Amid the volatility and daily event fetishes that have driven asset markets hither and yon this year, the US economy continues to steadily plod along. The data points are a mixed bag: missed GDP and productivity numbers here, consumer confidence and retail gains there. But the overall picture is relatively healthy. Importantly, there are some bright spots in the long-elusive area of wage and price gains. Hourly wage growth was, in fact, the one positive takeaway in an otherwise unimpressive jobs report at the beginning of this month. Now this morning’s January inflation report shows prices growing slightly ahead of consensus. Core inflation (excluding food and energy) is up 2.2 percent on a non-seasonally adjusted year-on-year basis, its highest level in four years.

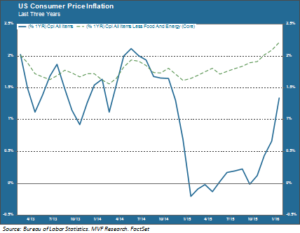

The oil price collapse has kept the all-inclusive headline inflation number well below core inflation for the past year and a half. That may be changing. The energy index component of today’s CPI report was negative 6.5 percent – the lowest decline since November 2014. Year-on-year headline CPI for January was twice the December level: 1.4 percent up from 0.7 percent. The chart below illustrates the recent trend in prices. If oil prices manage to stabilize, we can expect to see the headline number converge ever closer to core CPI.

Stay, Raise or Cut?

It is somewhat ironic that the next FOMC meeting concludes on March 16, the very same day on which the BLS will release the February CPI data. It is not totally implausible to imagine that headline CPI will be close to or even at that magic 2 percent threshold when FOMC members peruse the 8:30 am BLS release that day. They will already have digested new information on personal consumption expenditure (PCE – 2/26) and hourly wages (3/4) by then. Recent data on retail sales, industrial production, capacity utilization and consumer confidence indicate the potential for an upside surprise in those PCE and wage numbers.

On balance the news is net-positive for the economy, but that may not translate to a much-desired adrenaline boost for the stock market. The Fed is not sitting on the “horns of a dilemma”, as the fella said, but on the shaky tripod of a trilemma. Should they stand pat with rates where they are now? Push ahead with another 25 basis point hike as a sign of confidence in the economy’s continued recovery? Or – and this is highly unlikely but at least in the realm of possibility given global developments – contemplate a reversal? Interest rate policy divergence among leading economies has not gone down well with markets since the Fed’s last move in December. The global stampede towards the Pleasure Island of negative interest rates makes the Fed’s decision all the more tricky, irrespective of the conclusions they would normally draw from domestic data.

El Niño and Mr. Market

Lurking behind this policy trilemma is a capital market environment that perhaps resembles nothing more than US East Coast weather patterns this winter. We’ve had heat waves along with record levels of snowfall here in the nation’s capital, and temperatures that fluctuate from frigid to tropical seemingly overnight (we woke up in the teens today and are preparing for upper sixties tomorrow). That’s intraday volatility worthy of the S&P 500 – which registered three consecutive days of gains over one percent earlier this week after falling by more than one percent in three of the previous five days. Now, to be sure, we have not yet seen the displays of outright panic that so often accompany pullback environments. In the first eleven trading days of August 2011 the market gained or lost more than four percent five times. And the maximum peak-trough drawdown to date remains far short of the minus 19 percent low point of the 2011 event. So far.

But the threat of a deeper downturn lurks behind every X-factor that pops into and out of existence each day. The FOMC explicitly called out their concerns in January’s post-meeting communiqué, referring to the “global economic and financial developments” keeping them up at night. It is a pretty good bet that these “developments” are not going away between now and March 15-16. If more US economic data surprise on the upside between now and then, it is going to be a very difficult call for Chairwoman Yellen & Co.