On Thursday morning investors on the U.S. side of the pond woke up to a whiff of 2011: trouble in the European financial sector. Shares in Banco Espírito Santo (BES), Portugal’s second largest bank, were suspended from trading as rumors spread that severe financial difficulties may threaten the bank’s viability and require a bail-out. Shares in all major European indexes were sharply lower, and in Spain two corporate bond offerings were put on hold. U.S. futures contracts turned lower. It is fair to say that the Portuguese-speaking community – in Brazil and in Portugal – has not had a good couple weeks on the bourse or on the soccer pitch.

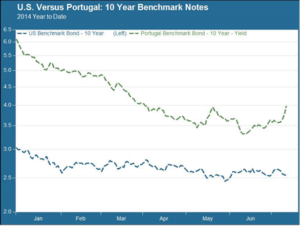

For a while it looked like it could be the beginning of a good old-fashioned rout. But as the day wore on, the complacency so prevalent in the current environment got the better of fear. U.S. indexes closed the day with mild losses: less than half a percent for the S&P 500 and the Dow Industrials, and a bit more than that for the Nasdaq. One might have expected to see soaring spreads between Portuguese and U.S. bonds. They did widen, predictably, but not by much. As the chart below shows, benchmark 10 year spreads remain far below where they were earlier this year, before the perplexing rally in European bonds gained steam.

Iberian Mysteries

For now the BES affair seems to be little more than a tempest in a teapot. European equity markets are mostly stable as they approach the Friday close, and major U.S. indexes are likewise mostly quiet. BES and Portugal’s central bank both issued statements affirming that the bank has sufficient capital reserves to weather the current troubles. The extent of these “troubles” appears somewhat opaque, though. They apparently center on the bank’s loan portfolio to the non-financial interests of the Espírito Santo family group, a Luxembourg-based diversified holding company which owns 25% of BES.

Even if there is less here than initially met the eye, though, Thursday’s flare-up is a timely reminder that things in Europe are not as stable as the region’s astonishingly low interest rates would indicate. Portugal is stuck in slow-growth mode, with unemployment over 20% and GDP projected to grow by less than 1% annually through 2015. Similar conditions prevail elsewhere on the Continent, including Spain, Greece and Italy. These conditions themselves do not necessarily portend disaster, but they do add fuel to a combustible environment for potential failures in the financial system.

Too Complacent?

The main reason why investors staring into their crystal balls don’t see ominous signs of a 2011 repeat is those magical three words: Whatever It Takes. Mario Draghi pronounced those words in 2012 and Europe’s financial market has been calm ever since. There is a strong conviction among investors that the ECB, the Fed and any other central banks involved will unleash a flood of stimulus onto whatever crisis emerges. And that is a reasonable conviction in light of what central banks have done up to now.

Still, it is never a good idea to let yourself become complacent to the point where you think that central banks or any other institutions can eliminate all risks, all the time. Here in the U.S., the S&P 500 has not experienced a one day price movement of more than 1% – either up or down – for three months. European bonds, as we have commented on extensively in recent weeks, remain at their lowest levels in literally centuries. The Banco Espírito Santo situation has not radically altered our worldview of where markets may be trending. But it serves as a good reminder that vigilance is just as important in a low risk environment as it is in stormier climes.