A lot of things happened this week, and it has been a challenge to try and connect the moving parts. Stocks are on track to register their sixth straight week of declines, for the first time since the confluence of the Eurozone financial crisis, credit rating downgrade of US Treasuries and a debt crisis debacle in Congress sent equities reeling in the late summer of 2011. The cryptocurrency market appears to be in meltdown mode. And nominal junk bond yields have almost caught up with inflation (not quite, though, as the ICE BofA High Yield index is at 7.4 percent and headline CPI weighs in at 8.3 percent). The war in Ukraine slogs on, Shanghai is still stuck in lockdown and Fed watchers remain obsessively glued to every utterance from an Open Market Committee voting member who might drop hint of a 0.75 percent move next time (in vain, because the Fed really does seem to have circled the wagons around 0.5 percent).

The Clubber Lang Theory of Markets

The strand that weaves through all these moving parts is a fact of market life known as the pain trade. In the movie Rocky III the heavyweight challenger Clubber Lang, played to perfection by Mr. T, is asked what he predicts will happen in the upcoming fight against Stallone’s Rocky Balboa. “My prediction? My prediction is…pain!” snarls the fearsome Lang.

For investors who take the advantage of margin leverage to pile into hot markets, pain somewhat akin to a nasty left hook from Clubber Lang happens when their positions go far south and they need to come up liquid funds to cover margin calls. Selling begets more selling. When the S&P 500 fell below 4,000 earlier this week, a number of market analysts saw that as a pain threshold likely to unleash more near-term selling related to margin calls.

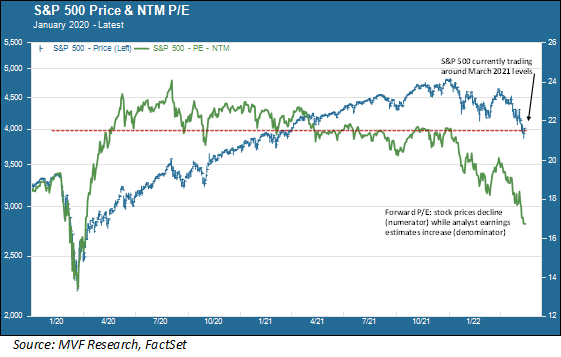

Looking at the above chart, it is not immediately clear why 4,000 should be a pain trade threshold, other than that it is a nice round number and sort of bifurcates the long rally in stocks that started when the Fed stepped into the pandemic crisis in late March 2020. You can look at that red dotted line on the chart connecting current stock prices to their levels in March ’21 and see that anyone who leveraged up somewhere between then and now would be feeling varying degrees of pain.

Stablecoins and Other Magical Things

Of course, investors loaded up on much more than the blue chip stocks on the S&P 500 during the good times. Now, many a prediction has been made many a time about the imminent demise of cryptocurrencies as they implausibly zoomed through the stratosphere over the last couple years. A couple things happened this week, though, to suggest that this asset class may be in for something more than a passing tempest this time around. Early in the week TerraUSA, a so-called stablecoin, became unmoored from its notional peg and started trading at levels typical of distressed debt – 25 or 30 cents on the dollar. The next day the largest of the stablecoin breed, Tether, plummeted five percent or so below the peg that is supposed to back each dollar of the token with a dollar’s worth of highly liquid cash equivalents.

Stablecoins are supposed to be a sort of gateway between the worlds of traditional financial products and the wild world of purely digital assets – cryptocurrencies like bitcoin and its ilk. For Tether to fall below its dollar-for-dollar peg is roughly analogous to a traditional money market fund “breaking the buck,” something last seen during the 2008 financial crisis. Financial regulators, central bankers and others who closely follow the market have long warned that stablecoins are nothing like the fully-backed assets they claim to be. Unsurprisingly, then, the tremors from Terra and Tether this week have been felt far and wide throughout cryptoland.

The crypto meltdown, then, feeds into the pain trade for the same reasons that highly leveraged positions in, say, the high-flying tech stocks of recent memory do. The good news is that there is likely to be nothing close to the kind of systemic risk that characterized the broader meltdown of the entire financial system in 2008. Back then all the major players were caught up in the highly leveraged asset-backed securities that initially brought down Lehman Brothers. Today many large financial institutions do have exposure to crypto, to be sure, but for the most part it’s more akin to toes dipped in the water than widespread systematic exposure. Bad for anyone who took a major punt on bitcoin at $60,000, not so bad for the so-called SIFIs, the systemically important financial institutions. As far as anyone knows, anyway.

Back To What Matters

So what does all of this mean for traditional portfolios of stocks and bonds? Conditions remain quite volatile, with multiple price swings of one percent or more throughout the day on many trading days. Credit risk spreads have started to widen – although, as observed earlier in this commentary, yields on high yield debt are still trailing present levels of headline inflation. Depending on how the stablecoin troubles play out, there could be plenty more damage in store for digital assets.

We would like to point out one feature of the above chart, though, to suggest that amid all the tumult there are some good reasons to keep a clear head about the underlying strength of the economy. In the chart we show the forward 12-months price-to-earnings (P/E) ratio, the green line. As you can see, the forward P/E has fallen fast over the past four months. Part of this, of course, is because the stock prices – the numerator in the P/E ratio – have come down. But at the same time analysts’ forward earnings estimates for these companies – the denominator of the ratio – have actually gone up, thus bringing the P/E even lower than it would be just from the stock price declines.

If the analysts’ consensus is correct (and we should note that such is not always the case) then at some point a company with a battered stock price and a strong growth outlook becomes a buying opportunity. That opportunity may not be today – like we said, there may be more pain trades to come and intraday markets are too frothy for implementing a rational trading strategy. But it’s the future cash flows that matter for a stock’s long-term return prospects. If those cash flows can be gotten at oversold levels, that makes it even better.