No, Jay Powell did not do a happy dance at the post-FOMC press conference, but the Fed chair was feeling good on Wednesday and it showed. And why not? The big takeaway from the much-anticipated “dot plot” – the Summary Economic Projections representing Committee members’ best guesses about the economy and interest rates – was the upward revision in growth expectations. After growing 3.2 percent in the fourth quarter last year (and 3.1 percent for 2023 overall), the median FOMC projection for 2024 real GDP growth is 2.1 percent, up substantially from the 1.4 percent median estimate in the last set of SEP numbers last December. And yes, with that higher growth estimate came expectations of somewhat stickier inflation, with the core PCE now projected to be 2.6 percent this year, compared to the December ’23 estimate of 2.4 percent. On that point, though, Powell’s customarily tight-lipped countenance nearly broke out into a smile as he pronounced that “we will get inflation back to 2.0 percent, we will absolutely get there.” Mic drop.

Breaking the Doom Cycle

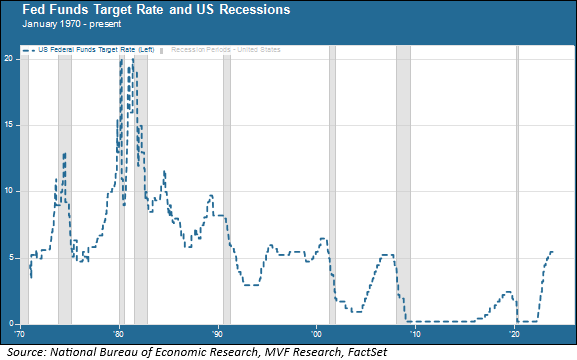

Powell is a student of history, and knowing the history of Fed monetary tightening cycles past is what gives the Fed chair just cause for a bit of joyfulness. Consider the story told in the chart below, of all the monetary cycles since 1970.

Those grey columns you see in the chart represent periods of US recession. Almost every major tightening cycle since 1970 has ended in recession, including the sharp downturns of 1973 and 1980, and the Great Recession of 2008. This chart explains why the conventional wisdom among economists at the beginning of 2023 was so uniformly of the view that a recession was on the horizon. But this time, or so it appears for now anyway, is different. In fact, while Fed officials are now increasingly comfortable using the term “soft landing” to describe the end of the 2022-23 tightening cycle, the phrase heard more frequently on the Street now is “no landing” – as in, not even a slowdown. We’re not sure that the Street is any more on target about this than they have been with their interest rate cut fantasies of late, but we will concede that the data pointing to a marked slowdown in the economy have not shown up yet in any meaningful way (although a recent upward trend in credit card and auto loan delinquencies may be a sign of things to come).

About Those Rate Cuts

What had traders waiting with breathless anticipation more than anything else, of course, was to see whether the Committee members’ estimates last December for three 2024 rate cuts were still intact. They were (and markets reacted accordingly), with a few individual dots moving up but the median staying put at three cuts. The first of these could, plausibly, happen in May although we think the June meeting, which will coincide with the next batch of SEP numbers, would be more likely. We could potentially see another rate cut in July, then a self-imposed blackout period ahead of the November presidential election with that third cut happening in December. This is nothing more than an opinion on our part so please don’t take it to heart – and plenty could change between now and then.

It’s also worth noting, though, that rate cut estimates for 2025 and 2026 tightened up a bit, such that according to the FOMC median projection, the Fed funds rate will stay elevated and not fall below 3.0 percent until after 2026. If you look at the Fed funds history on the above chart, this scenario would most closely resemble that of the mid-1990s, after the rate hike that began in 1994 and then stayed elevated until the dot-com crash of 2000 led to a recession in 2001.

In fact, that 1994 rate hike, while not nearly as steep as the 2022-23 cycle, is the one glaring exception to the hard landing events of other periods. What followed, as we all know, was a period of sustained economic strength, organic growth and the lagged effect of a productivity boost from earlier technological innovations. Jay Powell knows that history doesn’t repeat itself, but he is surely hoping for a very strong rhyme this time around.