It wasn’t all that long ago that Davos Week was a big deal. Confident, important communiqués about the state of the world delivered by important, impeccably tailored men (and a few women here and there). The rest of the world’s inhabitants might live out their quotidian habits in a perpetual fog, but the great and good who assembled in the little Swiss Alpine town every January were there to tell us that it was all going to be okay, that the wonders of the global wealth machine would soon be trickling their way. Now the fog has enshrouded them as well. While their status as influencers was getting sucked down into the lowest-common-denominator Twitterverse, their ability to explain the great trends of the day was upended by the improbable turn those trends were taking away from the comfortable Washington Consensus globalism of years past. “The mood here is subdued, cautious and apprehensive” reports Washington Post columnist (and Davos Man in good standing) Fareed Zakaria from the snowy slopes this year. Apprehensive, not confident, which is an apt way to sum up the present mindset of the world.

Never Underestimate the Power of Kick the Can

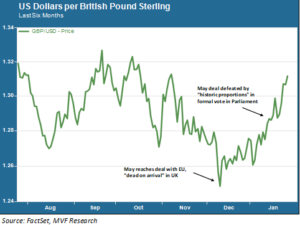

Yet, for all the fretting and fussing among the stewards of the world’s wealth pile, some of the key risks that have been plaguing investors in recent weeks seem to be turning rather benign. Consider as Exhibit A the state of the British pound, shown versus the US dollar in the chart below.

The pound has rallied strongly since plummeting in early December last year. If you go back and track the history of Brexit negotiations since that time, you find that the actual news about a Brexit resolution is almost all dismal. The deal PM Theresa May brought back from Brussels was panned as soon as it reached Westminster; that same deal formally went down to one of the most ignominious defeats in UK parliamentary history last week.

All the while – the pound sterling has rallied! Why? Because the Brexit deal’s unpopularity means that there are only two ways this whole sorry affair plays out between now and March, when the Article 50 deadline comes into effect. One is that the UK crashes hard out of the EU, which would be a disaster for the country. The other – and far and away the most likely, is to kick the can down the road. Extend the Article 50 deadline, probably to the end of the year, and see what kind of fudge can be worked out between now and then. Maybe (most likely, as we have been saying for some time now) a second referendum that scotches Brexit for once and all. Maybe something else. Maybe someone has to make a bold decision at some point. But not yet, not yet, as that fellow said in “Gladiator.” Thus the strong pound.

March Without the Madness

The month of March has in fact been looming large over Davos think-fests and cocktail parties this week. In addition to Article 50, there is that self-imposed deadline by Washington’s trade warriors to reach some kind of deal with China on the terms of cooperation going forward – absent which, according to Trump’s protectionist acolytes, there would be hell to pay in the form of new tariffs. Yet as the days go on, the evidence mounts that this administration’s tough talk on any number of fronts is all hat and no cowboy. This administration has plenty of other troubles with which to contend, and by now they know that actually following through with tough trade rhetoric will spark another pullback in the stock market. We don’t think it’s being Pollyanna to say that this trade showdown at high noon will likely not come to pass.

Finally, the other risk event that could befall markets after the Ides of March would be the Fed meeting that month with the potential for another interest rate hike. While that is a possibility, the Fed’s actions in recent weeks have been very cautious and non-confrontational with edgy markets. Recent inflation numbers have come in a bit below expectations. We’ll see what happens with Q4 GDP next week, but indications are that it will settle back somewhere in the 2-plus percent real growth range. In other words, the Fed will have plenty of flexibility if it decides to join in with the kick the can fun and hold off until next time. Even on the question of the Fed’s balance sheet there have been some recent indications that it may not wind down as quickly or deeply as previously thought.

“Never make tough decisions today that you can punt down the field for later” – this instinct is alive and well in the world of global policymaking. As long as that remains the case, Davos Man, you should take a deep breath and go back to enjoying your cocktails and canapés.