MV Weekly Market Flash: Any Excuse to Sell

Read More From MVSometimes, bad news is good news. A macroeconomic data point comes out below what was forecast, but all Mr. Market can see is a juicy rate cut on the near horizon. Other times, though, bad news is bad news. And good news is bad news, and so-so news is bad news. We seem to be in one of those times now. Fortunately, perhaps, it is happening in August rather than in the historically trickier months of September and October. Let the market blow off some steam during the dog days of beach reading and low trading volumes, and then head...

Read MoreMV Weekly Market Flash: Economy Grows, Inflation Cools, Markets Hyperventilate

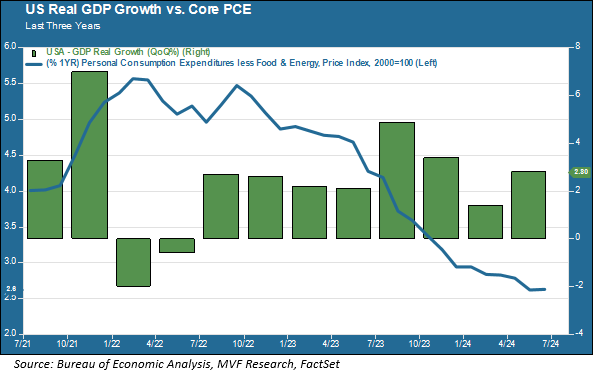

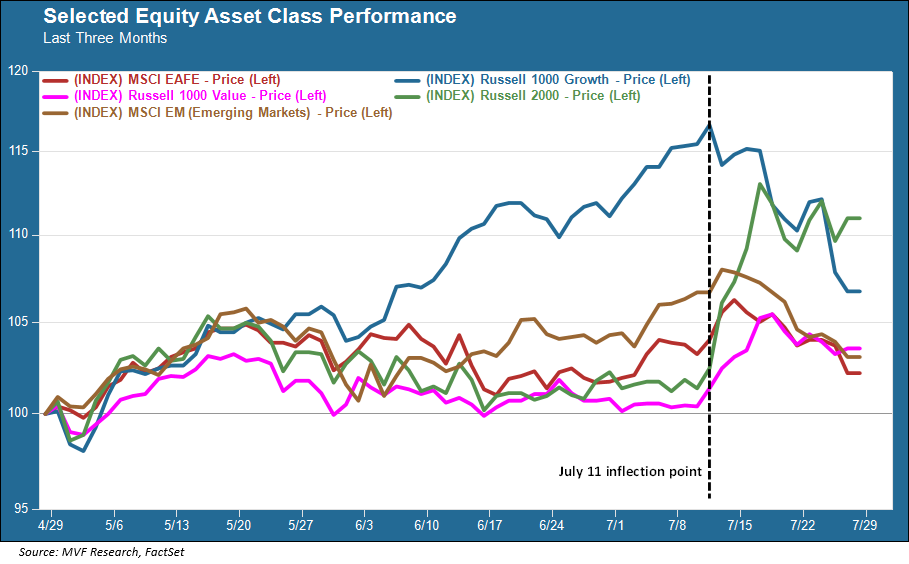

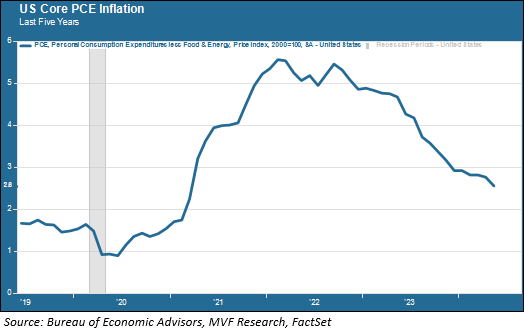

Read More From MVSome summers are quiet. This is not one of those summers. One month ago, a hitherto dull and dreary political contest supercharged into a must-see roller coaster of events. Two weeks ago, a benevolent inflation report sent securities markets into a tizzy, producing dramatic rotations in and out of asset classes in both equities and fixed income. So here we are, as July heads to a close, not expecting that August will offer much in the way of opportunity for a quiet repose at the beach. It’s at times like this that we like to remember what the dormouse said...

Read MoreMV Weekly Market Flash: The Search for the Killer AI App

Read More From MVA few week ago, we noted in our weekly commentary that it was “prove it” time for stocks claiming to have a big AI story front and center in their business propositions, observing as well that one of the key investment themes we wrote about in our annual outlook back in January was how the AI narrative was going to evolve from the hype and frenzy of 2023 to a more sober appraisal of its business use cases. Right on cue, a newfound sobriety in AI scrutiny appears to have found its way into the mainstream conversation among the financial...

Read MoreMV Weekly Market Flash: It’s Rotation Time (Or Not) Again

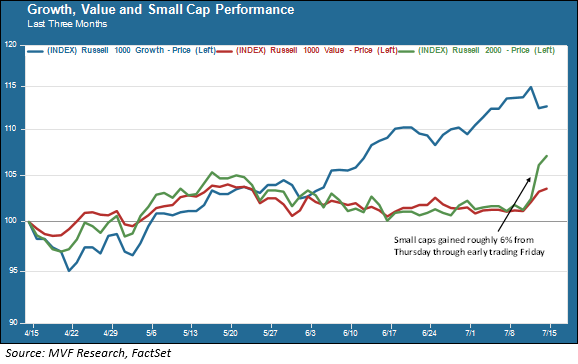

Read More From MVOne day does not a trend make. But yesterday was a doozy of a reversal in the fortunes of large cap growth stocks and their long-suffering compatriots in large value and small caps. That, necessarily, begat a flood of chatter about one of the most beloved themes among financial talking heads – The Rotation. We have seen this movie before, and more often than not it proves to be a head fake rather than a sustained development. But given how long growth’s outperformance has been going on, and how expensive many of these stocks have become, it’s worth at least...

Read MoreMV Weekly Market Flash: Economy Slows, Businesses Grow

Read More From MVWe received a few more data points this week validating the increasingly consensus view that the economy is slowing – gently, perhaps, but still slowing. On Wednesday the Institute of Supply Managers (ISM) Services index showed an unexpected slip into contraction territory, coming in at 48.8 versus economists’ expectations of 52.5 (a figure of 50 or more represents expansion, while below 50 signifies contraction), That same day the ADP Employment Survey was a tad below the consensus forecast, at 150,000 versus 163,000. The GDPNow estimate published by the Atlanta Fed, an estimate for real GDP growth, has been falling steadily...

Read MoreMV Weekly Market Flash: One Down, One To Go

Read More From MVNo, that headline is not referring to presidential debates. The first half of 2024 is drawing to a close today, and we have one more half year to go. Six months hence and we close the book on the fourth year of the Twenties (at least based on the evidence so far, we feel fairly confident in projecting that this century’s third decade will not come to be known by the history books as another Roaring Twenties – thoughts?). So what might the second half have in store for us? No More Rate Cut Unicorns, But Maybe a September Pony...

Read MoreMV Weekly Market Flash: It’s Prove It Time for AI Stocks

Read More From MVArtificial intelligence has never been far from the center of debate about what is driving the stock market in 2024; in fact, there is precious little else that has come to mind recently on the subject. This week saw three companies jostling and elbowing each other for the pole position as Most Valuable Player in the S&P 500 (and, by extension, the world) – Nvidia, Microsoft and Apple, all of which have a strong case to make as a center of AI excellence (Apple has been a bit late to the game, but arguably could be the company that most...

Read MoreMV Weekly Market Flash: An Abrupt Start to Election Season

Read More From MVOf all the consequential elections taking place in 2024, who would have thought that the European Union parliamentary contest would be the one to unleash a volatile pulse of Sturm und Drang into regional financial markets? Typically, the EU-level elections have served as an arena for demonstrative flamboyance, perhaps not unlike the over-the-top histrionics of Eurovision musical performances, in which the good citizens of Europe register their dissatisfaction with the status quo without doing anything they figure might have a practical impact on their quotidian lives. A Lightning Bolt from Jupiter One might have said that this year’s elections were...

Read MoreMV Weekly Market Flash: ECB, Alone

Read More From MVWe don’t often think of Europe as leading the way when it comes to the doings of the global economy, but this week the European Central Bank made the first decisive move in the transition away from monetary tightening. The ECB lowered its benchmark deposit rate by 0.25 percent to 3.75 percent, its first rate cut in five years. With neither the Fed nor the Bank of England likely to be moving off their peak rates in the near future, the ECB is for now alone among the major central banks. There are questions, though, as to whether this is...

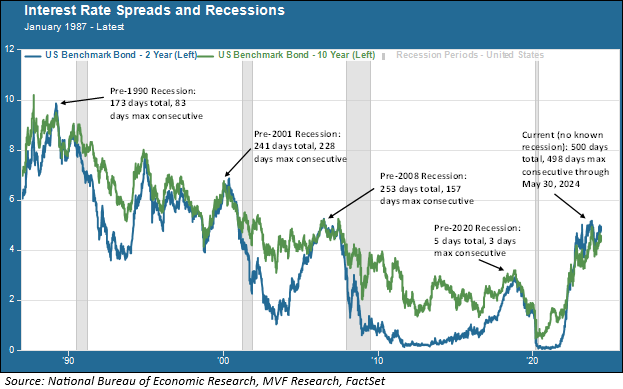

Read MoreMV Weekly Market Flash: The Not Quite Dead Yield Curve Signal

Read More From MVToday is one of those round number days the market loves to get excited about. No, not the Nasdaq Composite index reaching 17,000 – that happened a couple days ago and since then the index has given back the prize, currently trading around 16,800 as we write this. Today’s round number action takes place in the bond market. The Treasury yield curve has been inverted between the 10-year and 2-year maturities for 500 days, as of today, and will in almost all likelihood be adding to that total in the days and weeks (and months?) ahead. This round number event...

Read More