Fie, Fo, Fum

That’s a pretty successful business model, and its ubiquity in the online world can in part explain that sky-high price performance. But there’s a catch – there is always a catch. Shopify currently sports a price-to-sales (P/S) valuation of 25 times. Let us repeat: that is price-to-sales, NOT price-to-earnings. For purposes of comparison, the P/S ratio for the S&P 500 is currently around 2.3 times. Shopify doesn’t have a meaningful price-to-earnings ratio because the company has no earnings – from after-tax net all the way up to earnings before interest and taxes, Shopify is in the red. Investors buying in at these valuations have to imagine the company is going to grow exponentially and then some, uninterrupted, for the next five to ten years.

Unfortunately for Shopify, they operate in the shadow of the Hooli of retail – Amazon. While Shopify’s market share of around 4.7 percent of US retail eCommerce (according to eMarketer) is impressive and higher than Walmart, Apple and Home Depot, it pales in comparison to Amazon’s 36 percent share. And Shopify’s business model is simply too good for the Seattle Goliath to pass up. Indeed, Amazon is busy preparing the launch of a new platform for luxury retailers that sounds an awful lot like what Shopify offers. Except that this platform would come plugged into the full, sweeping array of Amazon fulfillment, logistics, payment, data warehousing and every other leading-edge service.

It may well be that Shopify defies the odds and manages to lock in a big enough network effect to grow at the levels those breathtaking valuations imply. On the other hand, it would not be hard to imagine a rueful lament in the not too distant future along the lines of “at best, we were just a crummier version of Amazon.” This lament is heard all over the technology space today – and we believe it is for the worse. Energetic but fair competition was supposed to be the foundational principle of our economy, and in its absence it is becoming increasingly missed.