The unseen world is a very strange place. Quantum mechanics, the physics that describes the way things work at the subatomic level, has been validated as a scientific theory again and again since its discovery in the early 20th century. Quantum mechanical laws perfectly describe the workings of literally everything electronic and technology-related in our lives. For all its mainstream applications, though, the implications of quantum mechanics are positively exotic.

Particles exist here, there and everywhere. Pairs of entangled particles instantaneously affect each other across light years of distance. Single photons display wave interference patterns until observed, at which point the wave collapses into a particle with a definitive position in space. This act of observation informs the standard explanation taught to students of quantum physics. Known as the Copenhagen theory, after the home of pioneering scientist Niels Bohr, it posits that all matter exists in a state of superposition (i.e. here, there and everywhere) until observed, at which point it collapses into recognizable forms like trees, cute puppies and Bloomberg workstations. Don’t try to understand the deeper meaning of the Copenhagen theory. Bohr and his fellow pioneers didn’t. “Just shut up and calculate” is how they, and those following, have instructed every new generation of fresh-faced (and confused) physics students.

Don’t Look Now

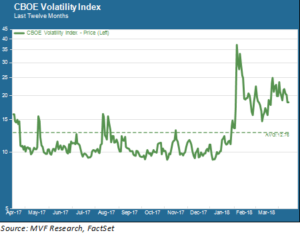

The subtext of the Copenhagen theory – that observation creates its own reality – resonates in the present day world of stock market volatility. It has come as a painful lesson to investors who came late to the low-volatility party of late 2017 and took bets that the calm seas would carry on. The chart below shows the price trend for the CBOE VIX, the market’s so-called “fear gauge,” over the past twelve months.

When the VIX jumps in price, as it did towards the end of January, it implies a higher risk environment for equities. To look at the above chart is to surmise that something earth-shaking caused risk to jump nearly overnight as the calendar turned from January to February. And, yet, what actually happened? A jobs report showed that hourly wages had ticked up slightly more than expected in the previous month (2.9 percent versus the consensus estimate of 2.6 percent). An “inflation is back!” meme went viral and off to the races went the VIX. Pity the poor punter holding XIV, an exchange-traded note (ETN) designed to profit from a calm VIX. That ill-fated security lost 94 percent – not a typo – of its value in one day, and the ETN’s fund manager announced that the fund would shut down as a result.

Ninety four percent. On account of one lousy wages number. How could this happen? The answer, dear reader, lies in the observer. Risk is a statistical property, a measurement of variance in price. But – as we can see from securities like that poor XIV – it is also an object, a monetized claim. And that has deep implications for equity and other asset markets.

Goodhardt’s Law and the VIX

Charles Goodhardt was an economist who in 1975 made the following observation: “Once a measure becomes a target, it loses the very properties that made it a good gauge to begin with.” Goodhardt’s Law could also be called the Copenhagen Theory of Market Risk. Once you treat risk – volatility – as an object of buying and selling rather than just as a passive statistical measure, you distort what that measure is telling you. Referring back to the chart above, the world did not change in any meaningful way between Friday, February 2 and Monday, February 5. No macroeconomic statistic other than that one random wage number suggested that the economy had changed in any radical way. And yet if you held an asset on Friday morning betting on things staying more or less the same, you were wiped out by the end of the day the next Monday (even though things had more or less stayed the same). Fundamental risk hadn’t changed. But the perception – the observation – of risk created the reality of a 94 percent price drop.

This fact has profound implications for asset markets. The measurement of risk is absolutely fundamental to the models that have informed the construction of portfolios since Harry Markowitz and William Sharpe pioneered the concepts of mean-variance analysis in the 1950s and 1960s. When that measurement ceases to be a “good gauge,” in Goodhardt’s formulation, the ability to arrive at informed valuations for many other assets is itself at risk. Modern Portfolio Theory is the name given to Markowitz’s and Sharpe’s legacy. Increasingly, though, that legacy has to navigate a postmodern financial marketplace.