The normal state of things is “Jobs Friday” – the first Friday in every month being the date of the Bureau of Labor Statistics monthly employment report. But hey, folks, it’s 2020 so anything is possible, including Jobs Friday coming on a Thursday (the real reason, of course, being that Friday is a holiday ahead of the July 4th weekend). Because media outlets tend to do a fairly terrible job at putting financial and economic data into perspective, we thought this would be a good time to consider what today’s employment report does, and does not, tell us about the current state of the economy.

Inside the Payroll Numbers

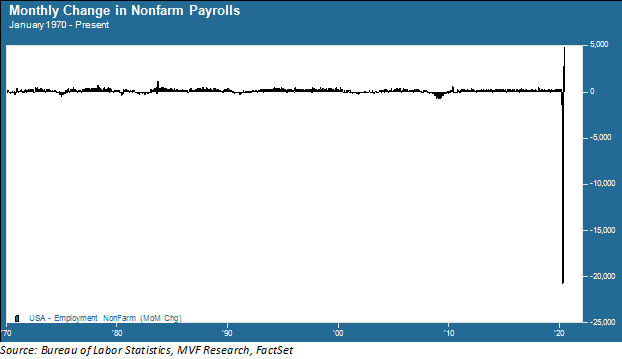

Let’s start with the payrolls. The headline number analysts study most closely is not the unemployment rate, but the number of additions or subtractions to public and private sector jobs outside the farm industry (known as “nonfarm payroll employment” in BLS-speak). If you see some political spokesperson on the nightly news spouting off about “millions of new jobs” then said flack is referring to this number. Recently this number has been all over the place, and mostly not in a good way. Today we learned that 4.8 million payroll jobs were added in the month of June. Sounds good, if one’s attention span is incapable of going back more than a month or two. Let’s look at the monthly payroll data trend going all the way back to 1970 to understand how unusual the current period is.

The change in nonfarm payrolls in the last four months – from March through June – is absolutely unlike anything that has happened before. The job gains of May and June add up to a bit over seven million. That’s a good start, but there is still a long way to go to make up for the more than 20 million jobs lost since the beginning of the coronavirus pandemic.

There are two more caveats to the payroll numbers. The first is that, while the data are referred to as the “June report” they are in no way reflective of the entire month. The BLS obtains this information from a survey typically conducted in the first half of the month – in this case the sample set comes from the week of June 7-13. That was a couple weeks after the Memorial Day holiday weekend that saw a widespread effort to reopen businesses shut down from shelter-at-home orders. More than half of the total number of June payroll gains – about 3 million in total – came from the leisure, hospitality and retail sectors, those very same facilities that were opening up en masses during and after the holiday.

That leads us to the second caveat: the vast majority of these payroll gains came from individuals who had been temporarily furloughed as opposed to permanently laid off. The number of temporary furloughs declined sharply as these people came back to work. But the number of permanent job losses (as categorized by the BLS) continued to increase in June by nearly 600,000. Those jobs will not be coming back anytime soon; moreover, this number is likely to continue increasing if, as expected, the end of fiscal payroll relief programs brings about an increase in business bankruptcies. It will be a stiff headwind for future labor market trends.

What Lies Ahead

The May and June jobs reports delivered positive surprises – numbers far exceeding what had been expected – largely because many states started to aggressively reopen their economies sooner than most observers had expected. As we head into another holiday weekend, though, we know that many of those individuals returning to work were walking into the thick of emergent viral hotspots. Yesterday the number of new Covid-19 cases surpassed 50,000 for the first time since the pandemic began, and the daily average is now twice what it was at the previous peak back in April. Most of the states where the sharpest increases are taking place are reversing their decisions and shutting down again. Sadly, a subset of those who went back to work in June are likely to be occupying hospital beds as the new month begins.

This time, though, there is no fiscal relief effort on the table to cushion the blow. The enhancements to unemployment benefits run out at the end of this month. There is no additional program for businesses, and Congress is on break for the rest of the month come this weekend. In speech after speech, Fed Chair Powell has been warning us what is likely to happen if we are unable to get the virus under control and/or if there is no additional help from federal policymakers. Unfortunately, both of those eventualities seem to be playing out already. There is a long road ahead.

We wish all of you a safe, happy and healthy Fourth of July weekend.