There has been almost nothing “happy” about the New Year thus far. It’s probably a good thing that investors had a whole weekend in which to shake off New Year’s Day hangovers before showing up to face a sea of red arrows on Monday morning. Those red arrows, of course, came courtesy of yet another series of bafflingly inept moves by Beijing’s financial policymakers. It would be an exaggeration to say that the world’s second largest economy is in a swoon, but its financial markets certainly are.

But while the dramatic pullback in world equity markets and rising volatility are strong reasons to give pause, we do not believe this is the right time to pull the panic switch. While unquestionably a critically important component of the global economy, China depends on other world markets for its exports more than other world markets depend on China’s domestic demand for their own fortunes. Moreover, the fortunes of US companies still depend more on the US consumer than anything else. This year may provide a decisive answer to the question of whether the US economy can continue to prosper as the world’s growth engine despite increasing weakness elsewhere. We don’t yet know that answer – but based on the data we have on hand, we are not ready to jump into the lifeboats. If today’s environment bears any resemblance to past periods, we think more of 1997-98, and less of 2007-08. It is worth revisiting what happened back then before we conclude with our thoughts on the current market.

Asian Currencies, Act I

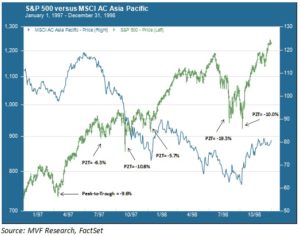

The Asian currency crisis of 1997 had an effect on equity markets around the world, including the US. The chart below shows the price performance of the MSCI All Counties Asia Pacific index from January 1997 to December 1998, versus the S&P 500 for the same time period.

The carnage in Asia was fast and brutal, with currencies falling as much as 40 percent against the dollar, and regional stock exchanges losing as much as 60 percent. As the above chart shows the S&P 500 (in green) suffered a rapid succession of pullbacks of 5 percent or greater between the summer of 1997 and January 1998 (the pullbacks are indicated in the chart along with the magnitude of each peak-to-trough drawdown). These pullbacks came on the heels of a near-10 percent correction that took place before the currency crisis. Many investors at the time interpreted this shaky performance – in the context of a deeply troubled global economy – as presaging an end to the bull market that had run nearly uninterrupted since early 1995. Asia was seen as the world’s emerging growth region, with great promise for US companies to manufacture, source labor and materials, and sell to the fast-growing middle class households in the region. The currency crisis threatened to bring a swift end to the good times and to provide a headwind to US companies’ EPS growth.

Russia Unleashes the Bears

As dire as the currency crisis was for Asian markets, which continued to fall through most of 1998, the US channeled its inner Taylor Swift and “shook it off” to rally strongly through the first half of 1998. Investors’ focus turned away from turmoil elsewhere to focus on the strength of the domestic US market, particularly the tech boom riding on the Internet’s penetration into commerce and social life. Then another foreign time bomb went off in August, when Russia devalued its currency and defaulted on its sovereign debt obligations. Another massive selloff took place in US equities – this one approaching the 20 percent threshold for a bear market. Caught up in the Russia collapse was the hedge fund Long Term Capital Management, which over the course of a tense few days threatened to turn this pullback into a genuine pandemic.

After all the drama, though, it turned out that the best way for investors in US stocks to navigate these two volatile years was to…do nothing at all. The S&P 500 registered a 66 percent cumulative price gain from the beginning of 1997 to the end of 1998. It was undoubtedly tempting to sell out at various critical junctures, but patience and discipline were rewarded.

Asian Currencies, Act II

Asian currencies are once again at the center of things. Most fell sharply against the dollar last year, though so far by generally less than they did in 1997. The Malaysian ringgit, for example, is about 23 percent lower versus the dollar over the past twelve months, and the Thai baht is softer by some 11 percent. Of course, this time it is the China renminbi – largely not a factor in the ’97 crisis – that is the center of focus. The RMB has devalued by just over six percent from where it was before the first bout of devaluation last August. What should not be forgotten, however, is that the renminbi was largely flat against the dollar in the first half of 2015, while the euro and other developed and EM currencies were falling.

Also worth remembering is that China as well as its Asia EM neighbors are in far stronger FX reserve positions today than they were in 1997. The threat of a debt default by any regional government is considerably more remote than it was nineteen years ago. China’s policymakers may demonstrate a tin ear when it comes to considering the likely short term impact of their decisions on world financial markets, but it is hard to imagine them making the kind of policy mistake that would trigger a real economic freefall.

And that brings us to China’s real economy. All the drama this week started with a below-consensus manufacturing report representing a fifth month of contraction. At the same time, though, recent indicators of consumer activity have been good – retail sales have been growing at double-digit rates for most of the last twelve months. If China’s economic transition is going to succeed, it is going to succeed thanks to the consumer, so these trends are absolutely consequential to the larger picture.

And if China does export price deflation to other markets through a weaker currency? Well, lower prices for China imports could be stimulative for US consumer activity. As we said earlier, what is good for the US consumer will likely be good for US stocks. Admittedly, this is a rational argument being made at the end of an irrational week. We may not be out of the woods as far as the current pullback is concerned. But we are not panicking.