We are all in the process of adjusting to a different life than the one we knew just a scant couple weeks ago. There is much that we still do not know about how the coronavirus crisis is going to play out in terms of the number of cases, the mortality rate, the scale of economic impact or the amount of time we will have to spend without in-person classrooms, sporting events, discretionary consumer activities and the like. And this uncertainty has fed into one of the wildest and most volatile weeks ever experienced in investment markets. Perhaps nowhere was the volatility more unprecedented than in the bond market. In the course of just one week, $109 billion flowed out of fixed income mutual funds and ETFs – that’s more than $80 billion more than the previous record outflow. By comparison, the total outflow from equity funds was $20 billion – still a big number relative to the average, but nowhere near as dramatic.

Investment Grade Rating, Junk-like Trading

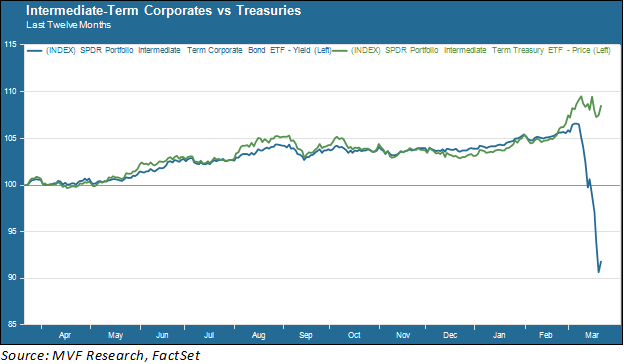

In trying to understand what happened in the bond market this week, let’s start with a clear visual of just how unusual the pattern was in the relationship between investment-grade corporate bonds and US Treasury securities. The chart below shows the relative price movement between 10-year Treasuries and their 10-year corporate bond counterparts. We use two State Street exchange traded funds as proxies for the respective bond indexes.

As you can see, investment grade corporates trade very much like Treasuries in a normal market environment. There is a very simple reason for why that is so, and it is this: investment grade corporate bonds rarely, very rarely default. And if a bond does not default, there is basically no mystery to what you as a bond investor are going to receive: a stream of interest payments and full principal redemption over the life of the bond. Now, corporations are not as fully risk-proof as an obligation of the US government. So there will typically be a small premium (i.e. a higher interest rate) between the safest investment grade corporates and Treasuries. That premium will grow as you move down the credit rating tables from triple-A to triple-B (any rating below the S&P grade of BBB-minus is deemed non-investment grade, or junk status). Because of their high levels of safety, investment grade bonds are deemed appropriate for even the most conservative of investment portfolios

So What Happened?

Given the safety properties of investment grade corporate bonds, how can anyone explain that jaw-dropping divergence between corporates and Treasuries that we see in the chart above. Prices for the State Street Intermediate Corporate Bond ETF, the blue price trend line in the chart, fell by double digits from the prior high of March 5 to the low on March 19. Is there any rational case to make that the value of the bonds in this index fell by a magnitude of that size?

There is not. To understand why this happens one needs to understand that while the price of a pooled investment vehicle, like an ETF, derives its value from the properties of the underlying assets, there are instances when the price of the asset in the market diverges from the underlying value. There was panic selling in all asset markets this week. In the case of these corporate bond ETFs, the magnitude of selling put downward pressure on the price far in excess of the underlying value of the pooled securities – the bonds – in the ETF. The bonds in the portfolio didn’t default. Their likelihood of default did not change in any material way. Their cash flow properties – the interest and principal payments set forth in the bond covenants – didn’t change. What changed sharply, was investor sentiment that led to panic selling.

Will It Happen Again?

It may help to think about the investment grade corporate bond market this week in the same way that we think about the panic buying of household staples like hand sanitizer and bath tissue that we have seen in grocery stores and pharmacies over the past week. The panic buying has widely distorted the relationship between the price that one of these now-scarce items can fetch on the street and the very commoditized value implied by the prices we have long been used to in shopping for them. Nothing fundamental has changed in the underlying composition of these products – just in the highly unusual conditions causing this temporary distortion between price and value.

We think it is safe to say that, even in these highly unusual times, we will not be paying $50 for a bottle of hand sanitizer forever. Similarly, we expect that the price-value gap seen in the bond market this week will return to a more realistic relationship in the days ahead. This does not necessarily mean that conditions will completely return to the way they were before. Depending on the longer-term economic implications of the coronavirus crisis, which are still playing out, the risk properties of certain segments of the corporate bond market may change. For that matter, we may find ourselves accepting higher structural prices for certain health and hygiene-related consumer staples over a prolonged period of time. It’s too early to tell. But the extreme irrationality of the price-value divergence we witnessed this week is not likely to persist.

As always, we want to assure our clients and friends that we are working as hard as we can to absorb all the data and information we can as this crisis unfolds, to communicate with you, and to make the right decisions for your long term investment goals. These are not easy times for any of us. We are always available to speak with you in any way that will help alleviate your concerns.