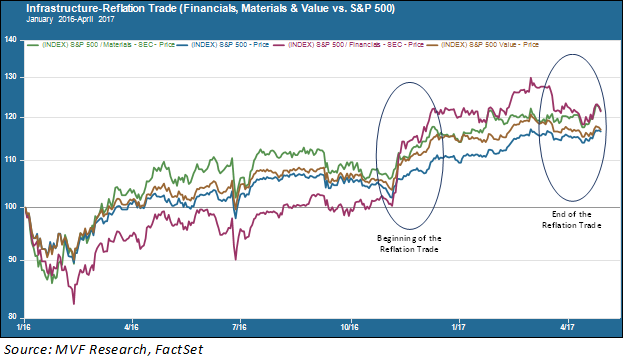

Conventional wisdom in the form of political forecasting failed in a big way on Election Day in 2016. It failed again in the form of a stock market thesis the very next morning. While most Americans were still processing the news that Hillary Clinton had lost the presidential race to Donald Trump, equity traders were busy putting into practice a single sentence from Trump’s acceptance speech the night before, in which he promised a major investment in public infrastructure. The “infrastructure reflation trade” took shape immediately, in the form of major bets on any company or industry sector likely to benefit from the surge in public works spending that seemed to be just around the corner. You can see in the chart below a few of the beneficiaries of this trade: financial institutions (profiting from higher interest rates), materials (raw input resources) and value stocks in general.

Roads (and Bridges, Energy Grids etc.) to Nowhere

As the above chart shows, the infrastructure-reflation trade didn’t last very long – the main reason being that there never was any infrastructure program. A rational observer might have watched these sectors jump immediately after the 2016 election and wonder how it was that a political party famously hostile to any kind of government spending outside of defense spending would be opening the public purse for a bunch of highways, bridges, electricity grids and the like. That rational observer would have been right, but it would take a few months for the herd of infrastructure bulls to finally get the memo.

In hindsight we know what happened instead: another long period of outperformance by growth stocks in general and the large technology names in particular. Value and cyclical stocks underperformed throughout the period, while financials rose and fell as expectations on interest rates waxed and waned (financial institutions generally react favorably to higher interest rates due to the positive impact on net interest margins). That trend accelerated even further with the arrival of the coronavirus pandemic, as the world went online and left the physical world of in-person experiences high and dry.

For Real This Time?

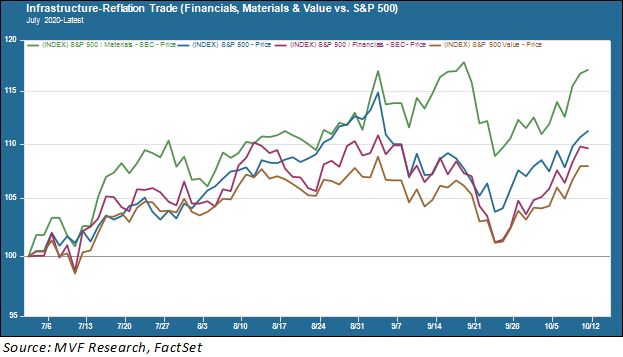

Four years on, with another election looming on the horizon, the stirrings of the long-dormant infrastructure trade can be heard on the Street, however faintly (and however subject to the volatility that still hangs over the election itself). In recent weeks polling has moved steadily in favor of the Biden-Harris ticket. The market is nothing if not finely tuned to the subtlest of shifts in prevailing sentiment. If the current trend continues, or at least doesn’t sharply reverse for some hitherto-unknown reason, the scenario of a Democratic victory in the presidential race as well as a Senate majority becomes something close to a default case for investors positioning ahead of the actual outcome.

Again – there is still plenty of uncertainty about the entire electoral process, particularly in regard to the period from Election Day itself to the deadline for certifying delegate slates for the Electoral College in December. And even if there is a Democratic sweep, there will still be plenty of headwinds for the newly-elected majority to implement a massive new public spending program. For one thing it would almost certainly necessitate an end to the Senate filibuster, since even the most optimistic scenarios for Democrats do not countenance a filibuster-proof majority of 60 seats. Moreover there will be plenty of other urgent priorities competing for attention on day one and beyond.

Nonetheless, you can discern the beginning of some tentative positioning ahead of November. In the chart below you see those same trades we showed in the previous chart: the financial institutions and materials sectors, and value stocks in general versus the S&P 500.

It may well be that this infrastructure trade fares no better than the previous infrastructure trade. While large cap value stocks have outpaced growth stocks by about 4.1 percent versus 1.8 percent for the month of October thus far, they still trail by a massive margin over the past twelve months: 43 percent for growth versus 2.4 percent for value. That’s not something anyone wants to be on the wrong side of! But it also suggests that, for reasons of relative valuations if nothing else, the time for a major rotation may plausibly be at hand. A compelling real-world narrative like the infrastructure-reflation trade could potentially supply the catalyst. It may end in tears for the early movers – but then again it may end in Champagne.