The Battle of Hadrianople took place in 378 CE, two years after a multitude of Germanic Gothic tribes had gained permission to cross the Danube River into the Roman Empire. The Gothic hordes killed the eastern emperor Valens and embarked on further hostilities against the Romans that led to the sack of Rome itself, in 410 CE. The western Roman Empire itself, though, hung on for more than a half century longer after being sacked before finally expiring for good in 476. For most of this last century, from the Goths crossing the Danube to the valedictory of Romulus Augustulus, the last emperor, the elite segments of Roman society sought various ways to make peace with, accommodate and – most of all – derive personal power and profit from the invading Goths.

Not unlike, perhaps, the mindset of presidential hopefuls with their eyes on 2024 as they bend the knee to the mobs who stormed the Capitol earlier this month. And not unlike the professional hedge fund managers who – terrified of the power of online Reddit mobs laid bare in the real world of markets this week – are tossing aside their spreadsheets and quantitative models and, in oleaginous fashion, scraping data from the chat groups of short seller-hating trader bros. Who’s got the next hot tip?!

Game Stop’s Got the Beat

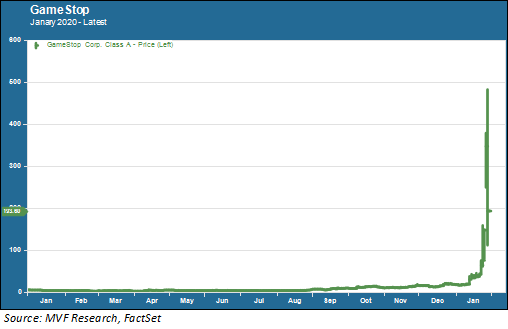

The storefront façade of Game Stop would not have looked out of place in a mall scene from “Fast Times at Ridgemont High,” attracting surfer dudes and gum-chewing mall rats with its physical copies of video games meant to be played on clunky, boxy consoles. In short, it’s not all that great a company, an opinion shared by many professional fund managers that engage in short selling. You sell a company short when you think it has a crummy business model and should be trading for less than its current price. Good old-fashioned healthy capitalism, right? What you don’t want to see as a short seller is this:

Short selling is a fairly risky part of the market: you take a bet on something you don’t actually own (hence the meaning of “short”), put up the money needed to cover the obligation to the other side of the trade, and hope that the price will go down (where you pocket the difference between where the price was when you made the initial trade and where it is when you close out the position). If the price doesn’t go down but rather soars like a bottle rocket – see chart above – you’re on the hook to cover the difference.

Melvin and the Greuthungi

Game Stop’s shares never traded above $10 until late last fall. This week they traded almost as high as $500 at one point. That’s a whole lot of difference to cover, as the managers at a hedge fund called Melvin Capital know all too well. Melvin got caught by the mob – literally. The denizens of a coarsely colorful chat group called r/WallSteetBets had been targeting the professional short seller for several months because, well, they subscribe to the Barstool Sports dogma that stock prices should always go up and anyone (like short sellers) who does things to make stock prices go down is a Bad Person.

So the Reddit mob went after Melvin Capital just like the Greuthungi – one of the Gothic tribes that was initially denied asylum by the emperor Valens when their Trevengi brethren crossed the Danube – went after the hapless emperor and lopped off his head. The portfolio manager at Melvin was a bit luckier than poor Valens – not only did he manage to avoid decapitation but two other hedge funds stepped in with a $2.75 billion bailout to let Melvin close out the short without going bankrupt.

The Social Network

Perhaps the crazy gyrations in the share price of Game Stop and a handful of other subpar companies caused by online mobs should not come as much of a surprise – we live, after all, in a world framed by social media. The same dynamic that has reduced our national political conversation to context-free bursts of 280 characters works just as well in finance. Amplification – the ability of like-minded communities to find each other and create a powerful hive with the potential to make an impact on the real world – this is what social media platforms make possible. Social media communities render the expertise of hedge funds irrelevant. Financial technology makes the cost of going after the Melvin Capitals of the world next to nothing. All the professionals can do – the quant jocks with their spreadsheets and elaborate models and value-at-risk calculations – is toss it all out and troll the Reddit sites for nuggets about what might come next (heaven forbid it might be their turn!).

All of which can endure for a very long time – after all, it was a full hundred years from when the Goths crossed the Danube to when Rome fell for good.