When you’re small, a little change can go a long way. Say that your new start-up company earned $1.00 per share in its first year of operations. In the second year you managed to earn a second dollar, so that your year-2 EPS is $2.00. That’s a pretty impressive growth rate: $1.00 to $2.00 implies a 100 percent improvement. But let’s say that my company which earned $100 last year adds that same $1.00 to its earnings this year. So the point of comparison is $101 to $100, which is a measly growth rate of one percent.

The point of this little thought exercise is that the bigger a company gets, the harder it is for that company to put down stonkingly high growth rates. Which brings us to one of the world’s biggest companies: Apple. Earlier this week the tech and communications behemoth announced quarterly revenues of $86.6 billion – a giant number in anybody’s books. Even more impressive, though, was the comparison with the comparable revenue figure from one year earlier, when the company generated sales of $58.3 billion. That translates into a growth rate of 53.6 percent – a head-spinning result for a company of this size.

Tech is the Economy and the Economy is Tech

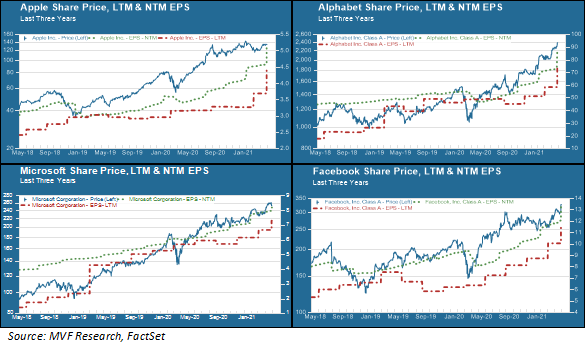

Apple is not alone. The biggest tech platforms have been on a tear in the last few years, accelerating into warp-speed growth in both earnings and share prices since the beginning of the pandemic a year ago. The chart below shows the earnings (both trailing and forward) along with the share prices for four Big Tech leaders: Apple, Alphabet (Google), Microsoft and Facebook.

How is it that these tech platforms are able to consistently put down growth rates of several magnitudes higher than the overall growth rate of the world economy? Each of the companies shown here (along with others such as Amazon and Netflix, which have grown at similar cadences) has its own business model, but in general they have capitalized on a handful of trends that increasingly define the modern economy. First of all, entertainment. The good citizens of the world spend an inordinate amount of time interacting with screens of varying shapes and sizes, which deliver to them all manner of diversions from streaming audio and video to gaming, social media chat, learning foreign languages or what have you.

Second of all, the cloud. Just about any business anywhere in the world needs a so-called “digital access strategy” if it is going to compete in the big leagues, and that strategy inevitably involves using the cloud for an increasing proportion of business operations and customer interactions. Microsoft, Amazon and Alphabet dominate this space.

Finally there is advertising and the rapid rise of omnichannel marketing wherein engaging with the customer through highly targeted, analytically informed online advertising is critical. Alphabet and Facebook are preeminent in this domain.

From these building blocks of the online economy much else flows across all major industry sectors. In view of this, it is perhaps unsurprising to see how the tech sector dominates the stock market, accounting for about a quarter of the total market cap of the S&P 500. The question on the minds of many is: how sustainable is this? And what, if anything, could bring Big Tech down to a smaller size?

Cometh the Regulator

If the tech firms are left more or less to their own devices (pun not intended…or?) then it would be reasonable to assume they will continue to grow on the basis of organic demand for their services and a massive war chest to spend on buying out up-and-coming competitors. But that might not be a smart way to bet. Regulators are never far from sight when the discussion turns to antitrust and unfair business practices. Here the European Union could be the Beowulf that eventually slays the Grendel of Big Tech.

In this same week in which Apple announced its blockbuster quarterly results, the EU’s competition commission, led by Margrethe Vestager (by all accounts every bit as fearless as that old epic hero Beowulf) brought formal antitrust charges against Apple in connection with the company’s practices in charging commissions and restricting fair (in the EU’s opinion) access to customers through its App Store. The antitrust charges stem from a complaint filed by Spotify, the popular streaming company domiciled in Sweden, about facing roadblocks via App Store business practices that favor Apple’s own streaming service, iTunes.

The EU charges may ultimately amount to nothing – this is far from the first time that Vestager’s competition commission has gone after a US tech giant. But there is every sign that they are up for the fight, and a reasonable likelihood that at some point something will stick. Nor is it just the EU that has the potential to draw blood. The US Justice Department has its own inquiry going on related to Facebook’s advertising practices (indeed, Apple itself has taken aim at Facebook’s ability to use its data-heavy targeted advertising at customers using Apple devices). And then there is China, which aims to have its own version of the Internet encroach on the territory currently dominated by US Big Tech.

All of which is to say that the tech giants will in very high likelihood continued to be an inescapable force in the global economy. But their fortunes are far from certain, and one would be amiss to pay no heed to the potential risks lying in wait.