MV Weekly Market Flash: Equity Investors Plow Through Hot Inflation

Read More From MVWe always arrive at work on an Inflation Day with a certain amount of uncertainty hovering over us. When the CPI or the PCE report – the two main indicators of US consumer price trends – comes out at 8:30 a.m. it has the potential to sharply shift market sentiment away from whatever direction it was moving in. When the numbers come in hotter than expected, that sentiment can turn sour very quickly. Not so for the hot numbers that came out this week. The Consumer Price Index report for February came out on Tuesday and showed inflation advancing faster...

Read MoreMV Weekly Market Flash: Sometimes, Good News Is Good News

Read More From MVThe US equity market has been at one of those junctures recently that could go one of two ways. Glass half empty, or glass half full? Happily for those of us who like to see the stock prices trending in the upward direction, the glass half full crowd seems to be winning the day. The central point of contention has been thus: can Mr. Market overcome his bitter disappointment at once again being wrong, so very wrong, about how many interest rate cuts are in store for 2024, and learn to love the idea of a strong economy? Well, the...

Read MoreMV Weekly Market Flash: Nothing Changes Except the FOMO-Meter

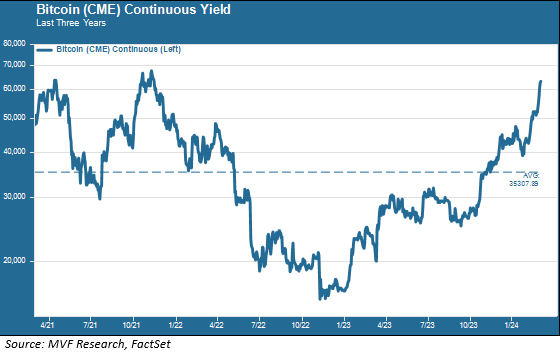

Read More From MVIf you are a long-term reader of our weekly commentaries and our annual outlooks you are no doubt familiar with our thoughts about cryptocurrencies. If you are new to our writings, then here is a short summary: at this point in the 16-odd year of this asset class, it exists essentially as speculation for speculation’s sake, with a real-world use case limited to underworld transactions on the dark web. Oh, and as a way for El Salvador’s autocratic president to style himself as the “world’s coolest dictator.” All of which is to say, we do not consider bitcoin and its...

Read MoreMV Weekly Market Flash: AI to the Rescue, Again.

Read More From MVThe Agony and the Ecstasy, one could say. Irving Stone’s famous 1961 novel may have been about the life of Michelangelo and his tortuous experiences while painting the Sistine Chapel, but the phrase easily lends itself to this week’s journey from darkness to light in the US stock market. As we wait for trading to get underway on this Friday morning, all appears well once again, thanks largely to the doings of one company and its continued ability to outdo the ever-higher expectations set by the market. Hedgies Caught Out Nvidia, the company that appears to have a dominant position...

Read MoreMV Weekly Market Flash: A Week of Mixed Signals

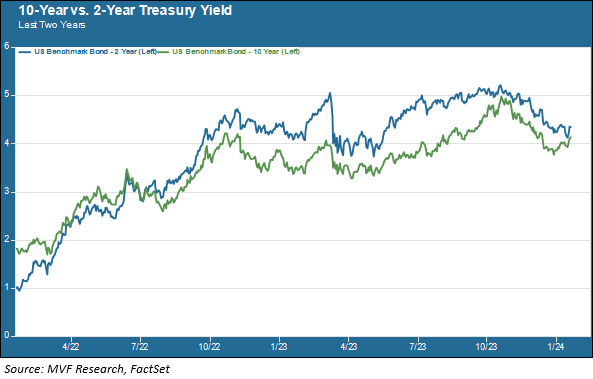

Read More From MVSpare a thought, if you will, for the poor bond market. The fixed income crowd lives and breathes for the certainty of where interest rates are headed, only to be forever buffeted by the crosswinds of conflicting economic data that tear apart the certitude of any directional trends. This week was particularly trying, and most of all for the masses tethered to the “6 in ’24” narrative proclaiming six Fed funds rate cuts in 2024, a narrative which, outside the seemingly impenetrable insular bubble of bond traders and their media boosters, does not exist and has not existed. The culprits...

Read MoreMV Weekly Market Flash: Very Expensive, Or Just Expensive?

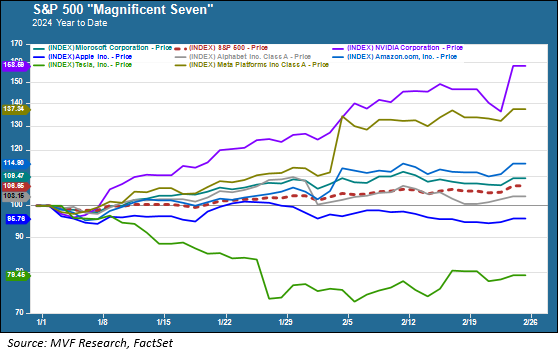

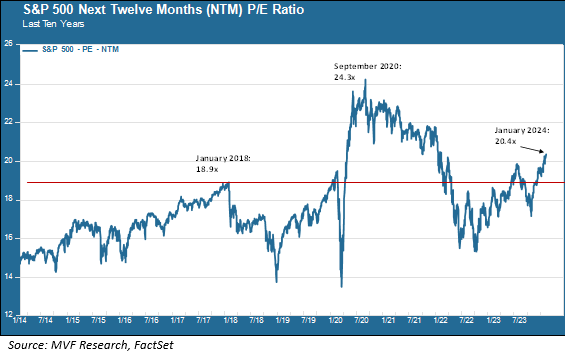

Read More From MVMeet the new year, same as the old year…or so it would seem by the price dynamics of the S&P 500 in the early weeks of 2024. On the way to achieving another one of those round-number milestones so beloved by the financial media talking heads, it was the usual mega-cap stalwarts leading the way. Meta (Facebook) and chipmaker Nvidia have been particular standouts on the road to 5,000 for the blue chip index, though Tesla’s Magnificent Seven credentials appear to be at least temporarily suspended as the carmaker has been struggling on a variety of fronts. Multiple Distortions One...

Read MoreMV Weekly Market Flash: China Versus India

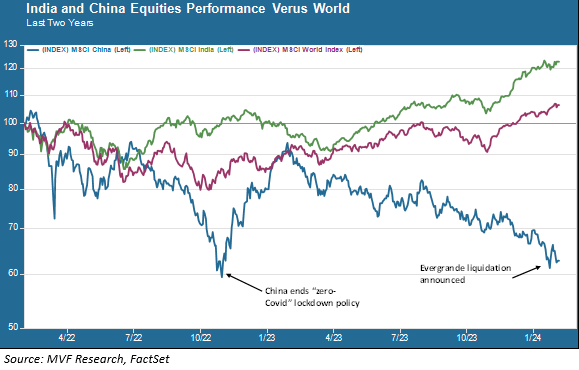

Read More From MVIt is once again that silly day of the year when news organizations dutifully report on the weather forecasting acuity of that beloved groundhog in Punxsutawney, Pennsylvania. The quadrupedal meteorologist apparently signaled an early spring, so three cheers for that. Here’s where we don’t see any signs of an early spring: China. The China Shenzhen A Shares index is rapidly approaching a bear market just from where it started the year; down 19 percent since the beginning of January. The index is already well into bear territory overall, down 35 percent from the latest peak reached in January 2023. It's...

Read MoreMV Weekly Market Flash: Another Installment for the Goldilocks Diaries

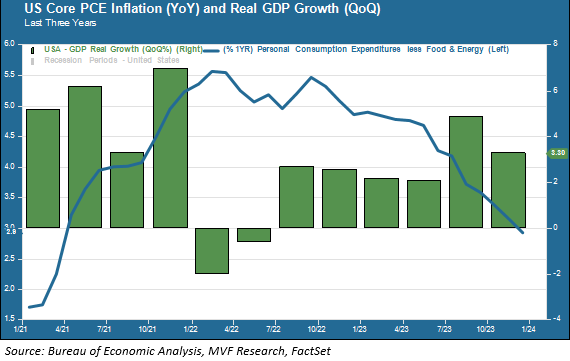

Read More From MVThis week brought with it a couple more pieces of data to suggest that the positive trend the US economy enjoyed throughout 2023 is far from over. The good news this week: Gross Domestic Product (GDP) grew at a real quarterly rate (annualized) of 3.3 percent for the fourth quarter, which translates to a 3.1 percent annual rate for the full year of 2023. That is a much stronger growth rate than economists had expected, and notches yet another win for the US as the world’s best-performing advanced economy. Today we got the second installment of Goldilocks data (not too...

Read More2024: The Year Ahead

Read More From 2024:One year ago, we along with the vast majority of mainstream economists were predicting that the US economy would experience a cyclical recession. Not a deep one, not a cataclysm like 2008 or a manufactured one like 2020, but a regular old end-of-the-business-cycle recession. After all, interest rates had gone up by more than at any time since the draconian “Volcker shocks” of the late 1970s and early 1980s. Household savings were dwindling down to their lowest levels in decades as those extra cushions from pandemic-era stimulus payments wore off. Corporate management teams were warning of trouble ahead: “uncertain macro...

Read MoreMV Weekly Market Flash: The Yield Curve’s Tortured Path to Normal

Read More From MVSo close, and then so far. That was the story of the Treasury yield curve last October, when the 10-year yield briefly touched a decades-long high of five percent. For an ever so brief moment, it looked like the yield curve, stubbornly fixed in the inverted shape that in the past has been a reliable predictor of an approaching recession, might revert to normal. Then, a prominent hedge fund manager announced to the world his view that intermediate rates would not go any higher. Some more good news about inflation trickled in. Finally, the Fed came out of the December...

Read More