To somewhat paraphrase William Shakespeare, we come not to bury innovation, but to praise it – though perhaps in a somewhat roundabout way. To be perfectly clear, we are fans of innovation. We applaud the creative process that leads to the possibility for breakthrough inventions that can change our lives for the better. After all, the modern world was built on a couple earth-shattering innovations of the late nineteenth century: electricity and the internal combustion engine. We are potentially on the cusp of some new inventions that, while maybe not quite as far-reaching as the transition from the wood-burning hearthside to central heating, are nonetheless exciting, with possible solutions for social imperatives ranging from climate change to personal health and longevity.

The point of this article is not to pass judgment on the fundamental merits of any innovation, nor on any securities or funds that purport to offer investment exposure to such innovations. Reasonable people can argue the pros and cons of any aspect of the invention or the underlying investment strategy. Our point here is one about investor behavior. It is a reminder of how things can go wrong when one chases innovation in the expectation of outperforming short-term returns.

A Story in Three (So Far) Phases

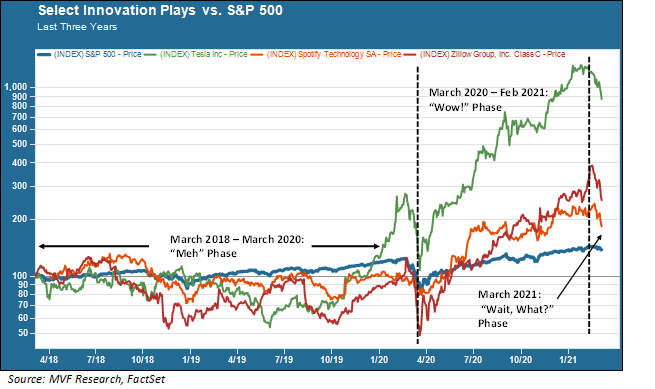

The chart below shows the three year return history of three stocks that are popular holdings in many innovation-themed investment strategies: Tesla (clean technology), Spotify (streaming entertainment) and Zillow (financial technology).

We have divided this history into what appear to be three fairly distinct phases. Now, when you look at this chart, try to think about it in the way say, an investment consultant might look at it. Investment consultants are in the business of recommending asset selection choices to individual investors and institutions like the investment committees of pension funds and charitable organizations. While many factors can potentially come into play during this selection process, it is well-established that a high premium is placed on recent returns performance relative to some benchmark index.

In the chart above you can see that for about a two year period from March 2018 to March 2020, these three securities were pretty unimpressive in their performance relative to the S&P 500, as a benchmark. They were underwater on a relative basis for much of this time (barring Tesla’s wild swings up and down during the first three months of 2020). We call this the “meh” phase, because that is the kind of response this performance would elicit from an investment consultant looking for outperformance versus the benchmark. There was plenty of innovation in all three companies during the “meh” period – there just weren’t the kind of returns that would impel the investment consultant to chase the innovations.

Wow, Look At That!

That fairly blah track record changed dramatically almost as soon as the Fed came riding to the rescue of the pandemic-shocked market in late March 2020. Suddenly these stocks and many others of a similar nature went into a hyperspeed ascent. The themes resonating with investors in 2020 included large-scale speculation on riskier names with little in the way of current earnings but with arguable (innovation-driven) potential for future growth. That as yet uncertain growth was made much more attractive in present value terms by plummeting interest rates. The yield on the 10-year Treasury, the world’s most widely-used reference point as the risk-free rate from which cost of capital calculations are constructed, fell to half a percent in the months after the Fed’s rescue efforts.

So again, think of the mindset of our investment consultant as she ponders asset selection decisions at the end of 2020. Kind of hard to ignore the stonking performance of any fund heavily invested in these innovation themes, no? Even harder because the innovation theme was such a prominent subject on social media. “Hey, why aren’t you invested in X?” is usually something an investment professional hears from a client only after X, whatever it is, has recently been soaring like a rocket.

Wait, What Just Happened?

Spare a thought if you will for our diligent investment consultant who couldn’t resist the temptation to go all-in on the innovation theme as the calendar year transitioned to 2021. These names kept going up for awhile (the market doesn’t pay attention to the Julian calendar that guides our lives) but hit a peak in mid-late February and have all fallen at bear market levels (20 percent or more from the high) since then. Not because the basic nature of the innovations is any different, but because the interest rates that were so friendly to speculative names in 2020 are much more onerous today. The 10-year Treasury is more than one percent higher today than it was in the middle of last year. That makes a vast magnitude of difference to the present-day valuation of highly uncertain future cash flows.

So is the lesson here simply not to invest in the promise of innovation? Certainly not! The trick is to do the work that leads you to a potential innovation before it has become the subject of cocktail party conversations and social media one-upmanship. You may be holding that exposure for a long time before it becomes the next great thing. In fact, chances are higher than not that it never will become the next best thing. There were hundreds of automotive companies that went bust, belly-up, kaput before Henry Ford came along with the Model T. The dot-com bust left the ashes of thousands of New Economy darlings behind while a few like Amazon ascended to the stratosphere. The next wave is likely to be no different.

Investing in innovation is not a fundamental, core component of a long-term investment strategy. It is something to do with a small slice of your total net worth – an amount you could live without if its value were to go to zero. Innovation is exciting, and there will always be the temptation to put one’s money to the test to see if that little entrepreneurial dream becomes the next Apple or Google. If you have the stomach and the nerves to buy in before everyone on Reddit is talking about it (and the discipline to not go overboard on the size of your investment) then all the better.