It’s hard to believe that we are already here, a day away from Thanksgiving and thus the onset of the holiday season. Amid the frantic shopping and general merrymaking, this is the time when we look back on the big stories that collectively defined the year gone by. For those of us in the investment profession – and quite possibly for humanity as a whole – there is arguably no bigger story to define calendar year 2023 of the Common Era than that of artificial intelligence.

Off To The Races

The year opened with the realization that generative AI – applications that generate highly advanced written or visual content from just a few easy prompts – was now available to anyone with a standard-issue computer, phone or other smart device. In late 2022 a company called OpenAI had released a program called ChatGPT that bedazzled its early adopters with its ability to do, well, just about whatever a user asked it to do (and sometimes much more, as some journalists discovered somewhat uneasily in their encounters with the system).

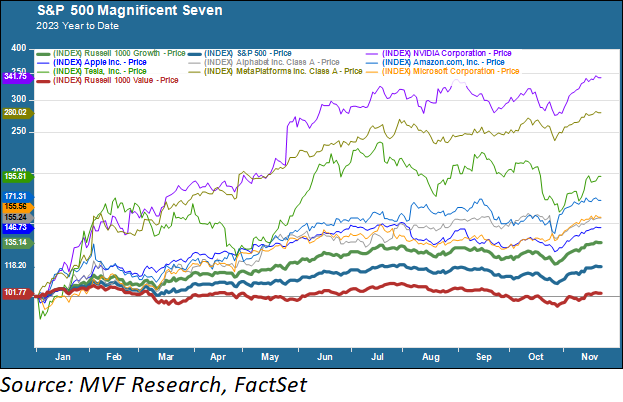

Then OpenAI announced a partnership with Microsoft to build out commercial applications on top of generative AI capabilities. It wasn’t too long before the market figured out which companies had a good story to tell involving AI. Seven of them – Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla – became the single biggest force driving US equities throughout the year.

For much of the year, in fact, these seven companies were the only thing driving the market – had it not been for their existence, the S&P 500 would have been underwater for much of the first half of the year. The pace has shifted a bit since then, but the Magnificent Seven, as they inevitably came to be known, still account for just under 30 percent of the entire market capitalization of that index of 500-ish stocks.

The Good, The Bad…

As is often the case, observers continue to argue about whether the AI story is based on something substantial, or yet another in a never-ending parade of effervescent bubbles. Is generative AI the key to enhanced productivity, the one thing that has been missing from the economy in recent decades? Will it be something that helps more people do more things more effectively, or will it put people out of work as AI applications take over everything from the most mundane forms of labor to the rarefied reaches of elite white-collar professions? Does Artificial General Intelligence – the holy grail of AI in which machines can perform anything humans can, only much more effectively and without having to take lunch breaks or sick days – imply something even more dire for civilization than mere widespread unemployment?

These questions haven’t necessarily been at the forefront of investors’ minds as they bid up the likes of Microsoft and Nvidia – but boy howdy, have they been hotly debated in the halls of OpenAI, and this week we were treated to a full-on spectacle of how this has been playing out.

…And The Ugly

It would be hard to overstate just how many palms of the hand slapped how many foreheads last Friday evening, when the news surfaced that OpenAI’s board of directors had fired the company’s CEO, Sam Altman. Altman was, for all intents and purposes, the official public face of AI and thus the single human being on the planet to whom all turned for insights about the year’s number one story. The story played out like a soap opera, and anyone who follows the daily doings of the denizens of Silicon Valley would already be familiar with the many characters who rushed in to be a part of the story – big-name VCs, other tech titans, journalists and others who ply their trade in the silicon sandbox.

By the end of the weekend Altman announced he was taking his talents to Redmond to team up with OpenAI’s partner Microsoft. Then practically the entire staff of OpenAI threatened to quit and follow their leader up north – including (not making this up) the board member who led the original move to fire Altman. Now it appears that Altman will be returning to OpenAI. Maybe! Who knows anything, other than that this story has more chapters to be written.

The soap opera aspect, unsurprisingly, is what has dominated the news this week. But there is a very serious set of circumstances behind it, reflected in the peculiar organizational and governance structure of OpenAI that was a deliberate feature of its original blueprint. Should an organization in possession of intellectual property with so many far-reaching and as-yet unknown potential implications be dedicated to putting prudence ahead of profits? Or should it be yet another tech behemoth (the organization already had an imputed valuation of around $90 billion before the events of last Friday) focused only on scaling up, moving fast and breaking things? Sam Altman was moving in one direction. Other board members found that direction concerning. A public spectacle ensued, and while order may well be restored in the short run, the questions will go on. Whether AI will continue to be the front and center story in equity markets is unclear. What is quite clear is that it will not be exiting the stage any time soon as far as the economy, and society in general, are concerned.

As we get ready for the holidays, we want to wish each and every one of you a happy Thanksgiving, full of joy, love and laughter shared with your friends and loved ones. We are truly fortunate to be a part of your lives.