MV Weekly Market Flash: AI to the Rescue, Again.

Read More From MVThe Agony and the Ecstasy, one could say. Irving Stone’s famous 1961 novel may have been about the life of Michelangelo and his tortuous experiences while painting the Sistine Chapel, but the phrase easily lends itself to this week’s journey from darkness to light in the US stock market. As we wait for trading to get underway on this Friday morning, all appears well once again, thanks largely to the doings of one company and its continued ability to outdo the ever-higher expectations set by the market. Hedgies Caught Out Nvidia, the company that appears to have a dominant position...

Read MoreMV Weekly Market Flash: A Week of Mixed Signals

Read More From MVSpare a thought, if you will, for the poor bond market. The fixed income crowd lives and breathes for the certainty of where interest rates are headed, only to be forever buffeted by the crosswinds of conflicting economic data that tear apart the certitude of any directional trends. This week was particularly trying, and most of all for the masses tethered to the “6 in ’24” narrative proclaiming six Fed funds rate cuts in 2024, a narrative which, outside the seemingly impenetrable insular bubble of bond traders and their media boosters, does not exist and has not existed. The culprits...

Read MoreMV Weekly Market Flash: Very Expensive, Or Just Expensive?

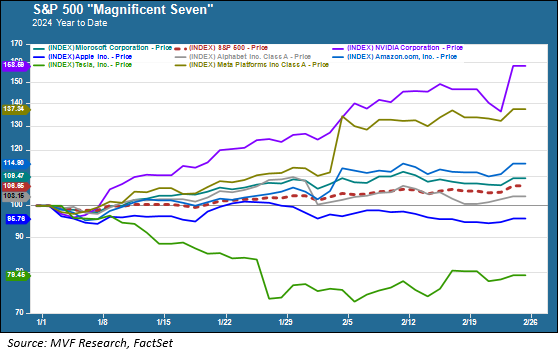

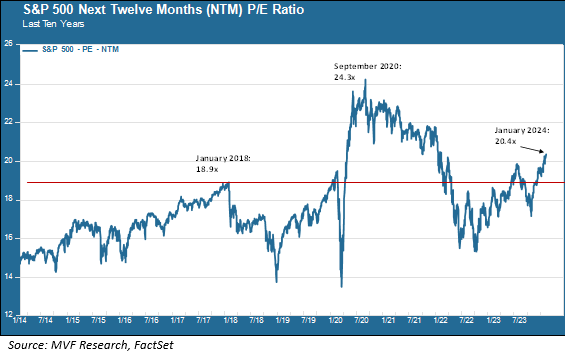

Read More From MVMeet the new year, same as the old year…or so it would seem by the price dynamics of the S&P 500 in the early weeks of 2024. On the way to achieving another one of those round-number milestones so beloved by the financial media talking heads, it was the usual mega-cap stalwarts leading the way. Meta (Facebook) and chipmaker Nvidia have been particular standouts on the road to 5,000 for the blue chip index, though Tesla’s Magnificent Seven credentials appear to be at least temporarily suspended as the carmaker has been struggling on a variety of fronts. Multiple Distortions One...

Read MoreMV Weekly Market Flash: China Versus India

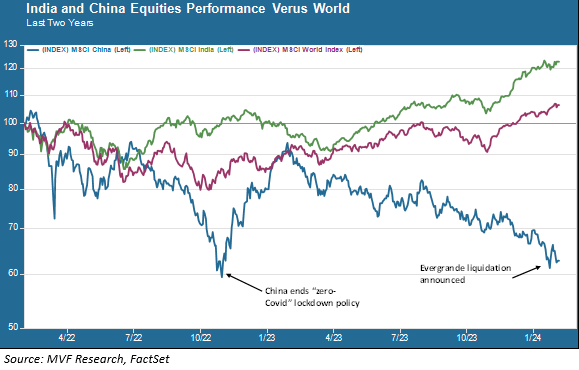

Read More From MVIt is once again that silly day of the year when news organizations dutifully report on the weather forecasting acuity of that beloved groundhog in Punxsutawney, Pennsylvania. The quadrupedal meteorologist apparently signaled an early spring, so three cheers for that. Here’s where we don’t see any signs of an early spring: China. The China Shenzhen A Shares index is rapidly approaching a bear market just from where it started the year; down 19 percent since the beginning of January. The index is already well into bear territory overall, down 35 percent from the latest peak reached in January 2023. It's...

Read MoreMV Weekly Market Flash: Another Installment for the Goldilocks Diaries

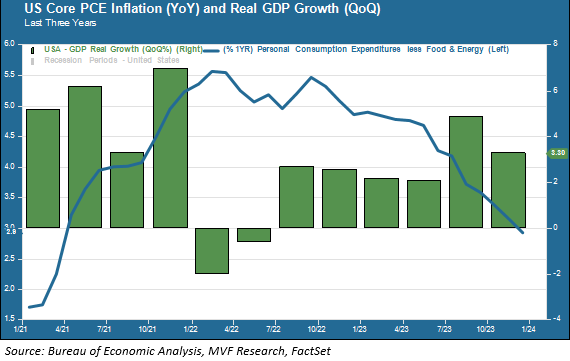

Read More From MVThis week brought with it a couple more pieces of data to suggest that the positive trend the US economy enjoyed throughout 2023 is far from over. The good news this week: Gross Domestic Product (GDP) grew at a real quarterly rate (annualized) of 3.3 percent for the fourth quarter, which translates to a 3.1 percent annual rate for the full year of 2023. That is a much stronger growth rate than economists had expected, and notches yet another win for the US as the world’s best-performing advanced economy. Today we got the second installment of Goldilocks data (not too...

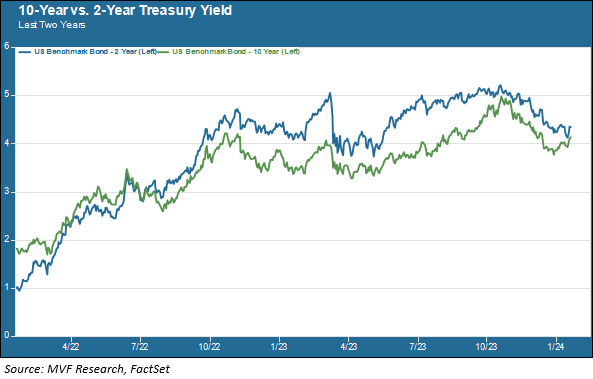

Read MoreMV Weekly Market Flash: The Yield Curve’s Tortured Path to Normal

Read More From MVSo close, and then so far. That was the story of the Treasury yield curve last October, when the 10-year yield briefly touched a decades-long high of five percent. For an ever so brief moment, it looked like the yield curve, stubbornly fixed in the inverted shape that in the past has been a reliable predictor of an approaching recession, might revert to normal. Then, a prominent hedge fund manager announced to the world his view that intermediate rates would not go any higher. Some more good news about inflation trickled in. Finally, the Fed came out of the December...

Read MoreMV Weekly Market Flash: Our 2024 Outlook

Read More From MVAs we normally do this time of the year, we are sharing with you our outlook for the economy and markets in 2024. For our clients, you will see this week’s commentary again as the executive summary of the Year Ahead report you will receive from us in a couple weeks or so from now. The Economy: Slower, But Still Growing The biggest economic story of 2023 was about something that didn’t happen. There was no recession in the United States or, for that matter, in the global economy at large. Against the predictions of most mainstream economists (ourselves included),...

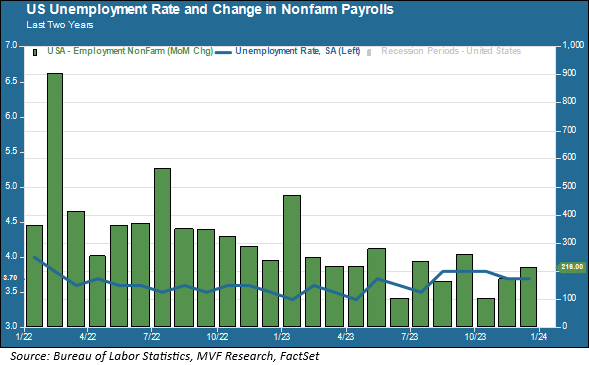

Read MoreMV Weekly Market Flash: New Year, New Jobs

Read More From MVThe first week of 2024 served up a bevy of data about the health of the US labor market. The main takeaway is that there are still jobs aplenty in our economy, nearly two years into the most dramatic monetary tightening program since the early 1980s. The December report published this morning by the Bureau of Labor Statistics showed 216,000 payroll additions last month, with the unemployment rate holding steady at 3.7 percent. Hourly wages rose by 0.4 percent, which is more than the 0.1 percent increase in the Consumer Price Index last month. In fact, hourly wages for the...

Read MoreMV Weekly Market Flash: Earnings Will Matter in 2024

Read More From MVIt’s the last trading day in 2023, and it’s fair to say that the year turned out better than most of the pundits had predicted. Now, of course, the pundits are busy with their prognostications for the year ahead, including specific calls for US equities and other asset classes that will likely reach their sell-by date well ahead of December 2024. While it is always wise not to put much stock into a single prediction (you might as well go ahead and try to guess who will win the World Series next year), it can be useful to see the...

Read MoreMV Weekly Market Flash: A Very Good Inflation Number

Read More From MVAs the year winds to a close, one of the big stories has been something that didn’t happen. That, of course, is the much-predicted Recession of 2023. It seems increasingly likely (though by no means a guarantee) that the economic downturn that did not happen this year will also not happen next year, putting Jay Powell in pole position to pull off what very few of his predecessors have – the “soft landing” at the end of a monetary tightening program. Here’s what that soft landing looks like in numbers: unemployment close to its recent lows at 3.7 percent, monthly...

Read More