This past Wednesday, apparently, was one of those red-letter special days in US stock market history. The current bull market, which began in 2009, became the longest on record, based on the daily closing price of the S&P 500. So said the chattering heads, not just on CNBC but on your friendly local news channel. Hooray! Or should we worry, perhaps, that the good times are coming to an end?

The right answer to that question and all others about the bull market’s record longevity is to ignore it, because technically it didn’t happen. Nope, this is not the longest bull market on record, not by a long shot. Now, some may quibble when we present the facts, arguing that we are splitting hairs. Well, sorry, but ours is supposed to be a precise business where performance measurements are concerned. And facts, surprisingly enough in this day and age, are still facts.

So, to be precise, the bull market that reached its peak on March 24, 2000 (the one we supposedly beat on Wednesday) did not in fact begin on October 11, 1990. That was a span of 3,452 days. The basis for “longest bull market ever” claims made this week is that 3,453 days elapsed from March 9, 2009 (the low point of the last bear market) to August 22, 2018. However! Based on the technical definition of bulls and bears, the bull that peaked in March 2000 actually began, not in 1990, but on December 4, 1987. That’s a total span of 4,494 days, or 1,041 days (about 2.8 years if you prefer) longer than our current bull market.

Definition, Please

So why did the media spend so much energy this week talking about the “longest bull market?” Because (a) it’s more fun to talk about things grand and historical than about the daily grind of random market movements, and (b) on October 11, 1990 the S&P 500 closed down 19.9 percent from the previous record high set in July of that year, and, well, 19.9 percent is close enough to 20 percent, which is the commonly accepted technical threshold of a bear market.

Let the quibbling begin! 19.9 percent is close to 20 percent, certainly. But it never passed that threshold. More importantly, the stock market pullback of 1990 (which started with the recession of that year but had recovered before the recession was over) never spent a single day – not a single day! – in actual bear market territory. You can’t say that a bull market began the day after a bear market ended when that bear market never even began.

So, again sticking to the definition of a 20 percent pullback from the prior high, the last bear market before the dot-com crash of 2000 occurred after Black Monday in 1987. On December 4 of that year the S&P 500 had retreated 33.5 percent from the prior record high reached in August. That wasn’t a super-long bear, lasting less than a couple months from the breaching of 20 percent, but it was certainly impactful.

The Music of the Market

Here’s the more important reason why we’re not just splitting hairs over the 19.9 versus 20 percent, though. If you look at the way markets trend over a long enough period of time you notice a certain pattern – a tune, if you will, the music of the market. Every bull market experiences periodic pullbacks. These happen for a variety of reasons, some of which may seem frivolous and some of which may seem more serious at the time. Traders in the market are highly attuned to how far these pullbacks draw down from the previous bull market high. A 5 percent pullback is deemed significant. The 10 percent threshold has its own special name – correction. And the 20 percent level, as we noted above, is the event horizon for a bear market.

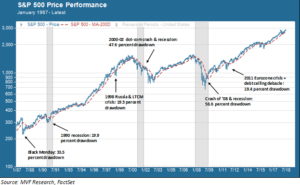

What tends to happen during the more severe bull market corrections is that they get ever so close to the 20 percent threshold without actually going over it. This happened in October 1990, as we showed above. It also happened in August 1998 with a 19.3 percent pullback (this coincided with the Russian debt default and subsequent meltdown of hedge fund LTCM). More recently, it happened in 2011 with a 19.4 percent pullback in the S&P 500 while the Eurozone crisis and US debt ceiling debacle played out simultaneously.

It’s not accidental that these pullbacks flirt with bear markets but refrain from going all the way. It’s how short term trading programs, which make up the lion’s share of day to day liquidity, are set up to work. A correction or bear market threshold is considered to be a technical support level. If prices approach, but don’t breach the support level it means that the net consensus of the market supports the status quo; in other words, that conditions continue to justify a bull market. These pullback-recovery movements happen frequently. Real bear markets are much rarer, and more durable when they do happen.

The chart below provides a good illustration of this “music” – it shows the price trend of the S&P 500 from 1987 to the present (lognormal scale to provide consistency in magnitude of returns over time).

This chart is instructive for another reason. To paraphrase Tolstoy, every pullback has its own dysfunctional story. What causes a pullback to become a full-on bear market? It’s not always a recession – witness 1990, when we had an economic downturn but only a limited market pullback. It’s not always a financial crisis – we had one of those in 1998 and again in 2011 but in both cases economic growth stayed positive. In 1987 financial markets came close to shutting down, but again the economy was still resilient and the drawdown, while intense, turned out to be brief. By contrast, in 2000-02 and again in 2007-09 we got a double-dose of financial crisis and recession in roughly the same time frame (the grey bands in the above chart signify recession periods). Both the magnitude and the duration of these drawdowns, of course, were more severe.

In any event, with all apologies to financial market pundits everywhere, there was nothing particularly historical about this week. Perhaps our good fortune will last another 1,039 (and counting) days and we will have a real, actual “longest bull” to celebrate. Or maybe not. Expect more pullbacks along the way in either case. Remember that most pullbacks do not end up in a real bear market, and also remember that while we humans have a need to read meaning into calendar events, markets themselves do not.